- The US dollar initially tried to rally against the Mexican peso as the Non-Foreign Payroll announcement came out with a reading of 145,000 jobs added last month, which was much higher than the anticipated 111,000.

- Because of this, the US dollar got a bit of a bid against almost everything, but by the end of the day, we have seen traders start shorting the greenback yet again.

The US dollar has been suffering at the hands of the currency markets for a while now, as traders expect to see the Federal Reserve start cutting rates. At one point, the Fed Funds Futures market has gone from a 25% expectation of an interest rate cut in July down to 5%. It has bounced back since then, but with that being said, it’s probably worth also noting that most of what people are banking on is rate cuts in the month of September.

If we were to for some reason does not get that, it would probably send the US dollar higher against most currencies, but this one might be a little bit different due to the fact that the 2 economies are so heavily intertwined. After all, Mexico is the largest of the exporters that does business in the United States, even passing the amount of exports that the Chinese send into that country. In other words, if the US economy does fairly well, it’s actually good for the Mexican peso.

Interest Rate Differential

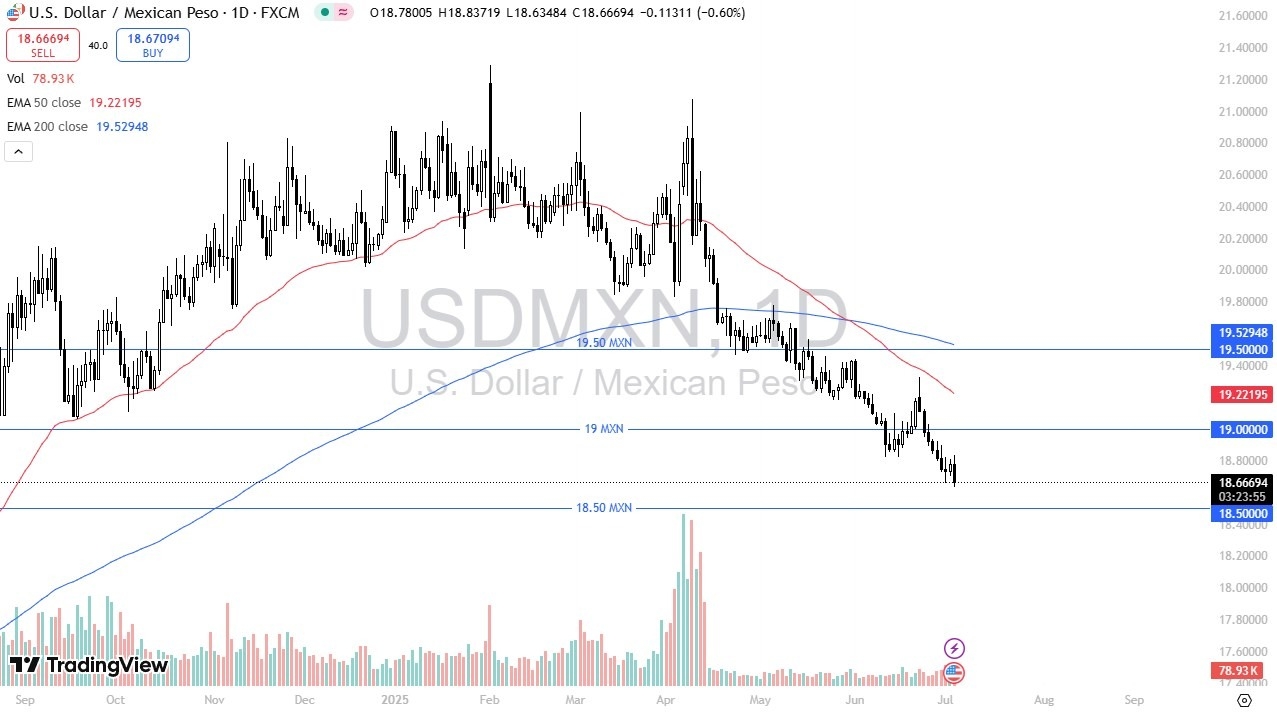

The interest rate differential also favors Mexico, so I think you still have a situation where this pair will go lower, and right now I suspect that we are going to try to get down to the 18.50 MXN level, mainly due to the fact that this pair does seem to like “half-century numbers”, and that would be the next one. I like the idea of fading short-term rallies and aiming for the 18.50 MXN level, but I also recognize that if we were to turn around a break above the 19 MXN level, that would change a lot of things. At this point, I don’t think it’s likely, but it is a possibility.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.