- During the trading session on Wednesday, we’ve seen the British pound rise rather rapidly against the US dollar, especially as word got out that supposedly, Pres. Donald Trump was looking to fire Jerome Powell as the head of the Federal Reserve.

- Because of this, the US dollar sold off most everywhere, but we have since seen Pres. Trump denied that he was getting ready to fire Jerome Powell, so we have seen the market turned back around.

- The British pound is still slightly positive during the trading session, but it has clearly given back quite a bit of the initial shot.

Technical Analysis

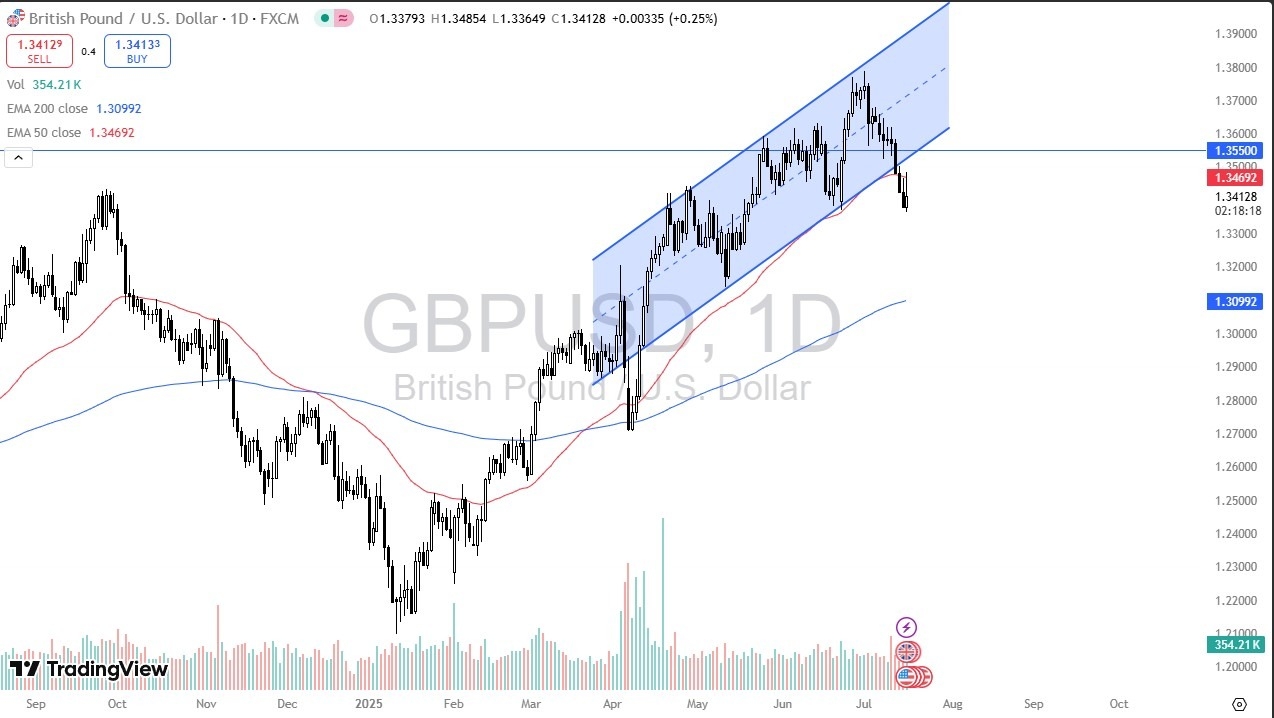

The technical analysis for this pair is starting to turn to the downside, as the rally ran into a lot of problems in the 50 Day EMA. Above there, we have the 1.3550 level, and of course the previous uptrend in general which now could offer quite a bit of resistance. In other words, I think we are about to see the fish pound fall significantly against the US dollar.

That being said, the reality is that the British pound has outperformed many other currencies against the US dollar for the better part of the year and a half, even when it’s falling. Because of this, I think that this could either end up being a nice shorting opportunity, where you can use it as a signal for shorting other currencies such as the euro and the Japanese yen against the US dollar. With that being said, I think we got a situation where short-term rallies probably get sold into, but if we were to see the British pound break above the 1.3550 level on a daily close, then I would have to rethink the entire situation here in Sterling.

As far as a target is concerned, we could be looking at the level 1.31, which is basically where the 200 Day EMA is currently hanging around. That would obviously attract a lot of attention, but we will have to see how quickly we get there, and of course whether or not the rest of the Forex market follows right along.

Ready to trade our GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.