- During the trading session on Monday, we have seen the British pound gap higher against the Japanese yen as there was a significant “risk on move” out there, due to the announcement that the United States and China are looking into cutting tariffs drastically and then giving themselves 90 days in which to come together with some type of agreement.

- This is obviously a very crucial thing for markets overall, because it can give you an idea that the risk appetite will either be better or worse.

Technical Analysis

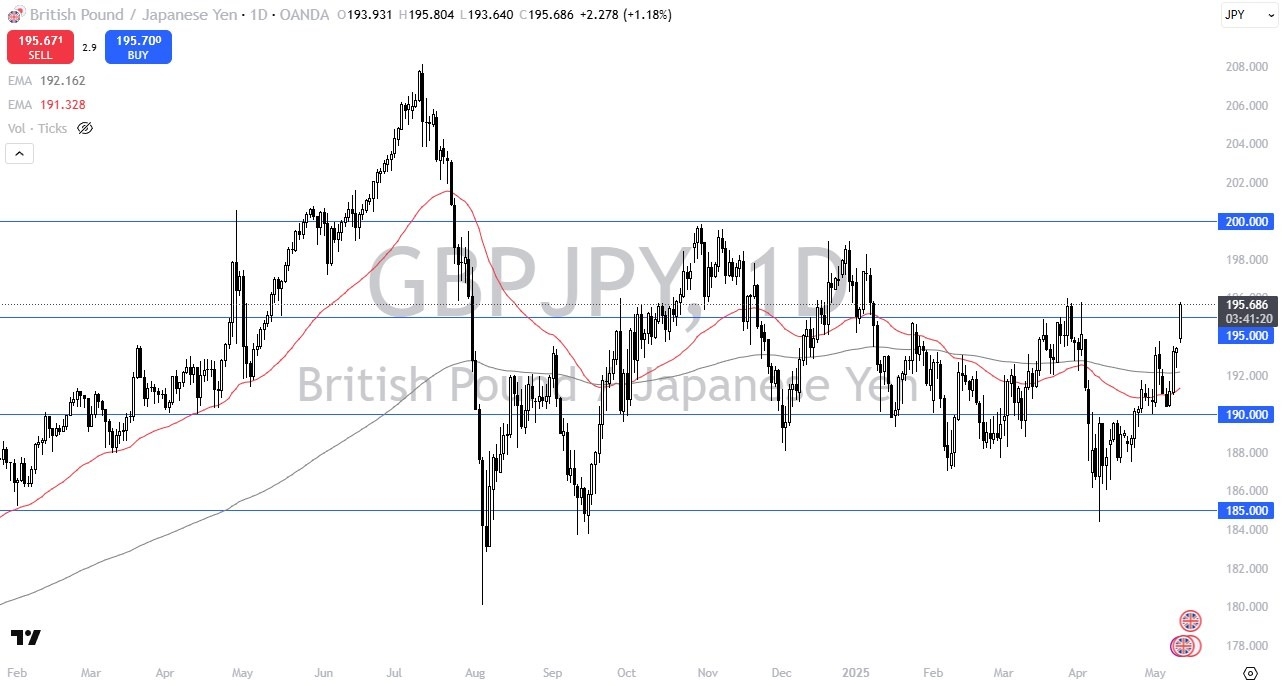

The technical analysis is worth paying close attention to, because the ¥195 level is an area that began significant resistance. If we can break above the ¥196 then it opens up the possibility of the move to the ¥200 level that could very well happen. I also recognize that the gap below is going to be paid close attention to, as it typically will offer support after a move like that. The ¥193.40 level is an area that you will have to pay close attention to because of this. The 200 Day EMA sits just above the ¥192 level, which in and of itself will be crucial as well.

Risk appetite is a huge influence on how this market moves, and therefore if we see stock markets and other risk assets rally, then we could see the British pound take off against the Japanese yen which of course is a major “safety currency” for a lot of forex traders.

With this being the case, I think you’ve got a situation where we are a little extended, but if we truly take off to the upside when it comes to risk appetite due to the US/China talks, that could very well be a major boost for this pair as well, not to mention the fact that you get paid at the end of every session to hold onto it.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.