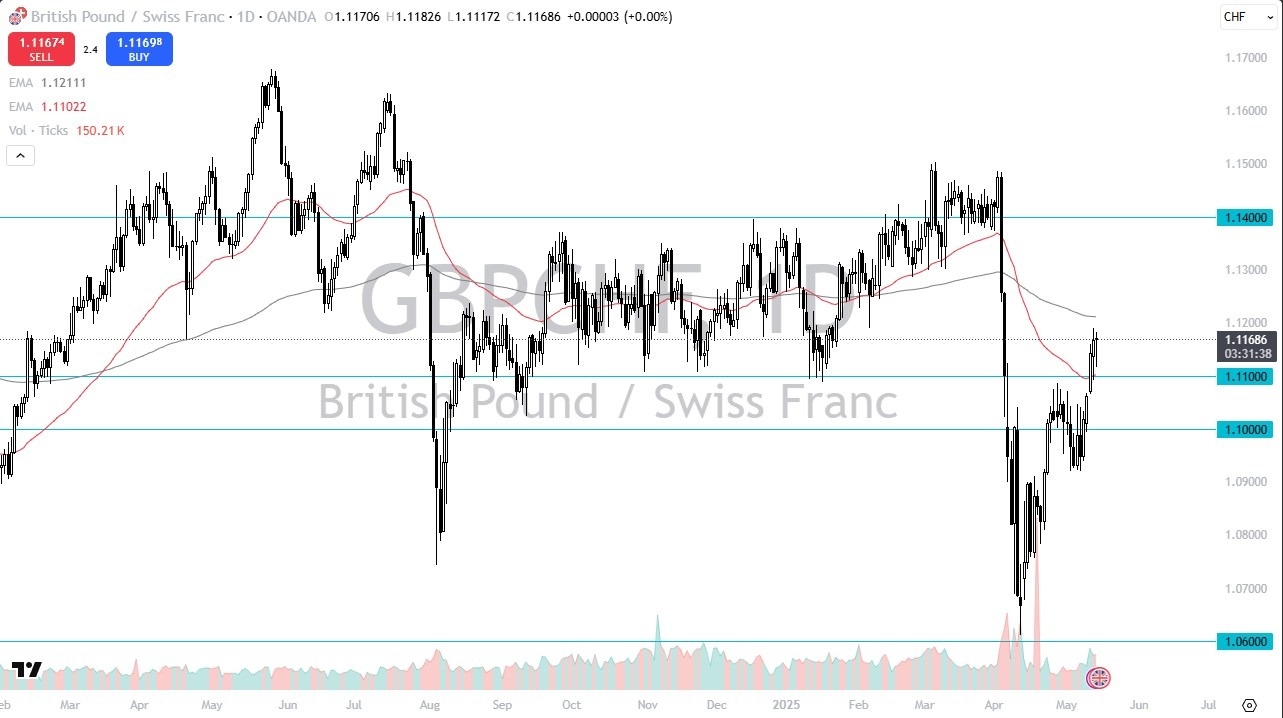

- The British pound initially dipped against the Swiss franc as we have a lot of volatility during the trading session on Wednesday.

- However, we have seen a lot of support just above the 50 Day EMA, sitting right around the 1.11 CHF level.

- This is an area that’s been important a couple of times, so it does make a certain amount of sense that we would see a bit of “market memory” in this area.

But a bouncing the way we have, we ended up forming a bit of a hammer, and this does suggest that perhaps the market is going to try to go higher, perhaps also trying to escape some of the “safety” of the British pound.

Technical Analysis

The technical analysis for this market is a little bit noisy at the moment, because we are between the 50 Day EMA and the 200 Day EMA indicators, so that does typically tend to cause a bit of noise in the markets, as traders try to sort out which direction they should be. If we can break above the 200 Day EMA, near the 1.1240 level, then I think you have a shot at going much higher, perhaps going all the way back to the 1.14 level. This is not to say that it’s easy to get up there, but I do think it is very likely to at least be a potential move.

If we break below the 1.11 level, then it’s possible that the market could drop down to the 1.10 level. The 1.10 level is a large, round, psychologically significant figure as well, and an area where I would expect to see a certain amount of support. Anything below there could end up causing quite a bit of negativity in this market, and quite frankly, the Swiss franc could be a currency that if we start to see a lot of risk aversion out there, it could end up attracting more inflows. However, we have recently seen traders tend to celebrate the idea of taking on risk, which lends this pair to go much higher.

Want to trade our daily forex analysis and predictions? Here’s a list of the best FX brokers in Switzerland to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.