GBP/USD Forecast: Pound Sterling reverses course after posting multi-year high

GBP/USD stays under bearish pressure on Wednesday and trades near 1.3700 after touching its highest level since October 2021 at 1.3788 on Tuesday. Investors await private sector employment data from the US.

GBP/USD managed to post small gains on Tuesday but reversed its direction early Wednesday, with the US Dollar (USD) Index finding a foothold following a seven-day losing streak. Read more…

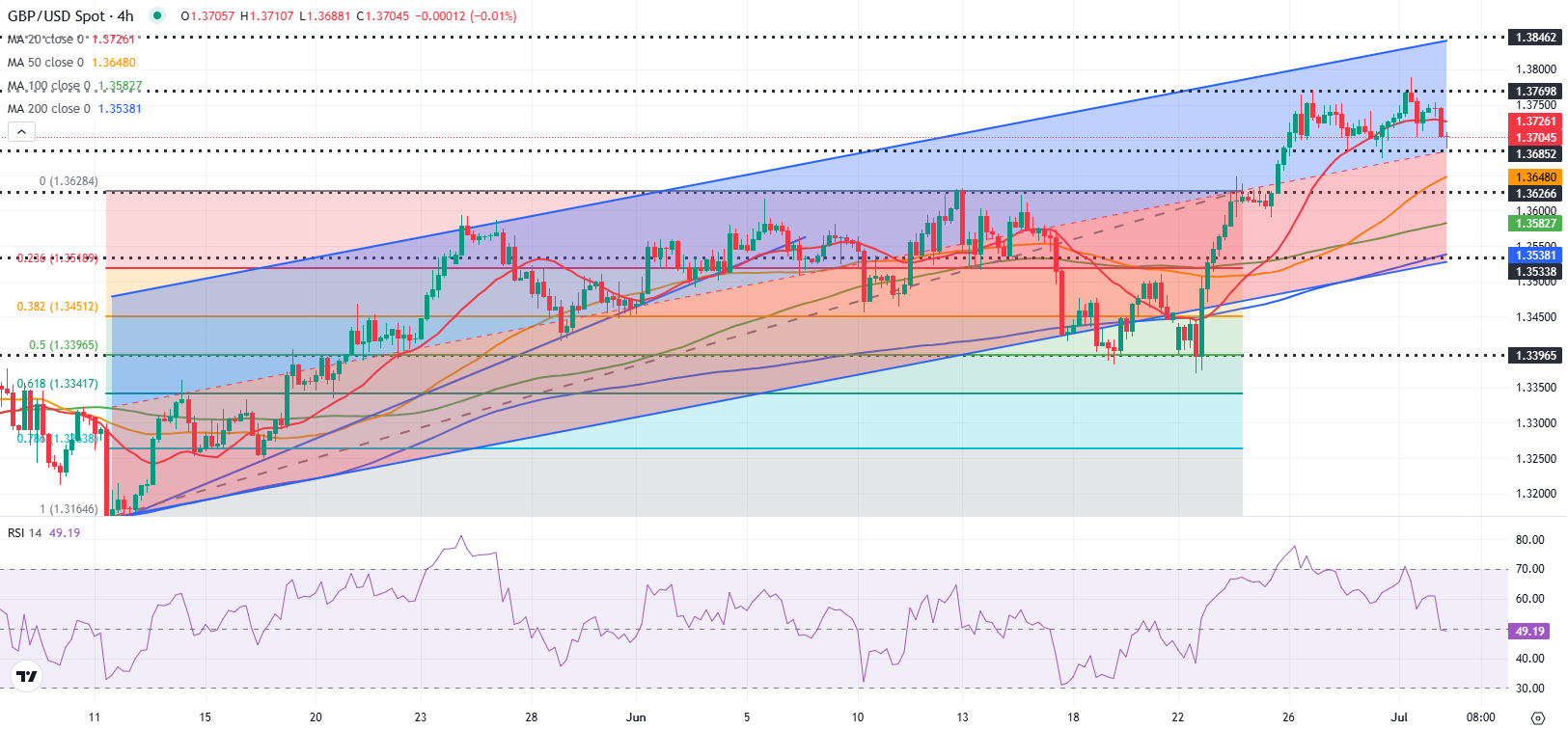

GBP/USD at the top of a bullish channel

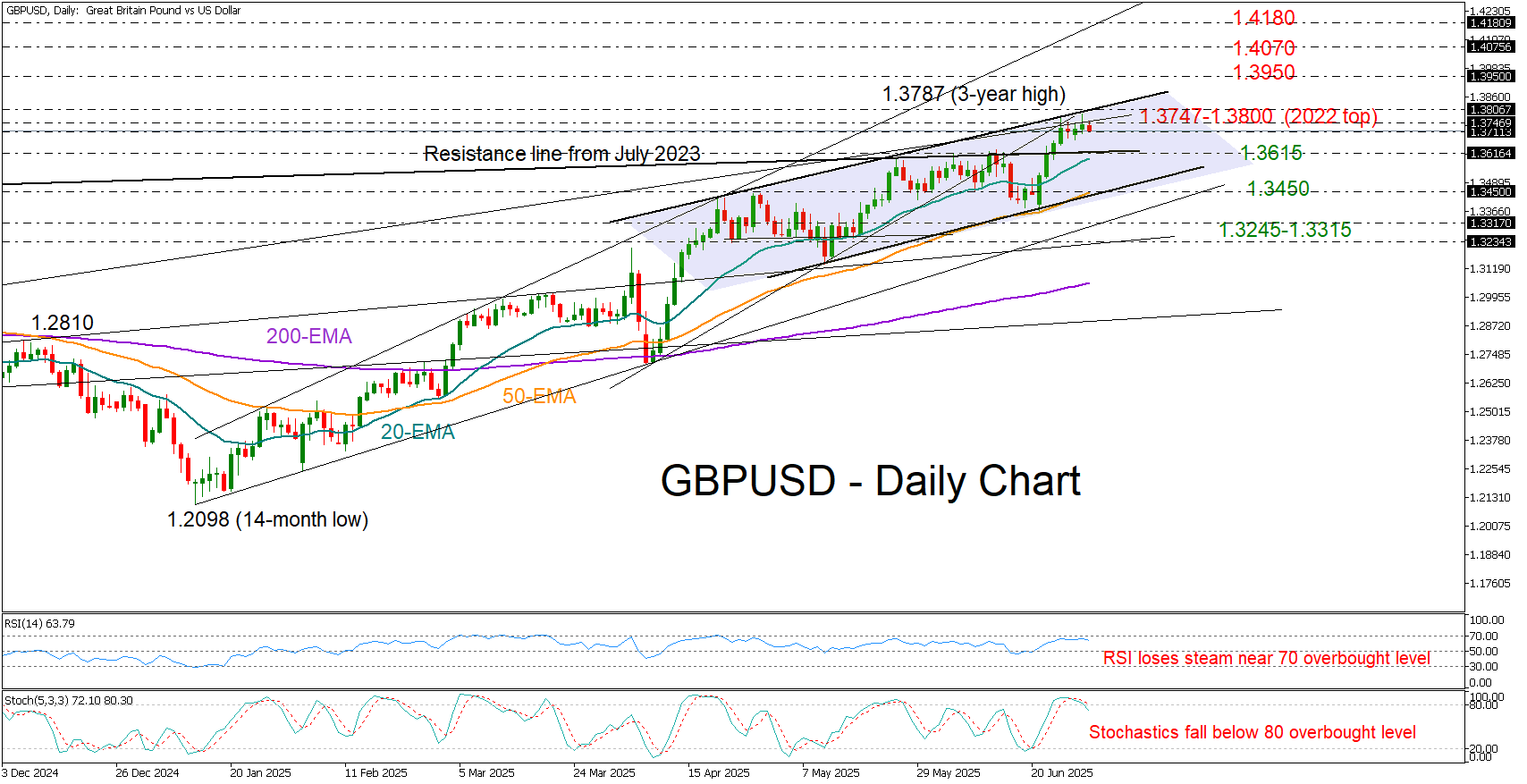

GBP/USD began July’s trading with sluggish momentum, following five consecutive months of gains that pushed the price to a three-year high of 1.3787 on Monday.

Much of the pair’s ascent is due to the dollar’s weakness, while the Bank of England’s gradual approach to rate cuts has been a positive catalyst too. Speaking on a panel with global peers in Portugal, BoE Governor Andrew Bailey reminded investors that interest rates are expected to decline further, while also hinting at a potential slowdown in quantitative tightening, clouding the outlook for the remainder of the year. Read more…

GBP/USD poised to break out: Wave ((iii)) of 3 of (3) set to accelerate beyond channel resistance

The current structure in GBP/USD (1D) suggests we are in the early stages of wave ((iii)) of 3 of (3) on a higher degree impulse cycle. The internal count from the wave (2) low clearly delineates wave (1)-(2), followed by wave 1-2 within wave (3), setting the stage for the heart of the move — wave ((iii)).

The price action has respected the boundaries of a well-defined ascending channel, with subwaves i and ii of ((iii)) already forming. The powerful rally off the wave ii low, breaking above minor wave i high with momentum, supports the view that wave ((iii)) is now underway. Read more…