- During the trading session on Tuesday, we saw the British pound dropped fairly significantly against the US dollar.

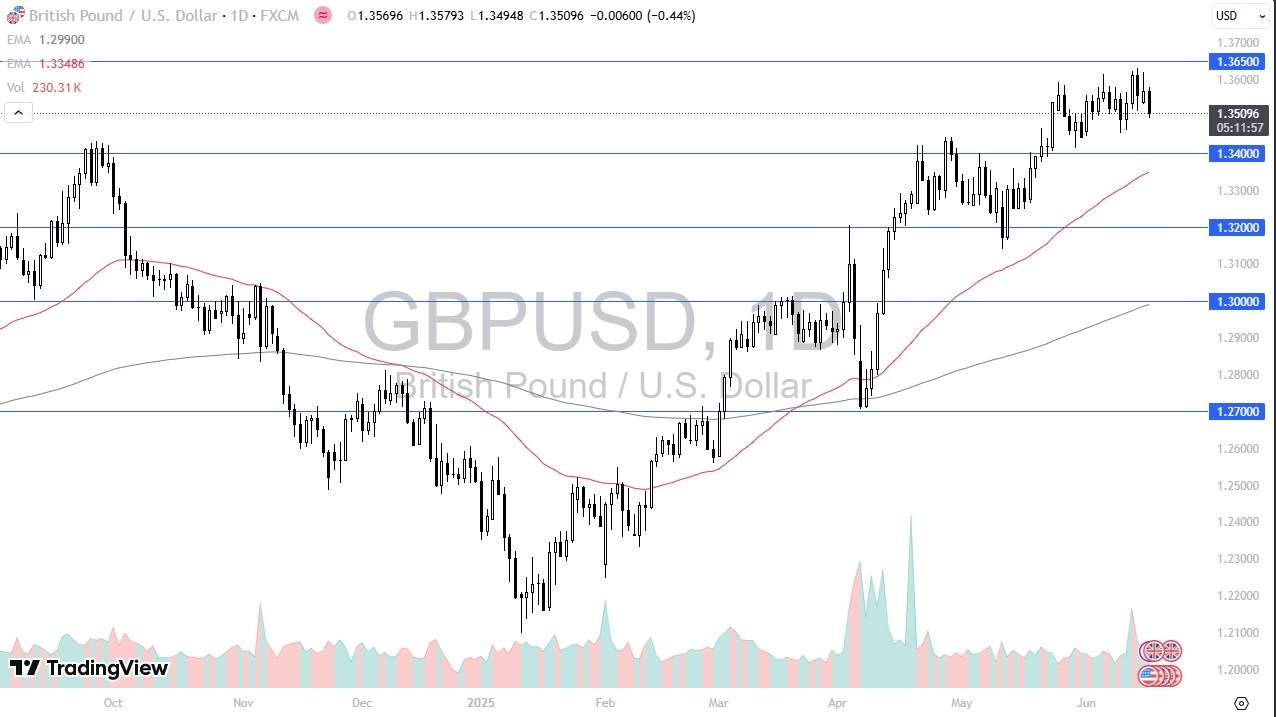

- This is perhaps simply due to the fact that we are mechanically trading back and forth in a range bound area, with the 1.34 level underneath offering massive support, while the 1.3650 level offers significant resistance.

- You should also keep in mind that the Federal Reserve is releasing an interest rate decision during the trading session on Wednesday, so people will be looking at this through the prism of what’s going on with the interest rate decision in the United States, and perhaps more important, the trajectory of interest rate policy.

Technical Analysis

The technical analysis for this market of course is somewhat bullish over the longer term, but in the short term, it looks like we are simply going to be neutral, which does make a certain amount of sense as we are waiting for that interest rate decision, but we also have a lot of questions asked about global risk appetite, as the US dollar of course is considered to be a safety currency, and the British pound is considered to be a little bit “more risky” than the greenback. Having said that, the market continues to see a lot of chop, and I think this will be the case in the short term.

Ultimately, I think this is a scenario where people will be very cautious with their position sizing, release it should be. However, if we were to break above the 1.3650 level on a daily close, that could really start to open up the bigger move to the upside. On the other hand, if we were to break down below the 1.34 level, that would of course be an area where the 50 Day EMA is racing toward, and it will almost certainly attract buyers.

It’s a market that’s been sideways for a couple of weeks, and I do think that makes quite a bit of sense considering that we had gotten here so quickly, and trends can only last for so long. With this being the case, I think you’ve got a scenario where buyers continue to support the market, but we need to get through the interest rate decision and much more breakout.

Ready to trade our GBP/USD daily forecast? We’ve shortlisted the best regulated forex brokers UK in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.