Pound Sterling flattens against US Dollar ahead of US inflation data

The Pound Sterling (GBP) claws back its early losses against the US Dollar (USD) during European trading hours on Wednesday and flattens around 1.3500. The GBP/USD pair turns calm, while the US Dollar consolidates ahead of the United States (US) Consumer Price Index (CPI) data for May, which will be published at 12:30 GMT.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, wobbles around 99.00. Investors will pay close attention to the US inflation data as it will influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook. Read more…

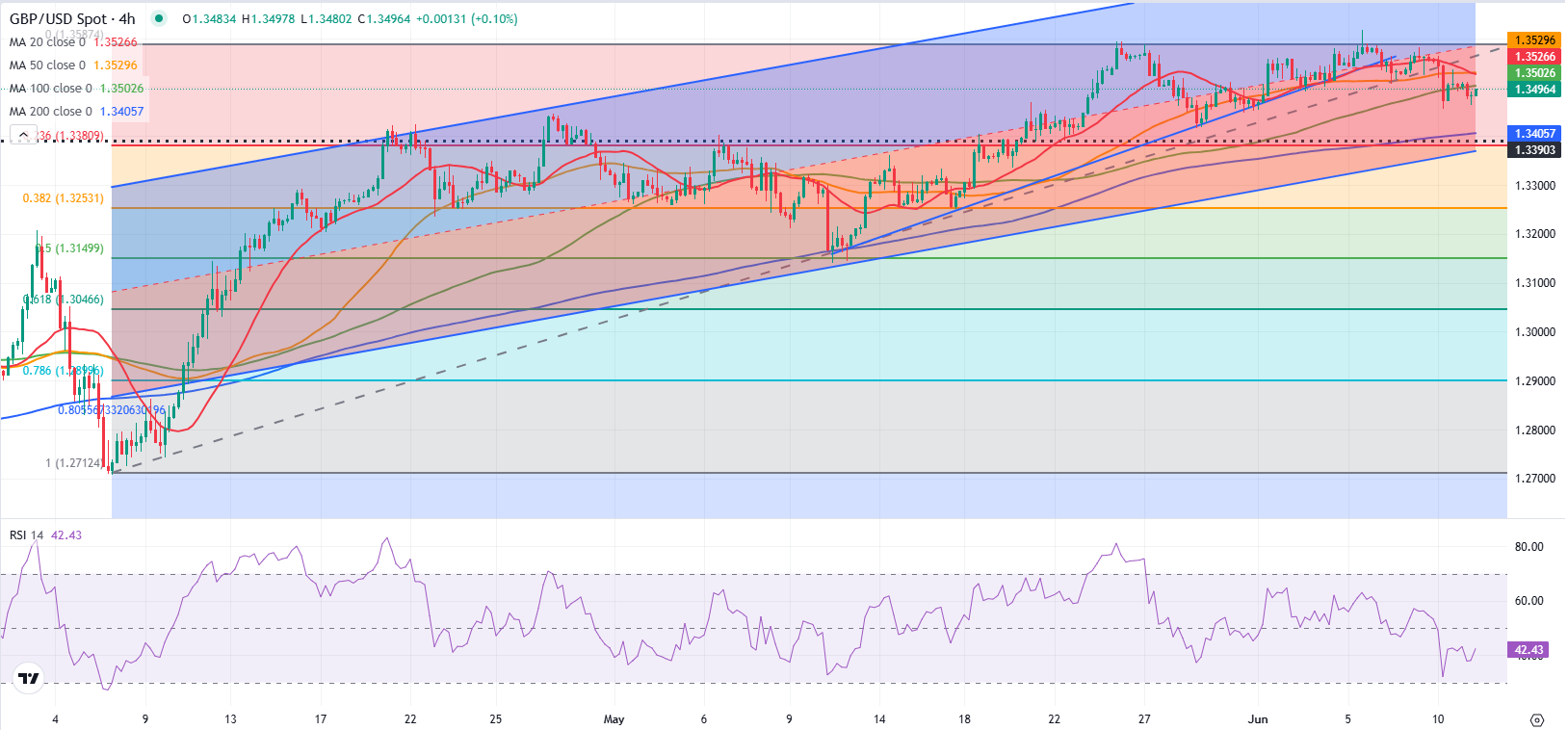

GBP/USD Forecast: Pound Sterling could extend slide on a hot US inflation print

After falling to a fresh weekly low near 1.3450 on Tuesday, GBP/USD corrects higher and holds steady at around 1.3500 in the European morning on Wednesday. The technical outlook points to a bearish tilt in the near term as markets await May inflation data from the US.

The disappointing labor market data from the UK, which highlighted an uptick in the Unemployment Rate alongside softer-than-expected wage inflation figures, revived expectations for the Bank of England (BoE) to cut rates multiple times this year and weighed on Pound Sterling. Reaffirming this view, a large majority of 59 economists that took part in a recently conducted Reuters poll noted that they see the BoE cutting the policy by 25 basis points (bps) in the third quarter and the fourth quarter, bringing down the bank rate to 3.75% from 4.25%, where it currently stands. Read more…