Short Trade Idea

Enter your short position between 22.88 (the lower band of its horizontal resistance zone) and 24.04 (the lower band of its horizontal resistance zone).

Market Index Analysis

- Intel (INTC) is a member of the NASDAQ 100, the Dow Jow Industrial Average, the S&P 500, and the S&P 500.

- All four indices are at or near record highs, but cracks appear outside the AI sector.

- The Bull Bear Power Indicator of the NASDAQ 100 shows a negative divergence.

Market Sentiment Analysis

Equity markets rallied to fresh highs yesterday, amid optimism over trade and tariff deals. Earnings season is bumpy with AI-related companies offering an upbeat outlook, while the non-AI-related sectors begin to show the impact of tariffs. Futures remain mixed after Alphabet boosted sentiment and Tesla tumbled in after-hours trading. Markets will focus on a slew of earnings today, which should dictate price action.

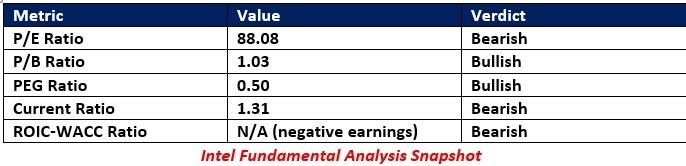

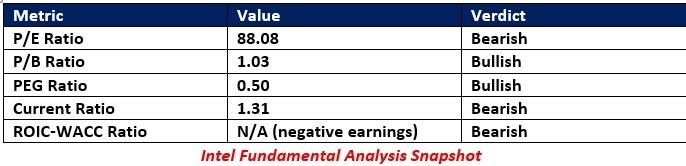

Intel Fundamental Analysis

Intel is a technology company that primarily designs CPUs for business and consumer markets. It lost its leadership position to AMD and missed out on the AI wave, while its future chips will rely heavily on TSMC.

So, why am I bearish on INTC at current levels and ahead of the earnings release?

Intel has failed to capture the AI wave and is in the early stages of its turnaround. The balance sheet is a red flag and does not support the capital expenditure necessary to achieve its goals. Its reliance on TSMC for its future chips is also worrisome. I believe its earnings reports will provide enough concerns that the share price will tumble.

The price-to-earnings (P/E) ratio of 88.08 makes INTC an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 41.22.

The average analyst price target for INTC is 21.77. It suggests overvalued shares with increased downside risk.

Intel Technical Analysis

Today’s INTC Signal

- The INTC D1 chart shows price action inside its horizontal resistance zone.

- It also shows price action moving away from the ascending 0.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bullish with a descending trendline, and a bearish crossover could follow.

- Trading volumes are higher during selloffs than during rallies.

- INTC corrected as the NASDAQ 100 rallied to fresh highs, a significant bearish development.

My Call

I am taking a short position in INTC between 22.88 and 24.04. The valuations are ridiculously high, especially for a tech company that missed the AI wave. I also think today’s earnings reports will cause a sell-off and raise more short-term concerns.

- INTC Entry Level: Between 22.88 and 24.04

- INTC Take Profit: Between 17.67 and 19.31

- INTC Stop Loss: Between 25.23 and 26.41

- Risk/Reward Ratio: 2.22

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.