- US Producer Price Index (PPI) data for May slowed, increasing the prospects of a Fed rate cut in September.

- Tensions between Iran and Israel boost the appeal of Bullion as a safe haven, and Gold prices surge.

- XAU/USD extends gains, with prices currently testing wedge resistance above $3,380.

Gold (XAU/USD) has emerged as a key beneficiary of US Dollar (USD) weakness, a theme that is expected to drive prices on Thursday.

With prices currently hovering around the $3,380 mark, geopolitical risks and the US fundamental backdrop continue to support Gold’s safe-haven demand.

The release of US Producer Price Index (PPI) data on Thursday has shown that inflation is slowing on the wholesale level. Headline PPI showed an annual increase of 2.6% in May, in line with analyst forecasts, following a 2.5% increase in April. Core PPI, which excludes volatile goods, fell to 3% in May, down from 3.2% in April.

Following Wednesday’s downside surprise in CPI numbers, further confirmation that price pressures are easing could provide additional impetus to Gold as expectations for a September rate cut rise.

The threat of an escalating conflict in the Middle East after reports that Israel is considering a military strike on Iran and Trump’s latest tariff threats support the precious metal, which benefits from safe-haven flows.

Additionally, NBC News reported, citing five people familiar with the matter, that Israel is considering taking military action against Iran in the coming days. At the same time, Trump confirmed on Wednesday that US personnel are being moved out of parts of the Middle East due to the escalating tensions between Israel and Iran. This occurs ahead of the sixth round of nuclear talks between the US and Iran, scheduled for this weekend.

Recent headlines surrounding trade also added to the sour market mood. Trump has stated that the US will set its own terms for unilateral tariffs, overshadowing the optimistic narrative surrounding the US-China “trade truce” announced on Wednesday.

Trump stated that “We will be sending out letters over the next weeks telling them what the deal is”. These comments were reported by Bloomberg on Thursday.

Gold daily digest market movers: US Inflation, Fed rate expectations, and central banks’ holdings of Gold

- For the Federal Reserve (Fed), softer inflation provides room for interest rate cuts, which in turn have reduced demand for US Treasury Yields, adding additional pressure on the US dollar and supporting Gold.

- Prior to the US CPI release on Wednesday, the CME FedWatch Tool indicated that analysts were pricing in a 52% probability of a rate cut in September. However, after the release of these inflation reports, the probability has increased to approximately 60%, with rates still expected to remain within the 4.25%-4.50% range at the June and July meetings.

- The European Central Bank (ECB) released its annual Monetary Euro report on Wednesday, which showed that central bank holdings were 36,000 tonnes, close to the highest levels since the Bretton Woods system. As central banks continue to increase their holdings this year, Gold prices are expected to remain stable in the near term.

Gold (XAU/USD) technical analysis: Bulls head toward $3,400

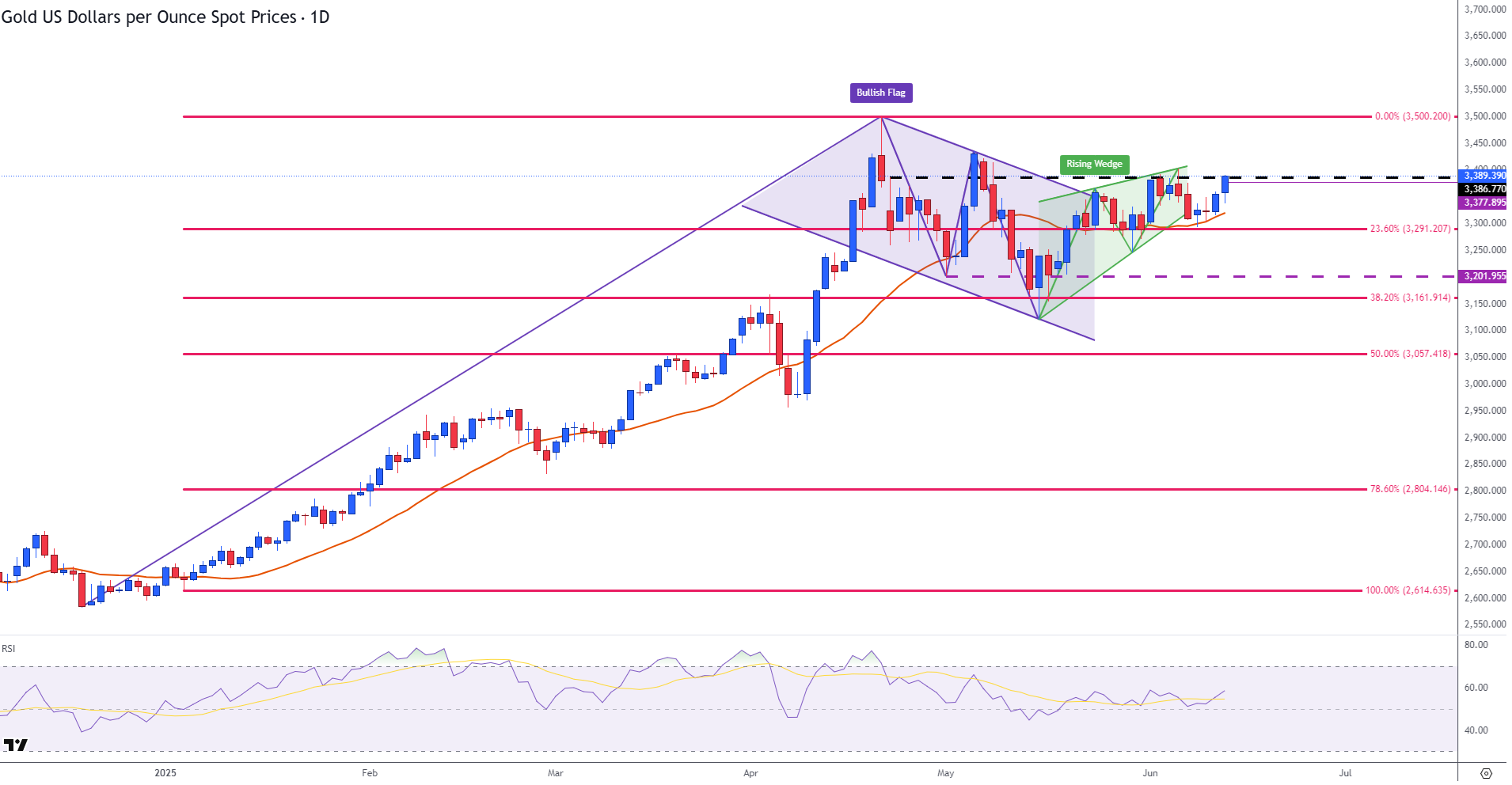

From a technical standpoint, Gold prices are trading above the resistance zone of $3,380, near $3,390 at the time of writing, a level that aligns with the upper bound of the rising wedge formation. This technical chart pattern, which formed on the daily chart, emerged after prices rebounded from the mid-May low near $3,320.

With a move above this zone opening the door for last week’s high around the psychological level of $3,400, the April ATH of $3,500 could come back in sight.

Meanwhile, the Relative Strength Index (RSI) stands at 59 and points upwards, indicating a bullish bias. On the downside, the $3,350 psychological level, which has provided support throughout the week, remains intact. Below that is the 23.6% Fibonacci retracement of the January-April high at around $3,291.

For bearish momentum to gain traction, a breach of this zone may pave the way for the next big psychological level of $3,200.

Gold (XAU/USD) daily chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.