- Gold price edges up, over 1.5% this week ahead of Trump’s tariff deadline.

- Traders brace for “liberation day” where Trump will implement reciprocal tariffs on all countries.

- Gold traders are looking for upside levels with $3,200 as the next nearby target.

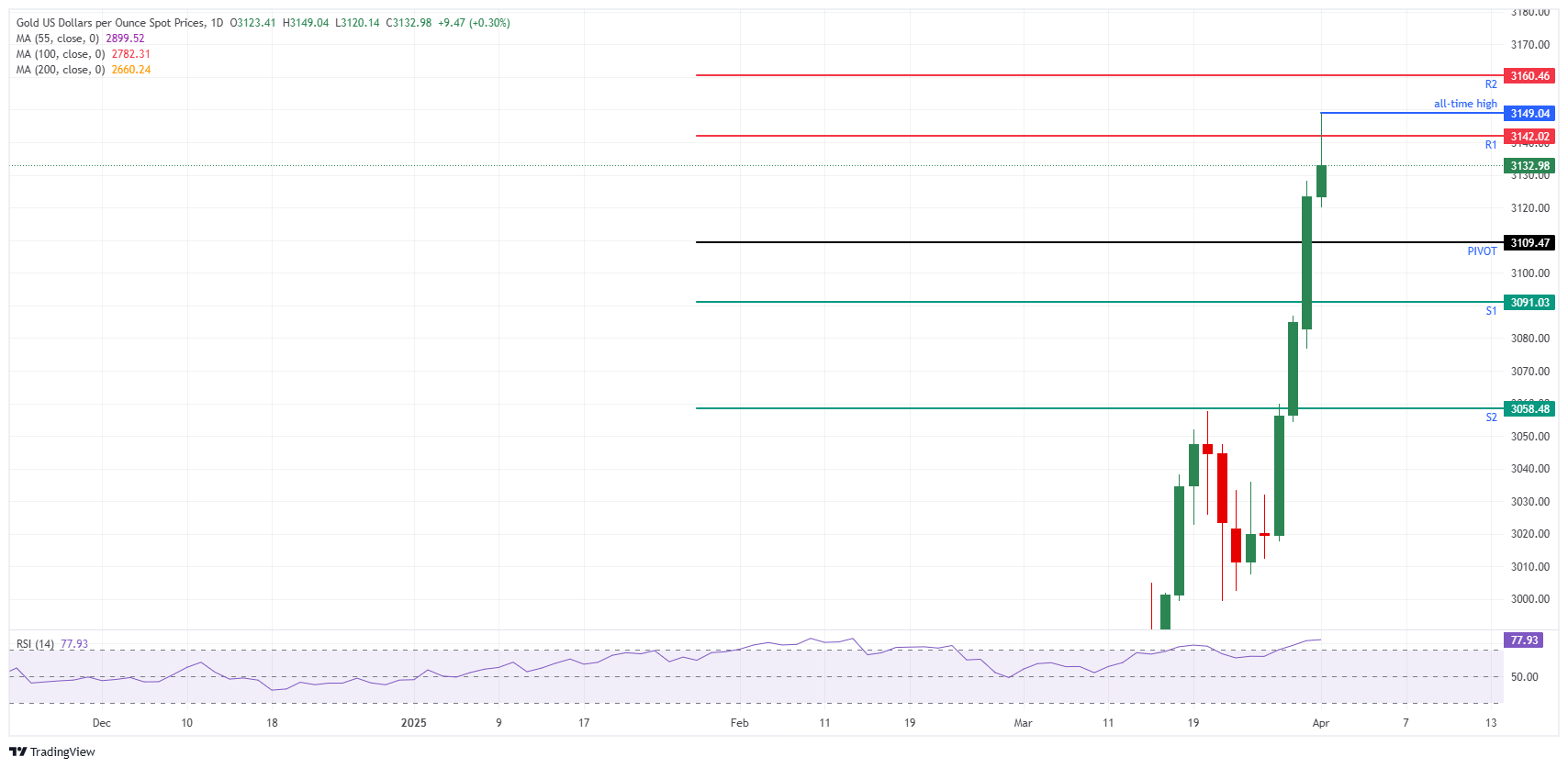

Gold price (XAU/USD) prints a new all-time high, the second one already for this week, with the reciprocal tariff implementation being just one day away. The precious metal trades slightly above $3,130 at the time of writing and the new all-time high was eked out at $3,149 this Tuesday. Investors are still seeking refuge in Gold’s market with United States (US) President Donald Trump set to announce reciprocal tariffs on Wednesday around 19:00 GMT.

Meanwhile, traders brace for a heavy trading week in terms of US economic data. In the runup towards the Nonfarm Payrolls release due on Friday, markets will wait for several data to be published. Overnight, during a CNBC interview, Richmond Federal Reserve (Fed) Bank President Thomas Barkin said the economic reading is wrapped in a thick fog and is unclear for policymakers to read where rates should go, while recession fears are still on the table, CNBC reports.

Daily digest market movers: South African miners gain

- The surging Gold price has propelled South African mining Stocks to their best monthly performance on record, shielding the country’s benchmark index from the mayhem in global markets, Reuters reports. The South African mining Equities had their best monthly performance on record in March, with a 33% jump, driven by increasing Gold prices.

- The CME FedWatch tool sees chances for a rate cut in May decrease to 13.1% compared to near 18.1% on Monday. A rate cut in June is still the most plausible outcome, with only a 23.1% chance for rates to remain at current levels.

- Physical demand and a favorable macro backdrop are helping drive the Gold rally, according to Amy Gower, a commodity strategist at Morgan Stanley, which predicts prices may rise to $3,300 or $3,400 this year. That outlook coincides with forecasts from other major banks, with Goldman Sachs Group Inc. now looking for $3,300 by year-end, Bloomberg reports.

Gold Price Technical Analysis: Rule of thumb

A small ‘parental advisory’ on the longevity of the Gold rally makes sense around now. With the main tailwind for the Goldrush set to be officially announced, the ‘buy the rumour, sell the fact’ rule of thumb should be considered. The risk could be that once the reciprocal tariffs take effect on Wednesday, only easing due to profit-taking in Gold could occur once separate trade agreements and partial unwinds take place.

On the upside, the daily R1 resistance at $3,142 has already been tested in Tuesday’s steep rally. The R2 resistance at $3,160 could still be targeted later in the US trading session as the European session sees Gold price action settle a touch. Further up, the broader upside target stands at $3,200.

On the downside, the daily Pivot Point at $3,109 should be strong enough to support any selling pressure. Further down, the S1 support at $3,091 is quite far, though it could still be tested without completely erasing the prior’s day move. Finally, the S2 support at $3,058 should ensure that Gold does not fall back below $3,000.

XAU/USD: Daily Chart

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.