GBP/USD Forecast: Pound Sterling remains fragile despite hot UK inflation readings

Following a short-lasting recovery attempt in the early European session on Wednesday, GBP/USD struggles to hold its ground and trades below 1.3400. The near-term technical picture highlights oversold conditions for the pair.

The data published by the UK’s Office for National Statistics (ONS) showed earlier in the day that the annual inflation in the UK, as measured by the change in the Consumer Price Index (CPI), climbed to 3.6% in June from 3.4% in May. This reading came in above the market expectation of 3.4%. In the same period, the core CPI, which excludes volatile food and energy prices, rose 3.7%, compared to the 3.5% increase recorded previously. With the immediate reaction, GBP/USD edged higher but failed to gather momentum. Read more…

The Pound continues to decline, with little support from the Bank of England

The GBP/USD pair has slowed its decline, stabilising near 1.3391. On the previous day, Bank of England Governor Andrew Bailey addressed key global economic challenges in a speech at Mansion House. He described the latest wave of trade tariffs as a systemic event capable of reshaping global trade dynamics. Bailey highlighted growing domestic imbalances in the US and weak domestic demand in China, urging both nations to clarify their strategies for addressing these issues.

However, Bailey clarified that not all trade imbalances are inherently problematic – many stem from productivity disparities between nations. Yet, he warned that widening macroeconomic and political divergences are increasing systemic fragility. Read more…

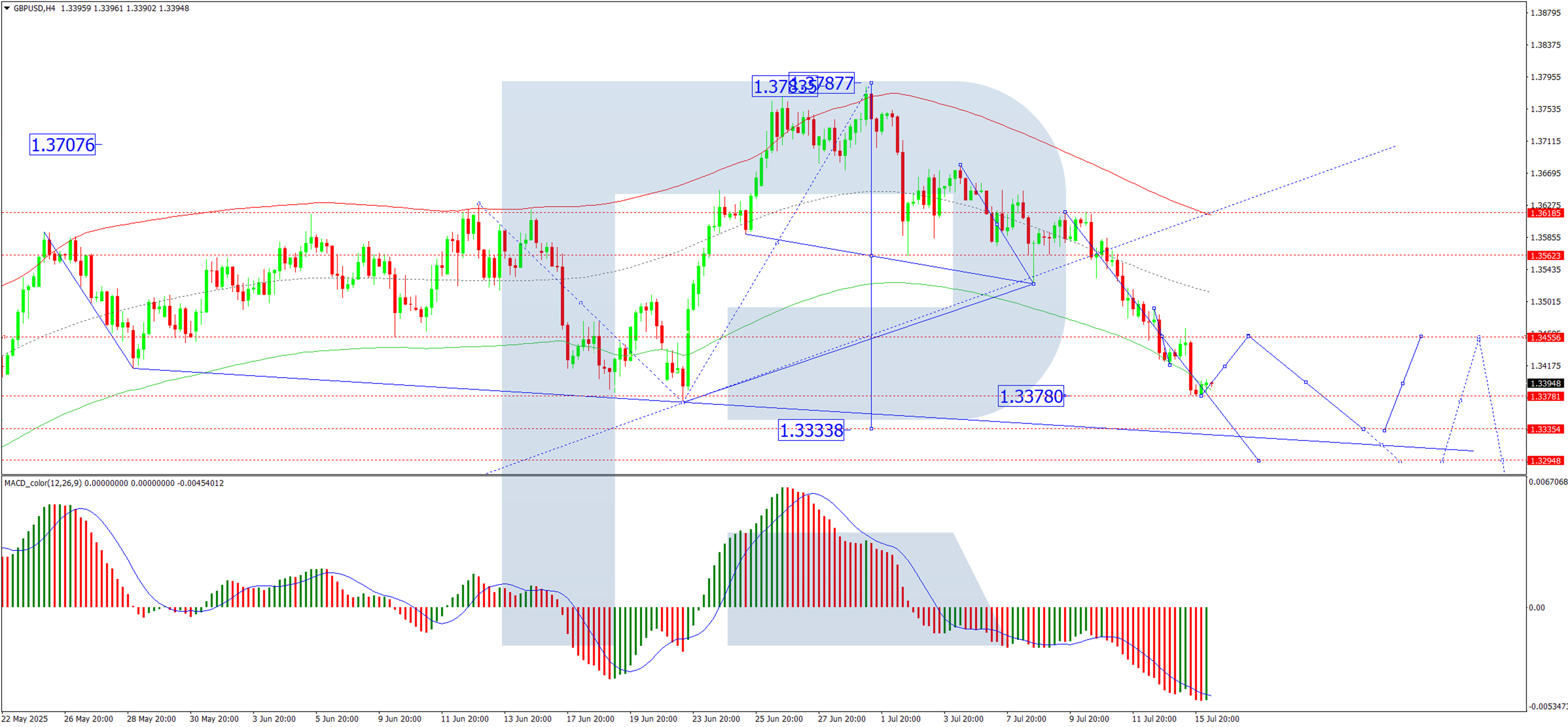

Cable is breaking out of an ending diagonal

Cable is turning lower and has been one of the weakest currencies over the last week or so, and the main reason for this, of course, were the UK GDP figures reported last week, which showed that the economy has contracted, while at the same time, Bank of England said that they will be looking into more rate cuts in the future. That’s why cable came nicely down towards the 1.3380 area in a relatively short period of time.

Now, what’s really important here is that the market is turning down after an ending diagonal that was positioned in the fifth wave, something we’ve been tracking closely with our members, and already warned about this limited upside back in June. Ending diagonals are known to be slow patterns, but once completed, they usually lead to a sharp reversal — and that’s exactly what we are seeing here. Read more…