Signals for the Lira Against the US Dollar Today

Risk 0.50%.

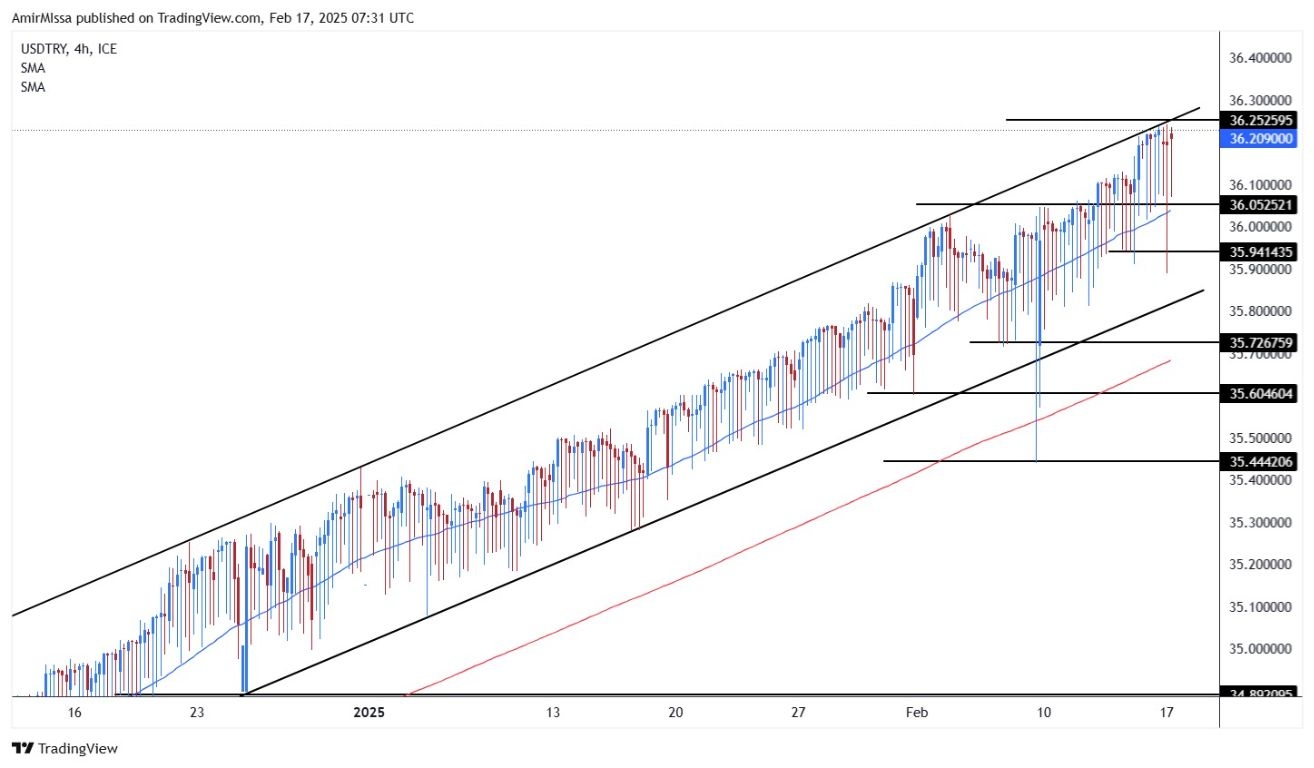

Bullish Entry Points:

- Open a buy order at 35.95.

- Set a stop-loss order below 35.80.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 36.25.

Bearish Entry Points:

- Place a sell order for 36.25.

- Set a stop-loss order at or above 36.30.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 36.10.

Turkish lira Analysis:

The USD/TRY pair stabilized near its all-time high, which it reached last Friday at 36.22 Turkish Lira per dollar. The Lira is expected to continue its decline in the medium term, coinciding with the decline in support for the Turkish currency by the country’s financial and monetary authorities. Moreover, the Governor of the Central Bank of Turkey stated that the current monetary policy objective in his country aims to provide a flexible framework for the exchange rate. Also, Fahti Karahan emphasized the possibility of taking measures described as decisive if necessary. Obviously, this is within the framework of the monetary policy makers’ keenness to balance intervention in the exchange rate and maintain flexibility at the same time.

Meanwhile, the Governor of the Central Bank of Turkey, Fahti Karahan, confirmed that the bank is sticking to its cautious approach to reducing interest rates, emphasizing the readiness of policymakers to act if global risks escalate and market uncertainty increases. Karahan also indicated that the bank is adopting a policy of reducing interest rates at a “very gradual pace,” emphasizing that the credibility of the bank’s monetary policy is based primarily on actions rather than statements, saying: “Ultimately, the effectiveness of the bank is related to credibility, and this cannot be achieved only by talking, but by acting. Therefore, caution remains essential.”

The Central Bank of Turkey had approved two consecutive interest rate cuts in December and January, totalling 500 basis points, bringing the benchmark interest rate to 45%. Although the bank had previously indicated a decline in inflation expectations, the update of these expectations, which was carried out through a survey conducted by the Central Bank, has returned to raise estimates of inflation rates at the end of this year. Karahan also warned of the possibility of an expansion in global commodity prices due to repeated supply shocks.

TRYUSD Technical Analysis and Expectations Today:

On the technical side, the USD/TRY pair continues to trade in the same sluggish upward trend. A state of pessimism about the future expectations of the Turkish Lira price continues. Technically, the US dollar is trading within a general upward trend against the lira. The dollar is supported by trading within an upward price channel, coinciding with the price moving above the 50 and 200-day moving averages, respectively. Clearly, that’s indicating the dominance of the overall upward trend in the pair’s movements in the long term. Currently, any decline in the pair represents an opportunity to buy again. The pair targets levels of 36.25 lira and 36.55 lira, respectively.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.