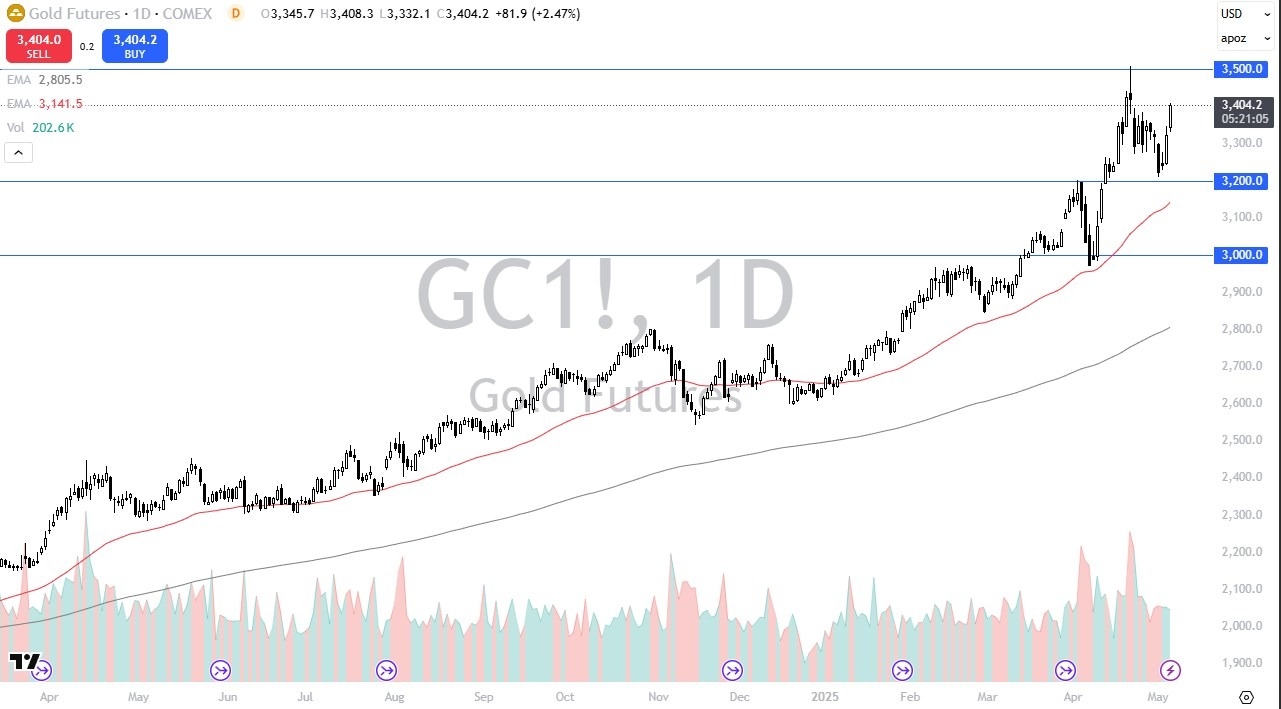

- Gold markets continue to be absolutely ridiculously bullish as we scream higher during the trading session on Tuesday.

- All things being equal, this is a market that I think will continue to find plenty of buyers on dips.

- I would be somewhat cautious at this point because we do have the FOMC meeting on Wednesday and that will most certainly have a major influence on what happens next.

With that being the case I remain somewhat optimistic, but I’m looking for a pullback to take advantage of This is a market that of course gets very noisy from time to time But it has remained bullish for what seems like a lifetime at this point With this I think you have to launch the $3200 level as a potential floor, which is also backed up by the 50 day EMA. So, with that, you probably have a scenario where traders are just trying to get a gauge on what the Federal Reserve is going to do. And I do think that the Federal Reserve is the main culprit behind any move coming up.

Its All About Powell for the Next 24 Hours

After all, if they do in fact lighten their hand on interest rates and perhaps let the market see a little bit of dovishness, that could be extraordinarily bullish for equities overall and perhaps even more bullish for gold as traders look to protect their purchasing power. Nonetheless, it does seem like the market is trying to run anything that the Federal Reserve does in anticipation of perhaps either lower interest rates or the hint of lower interest rates, and that’s probably what we’ll see.

The $3,500 level is a major barrier that would have to be watched very closely, as it is a large round psychologically significant number, an area where you probably see a lot of options traded, and the most recent swing high.

Ready to trade our Gold daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.