- GBP/USD coiled on Monday as Cable traders brace for a hard-hitting data docket.

- Technical moment has evaporated, leaving price action strung along key averages.

- UK labor data and US CPI inflation figures will greet Cable traders on Tuesday.

GBP/USD spun in a circle on Monday, wearing worry lines into the charts near 1.3430 as Cable traders buckle down ahead of a slew of key data on both sides of the Atlantic due on Tuesday. United Kingdom (UK) labor figures are due during the upcoming London market session, with United States (US) Consumer Price Index (CPI) inflation due later during the American trading window.

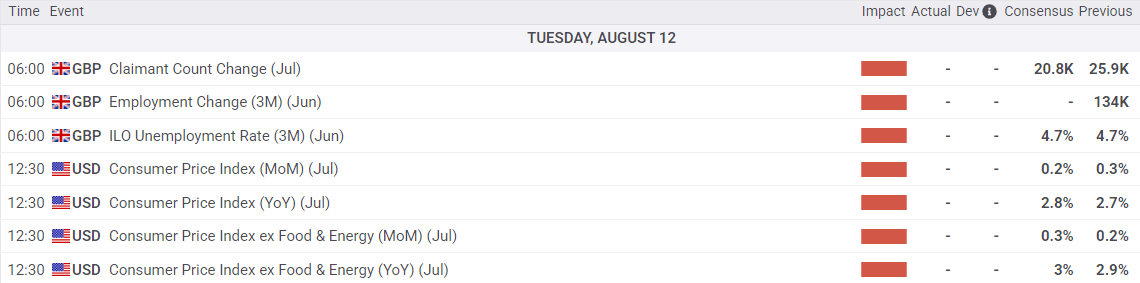

The latest Claimaint Count Change figures for July are due Tuesday, as well as the rolling three-month Employment Change numbers for the quarter ended in July. UK net job gains are expected to ease to 20.8K from 25.9K, while the ILO Unemployment Rate is expected to hold steady around 4.7% over the same period.

UK jobs, US CPI inflation in the barrel

The UK has been grappling with economic policy uncertainty both at home and abroad lately: The UK government’s constantly-changing budget guidelines to shore up a £41B overhang in the spending estimations is making it difficult for businesses and policymakers alike to forecast or make meaningful investment decisions as long as policy commitments remain a day-to-day factor. The Bank of England’s (BoE) latest rate cut, which came as no surprise to markets, hinted that further rate cuts from here may require a more solid grasp of the UK’s domestic economy.

US CPI inflation data from July is due on Tuesday and will draw far more investor attention than usual. Headline and core CPI inflation is expected to tick higher on an annualized basis, and investors will be hoping that an inflation upswing will remain slim enough to not knock the Fed off of its current trajectory on rate cuts. Headline CPI inflation is expected to rise to 2.8% YoY from 2.7%, while core CPI is forecast to tick up to 3.0% YoY from the previous 2.9%.

GBP/USD price forecast

GBP/USD remains hamstrung near the 50-day Exponential Moving Average (EMA) near 1.3430, spinning in place as markets await key fundamental data. A near-term bull run in Cable bids has either drawn to a close or taken a breather, depending on how Tuesday shakes out, but a lower-high technical pattern is weighing the odds in favor of fresh bearish strength in the immediate future.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.