Pound Sterling weakens as UK PMI grew modestly

The Pound Sterling (GBP) declines against its major peers on Thursday as the preliminary United Kingdom (UK) S&P Purchasing Managers’ Index (PMI) report for July has shown that the overall business activity grew at a slower-than-projected pace. The Composite PMI come in at 51.0, lower than estimates of 51.9 and 52.0 in June, suggesting that the overall business activity continued to expand, but at a moderate pace.

UK Composite PMI growth slowed down as the service sector activity surprisingly rose at a moderate pace. The Services PMI dropped to 51.2, while it was expected to come in higher at 53.0 from the prior reading of 52.8. Meanwhile, the Manufacturing PMI continued to decline amid global trade uncertainty and policy changed announced by Chancellor of the Exchequer Rachel Reevs in the last Autumn Budget. The Manufacturing PMI contracted but a slower-than-projected pace to 48.2, against estimates of 48.0 and the prior reading of 47.7. Read more…

GBP/USD Forecast: Pound Sterling trades near key support area ahead of US data

GBP/USD corrects lower after closing the first three days of the week in positive territory and fluctuates near 1.3550 on Thursday. Preliminary July Manufacturing and Services Purchasing Managers Index (PMI) data from the US and the market mood could influence the pair’s action in the second half of the day.

The US Dollar (USD) struggled to find demand on Wednesday and allowed GBP/USD to push higher as risk flows dominated the action in financial markets on the announcement of a trade deal between the US and Japan. Read more…

GBP/USD recovery faces key test

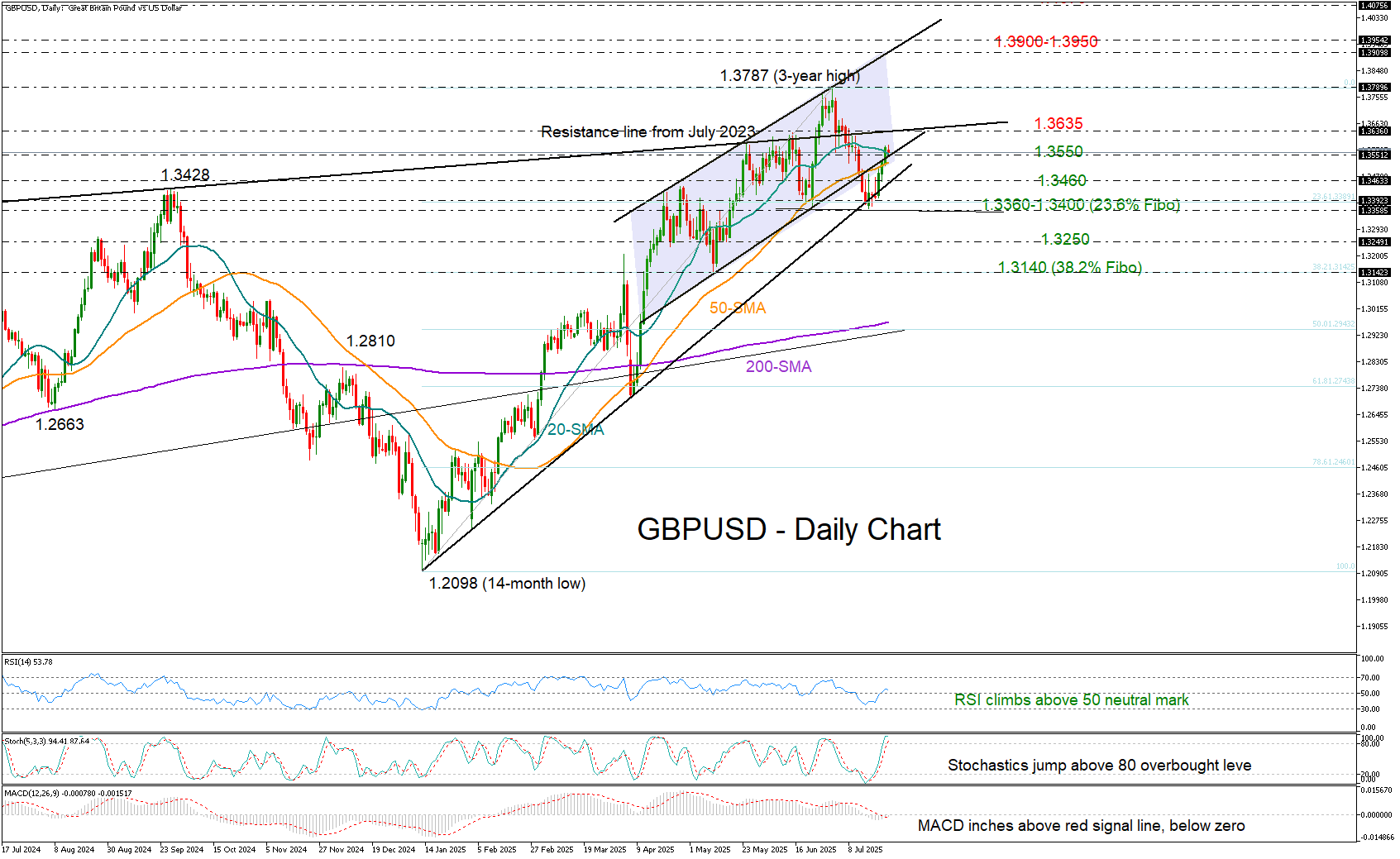

GBP/USD escaped a drop below the 1.3390–1.3400 support area last week, helped by dollar weakness, and is now attempting a close back above its 20- and 50-day simple moving averages (SMAs) near 1.3550.

The latest rebound preserved the nearly 14% year-to-date rally, but for bullish sentiment to strengthen, the pair must also clear the resistance line drawn from July 2023 at 1.3635. A decisive move above the three-year high of 1.3787 could then pave the way toward the 1.3900 round level, where the upper boundary of the short-term bullish channel lies. Beyond that, the price could pause near the 161.8% Fibonacci extension of the prior decline at 1.4070, before potentially heading toward the psychological 1.4200 mark. Read more…