- Gold rallies as tariff risks and trade tensions fuel demand for safe-haven bullion.

- EU-US trade talks stall as President Trump increases demands, sending the US Dollar lower.

- XAU/USD threatens psychological resistance at $3,400 as bullish momentum increases.

Gold (XAU/USD) is benefiting from renewed trade tensions on Monday, which have triggered demand for the safe-haven yellow metal.

As the August 1 tariff deadline looms, prospects of a deal between the European Union (EU) and the United States (US) are fading. As a result, XAU/USD has recovered with the price hovering near $3,400 at the time of writing.

EU-US trade tensions rise, lifting demand for Gold

Ongoing talks between the EU and the US have failed to make any meaningful progress over recent weeks. US President Donald Trump has threatened to impose a 30% tariff on most goods imported from members of the EU bloc in an effort to reduce the current trade deficit.

In an interview with CBS News over the weekend, US Commerce Secretary Howard Lutnick signaled optimism about a potential deal. He stated that “These are the two biggest trading partners in the world, talking to each other. We’ll get a deal done. I am confident we’ll get a deal done.”

However, he also warned that an extension would not be granted. “That’s a hard deadline, so on August 1, the new tariff rates will come in,” he said.

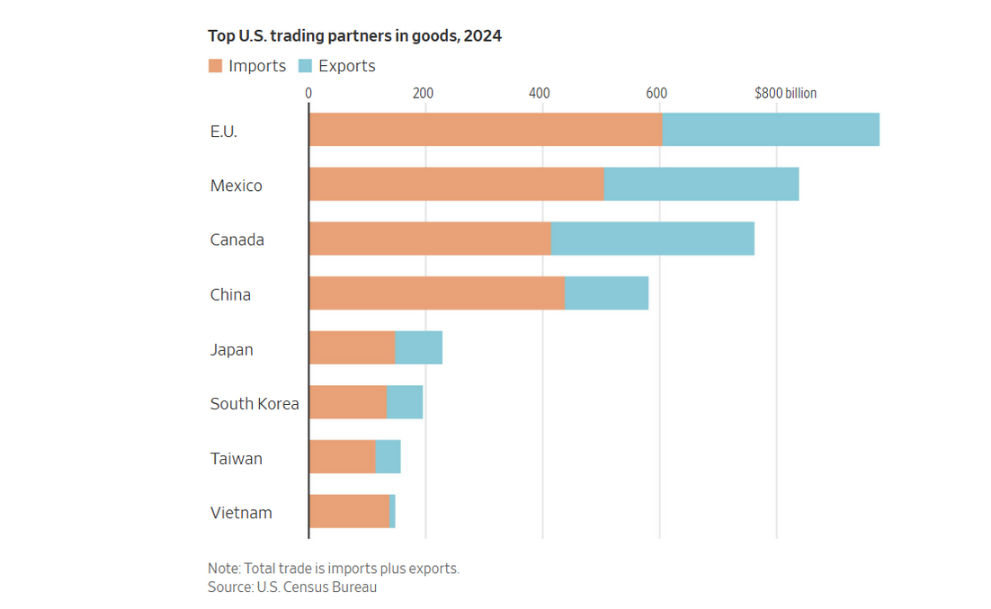

According to CNBC, the European Council reported that the total value of trade between the EU and US amounted to $1.96 trillion in 2024.

The chart below represents the value of trade between the US and its largest trading partners, as illustrated in an article in The Wall Street Journal.

Even with a deal, the US has signaled that the bloc would still be exposed to a baseline tariff of 15% to 20%. As the EU prepares for the worst-case scenario, it has threatened to retaliate against the US if a deal is not reached. A wide range of countries are finding themselves in a similar situation, which is causing a reduction in demand for the US Dollar. A weaker USD also makes Gold less expensive for foreign investors seeking safety in alternative assets.

Daily digest market movers: Gold reacts to renewed trade tensions

- Brussels is working to secure a trade agreement while simultaneously preparing a fresh set of retaliatory tariffs. These measures are aimed at targeting up to €72 billion worth of US exports, which would cover products such as cars, aircraft, bourbon whiskey, digital services, and other key sectors.

- Sector-specific tariffs are also set to remain in place. This includes the 50% tariff on steel and aluminium, with the same rate applying to copper imports to the US beginning next month.

- Auto parts imported to the US are currently subject to a 25% levy. Trump has also indicated that tariffs on pharmaceuticals and semiconductors may be implemented soon.

- According to Bloomberg, estimates from the EU indicate that duties are already impacting roughly 70% of imports to the US. This amounts to approximately $442 billion worth of trade.

- Economic data from the US has recently revealed that the economy remains resilient despite the fundamental risks associated with increased import costs.

- Michigan Sentiment data released on Friday showed that US consumers remain optimistic. Meanwhile, the University of Michigan (UoM) also published its preliminary inflation expectation figures. The survey revealed that both the 1-year and 5-year inflation expectations have decreased.

- US Retail Sales data on Thursday also surpassed analyst predictions, indicating robust consumer spending.

- As the Federal Reserve (Fed) remains reluctant to cut interest rates, citing concerns that tariffs may still lead to price increases, markets are currently pricing in a 56.1% probability of a rate cut in September. Meanwhile, the CME FedWatch Tool indicates that the likelihood of rates remaining unchanged at the same meeting stands at 41.3%. Any shifts in these expectations will impact the demand for US yields. Rising yields do not bode well for non-yielding assets, such as Gold.

Gold technical analysis: XAU/USD breaks above symmetrical triangle resistance, as bulls retest $3,400

The daily chart of spot Gold shows a breakout from the symmetrical triangle pattern, which has pushed XAU/USD above the 23.6% Fibonacci retracement level of the April low-high move near $3,372. As this level now steps in as support, the price is currently flirting with the critical $3,400 psychological resistance level. A surge in bullish momentum above this zone would bring the June 16 high of $3,452 back into play, opening the door for a potential retest of the $3,500 all-time high.

Gold daily chart

On the downside, a move below the $3,372 would bring the $3,350 psychological level back into focus. Below that is the 50-day Simple Moving Average (SMA) at $3,327. The 38.2% Fibonacci level at $3,392 and the 50% level at $3,328 may provide a floor for price action in the event of a pullback.

Meanwhile, the Relative Strength Index (RSI) at 59 signals an increase in bullish momentum, although it remains below overbought territory.

Overall, the market appears poised for a directional move, with traders likely monitoring trade talks cautiously, which could continue to drive price action.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.