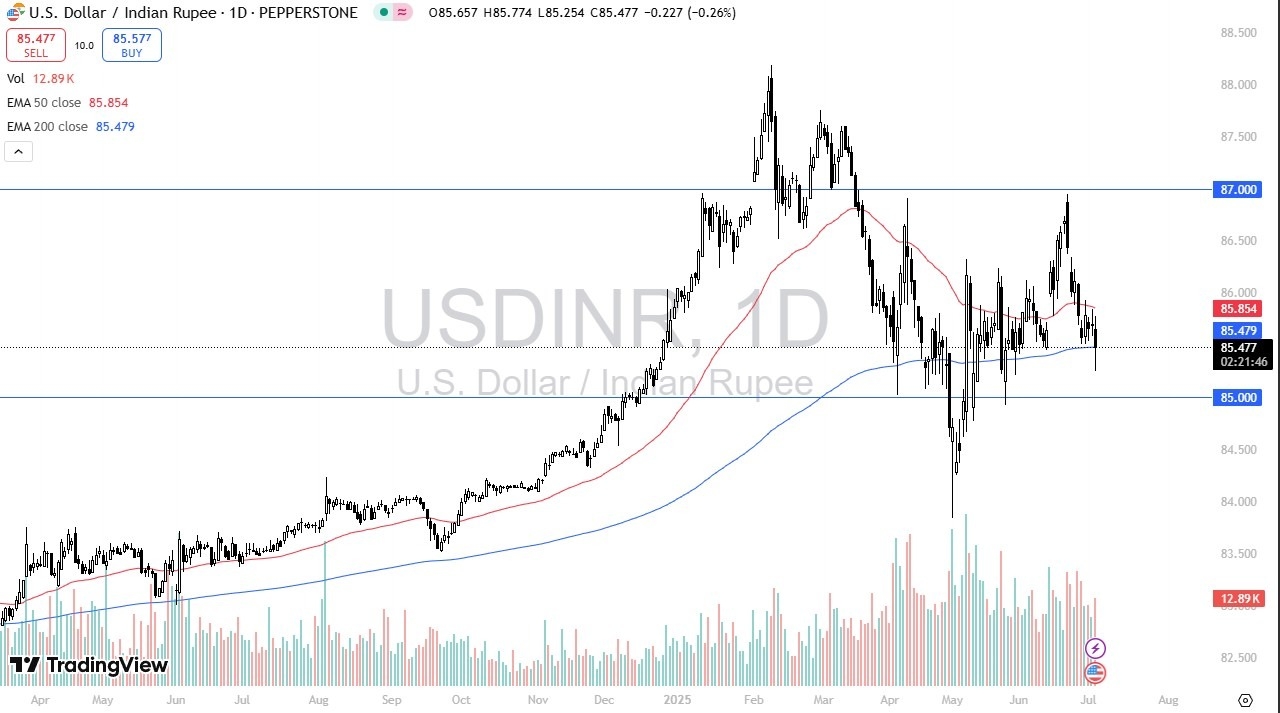

- The US dollar initially rallied against the Indian rupee during the trading session on Thursday, as we went hunting for the 50 Day EMA.

- The 50 Day EMA obviously will attract a lot of technical trading, but what I find even more interesting is that we drop below the 200 Day EMA, only to turn around and bounce.

- In other words, it was a very messy and noisy market, but that’s not a huge surprise considering that we got the Non-Foreign Payroll announcement out of America, which will tend to move a lot of US dollar related assets quite rapidly, especially a small currency pair like the USD/INR.

Range Bound

I still think that the pair is essentially range bound, and we are just jumping down to the bottom of that range, which is currently defined as ₹85. If we were to break down below the ₹85 level, then I think the US dollar could be in serious trouble, and we would probably end up dropping down to the ₹84 level. Keep in mind that the US dollar is struggling against multiple other currencies, but it’s an entirely different game when you’re talking about the Indian rupee, as the Central Bank of India has no qualms whatsoever about setting the trading range for this pair.

On the other hand, if we turn around a break above the ₹86 level, then the market could really start to take off and go looking to the ₹87 level. All things being equal, this is a market that continues to see a lot more choppiness than anything else, and with that being said I think you have to look at it as range bound until we get some type of explosive candle to the upside or down out of this well-defined range. All things being equal, this is a market that will continue to be noisy, but if you can fade from the obvious levels, it could be good for range bound trading.

Ready to trade our daily Forex analysis? Here’s a list of some of the best forex brokers in India to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.