- XAU/USD trades at $3,328, up 0.10%, after bouncing off $3,300 intraday low.

- Positive US-China trade talks in London lift risk appetite, boost equities.

- Choppy price action appears as traders await key US CPI data due Wednesday.

Gold price clings to modest gains on Tuesday after bouncing off a daily low near the $3,300 figure as talks between the United States (US) and China appear to be progressing well, improving risk appetite among investors who are driving US equities higher. The XAU/USD trades at $3,328, up 0.10%.

The market mood remains positive, fueled by the reunion between US and Chinese officials in London. Meanwhile, price action in the financial markets remains choppy as traders await the release of the latest US Consumer Price Index (CPI) figures for May. Estimates suggest that prices most likely rose, with US households feeling the impact of tariffs by the Trump administration.

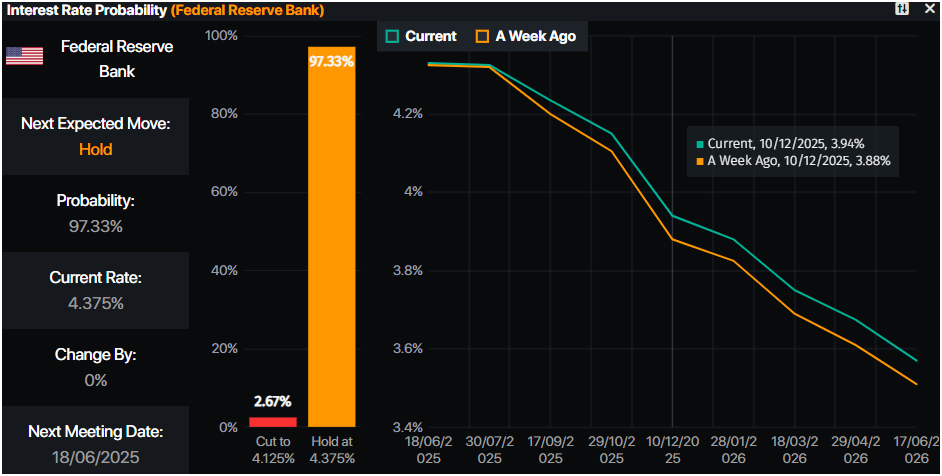

Therefore, the Federal Reserve (Fed) could remain in its wait-and-see mode, keeping interest rates at the 4.25%-4.50% range.

The US Dollar Index (DXY), which tracks the value of the Dollar against a basket of peers, recovers after hitting a daily low of 98.86 and is up 0.06% at 99.07.

On Tuesday, the US economic schedule revealed that small businesses are growing more optimistic, according to the National Federation of Independent Business (NFIB) Optimism Index, which improved in May compared to figures revealed in April.

Daily digest market movers: Gold price holds firm amid steady US Treasury yields

- The US 10-year Treasury yield remains flat at 4.474%. US real yields have also remained unchanged at 2.16%, capping the Bullion price advance.

- The NFIB Optimism Index rose from 95.8 in April to 98.8 in May, taking the index above its long-term average. The print finished a four-month streak of worsening conditions and sentiment for US small businesses due to uncertainty about tariffs.

- Traders would be relieved if talks between Washington and Beijing yield a positive outcome, which could prompt investors to shift toward riskier assets, such as equities. However, the release of inflation figures for the US could cap outflows from Gold.

- The US CPI is expected to rise from 2.3% to 2.5% YoY, with core figures projected to increase from 2.8% to 2.9% YoY.

- Geopolitical tensions remain high as US President Trump told Fox News that Iran is becoming much more aggressive in nuclear talks. This, along with Russia’s claim to control territory in Ukraine’s east-central region, could push Gold prices higher, clearing the path to test $3,350 in the short term.

- Money markets suggest that traders are pricing in 43.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price trades sideways within $3,300-$3,350 corridor

From a technical standpoint, XAU/USD found strong support around $3,290-$3,300 provided by a support trendline, along with the current week’s low. Momentum is also favoring further upside as the Relative Strength Index (RSI) remains bullish.

If XAU/USD clears $3,350, this opens the door for a move toward $3,400. Further strength lies in $3,450 and the all-time high (ATH) at $3,500.

On the flip side, Gold sliding below $3,300 opens the path to challenge key support levels, such as the 50-day Simple Moving Average (SMA) at $3,265, followed by the April 3 high, which has since become support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.