GBP/USD Forecast: Pound Sterling remains vulnerable on broad USD strength

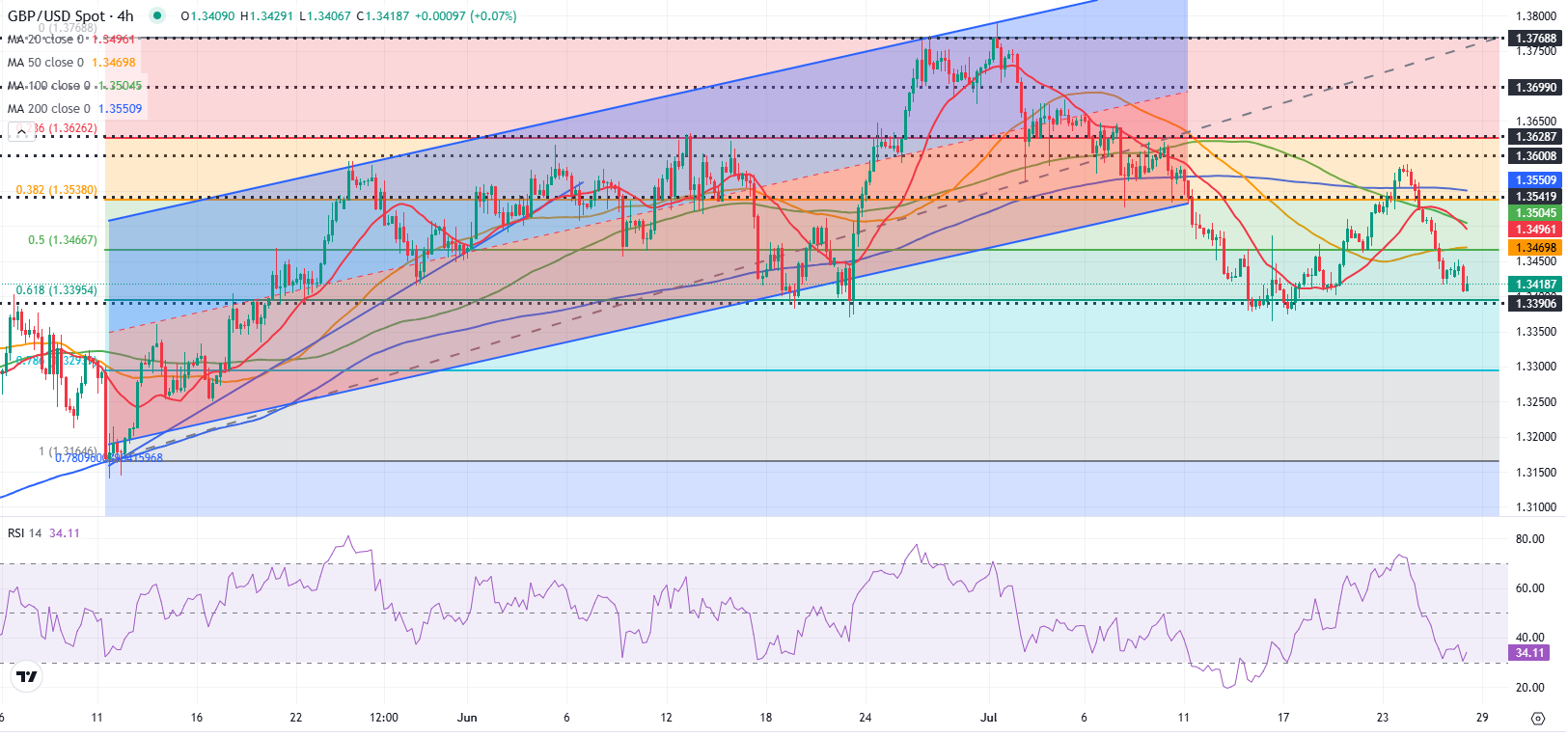

After posting large losses on Thursday and Friday, GBP/USD struggles to stage a rebound on Monday and trades in negative territory, slightly above 1.3400. The pair’s technical outlook suggests that the bearish bias remains intact in the short term.

The US Dollar (USD) outperforms its rivals as fears over an economic downturn in the United States (US) ease. The European Union (EU) and the US announced over the weekend that they have reached a framework trade deal that sets a blanket 15% tariff on goods traded between them. Additionally, European Commission President Ursula von der Leyen noted that they will not impose retaliatory tariffs and said they will invest $600 billion in the US on top of existing expenditures. Read more…

GBP/USD Weekly Outlook: Pound Sterling recovery loses momentum ahead of a big week

The Pound Sterling (GBP) staged a solid comeback from two-month lows against the US Dollar (USD) before GBP/USD buyers ran into the 1.3600 hurdle.

Despite its retracement in the second half of the week, the GBP/USD pair closed the week with gains as the USD registered its biggest weekly drop in a month. Read more…

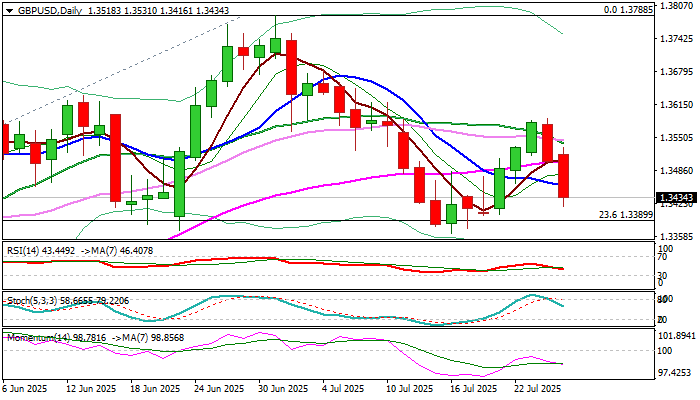

GBP/USD outlook: Under increased downside pressure

Cable remains under increased pressure and heads south for the second straight day (down 1% in two days). Persistent weakness in Britain’s business activity, increasing pace of cutting jobs and growing concerns about government’s finances, weigh heavily on sterling.

Pound accelerated sharply lower after repeated failure at strong technical resistance at 1.3576 (daily Kijun-sen / 50% retracement of 1.3788/1.3364 drop) with penetration of rising daily Ichimoku cloud (1.3476 – cloud top, reinforced by daily Tenkan-sen / 50% retracement of 1.3364/1.3588 recovery leg), adding to growing negative signals from MA’s being in bearish setup and strengthening negative momentum. Read more…