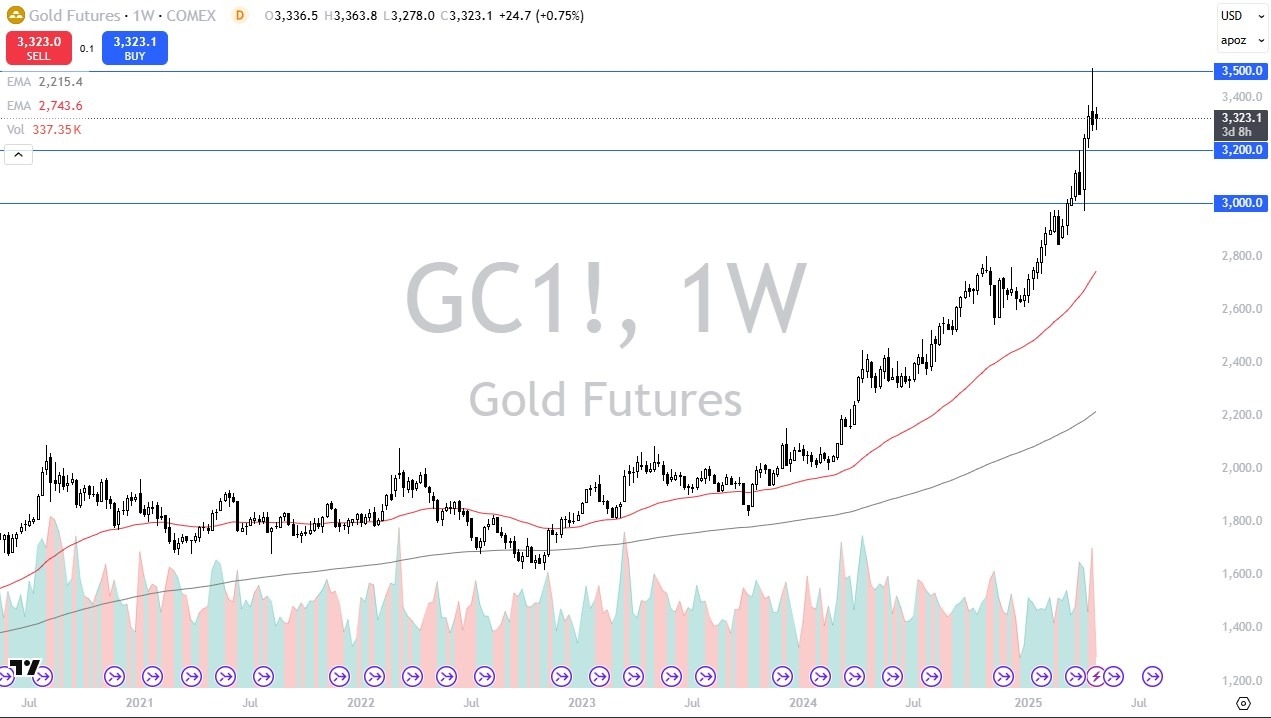

- The gold market has been very bullish over the last several months, and April was more of the same.

- That being said, it’s also worth noting that we have seen a massive exhaustion candle form during the 3rd week of April, which suggest that perhaps we may have some work to do before the next leg higher.

- What’s interesting for me is that we have also seen a massive exhaustion candle for that same week favoring the US dollar against the euro and many other currencies, which could suggest that perhaps the selling of the US dollar is starting to abate.

This isn’t to say that gold can go higher from here, quite frankly both can go straight up in the air at the same time. If we get some type of major “risk off” type of move, that could drive both the US dollar and gold higher. Regardless, I think there are plenty of reasons for gold to continue rallying, although the month of May itself might be a bit quieter than we have seen over the last several months.

Technical Analysis

The technical analysis for gold is obviously very bullish, but with that massive shooting star, and the fact that the $3500 level has acted as a brick wall, I think we are heading into a fairly quiet time for gold, perhaps even a bit of a pullback. That pullback very well be thought of as an opportunity to pick up cheap ounces of gold, which a lot of traders will most certainly be looking for at this point.

The $3200 level is support, but if we were to break down below there, the $3000 level would be the next major support region from what I can see. If we were to simply break to the upside from here, clearing the $3500 level opens up the possibility of a move to the $3800 level, although I do not like the idea of parabolic markets and chasing them. I prefer a bit of stability year, and I think a lot of the bullish traders do as well.

Ready to trade our monthly forecast? Here’s a list of some of the best XAU/USD brokers to check out.