- IBM stock gets slammed after reporting positive Q2 result.

- Revenue beat forecasts by $385 million as infrastructure revenue rose 14% YoY.

- Analysts largely take positive view of IBM despite market sell-off.

- IBM stock performance takes Dow Jones down with it.

International Business Machines (IBM) stock has lost much of its recent rally on Thursday after the market sold the legacy tech giant with shares down 10% at the time of writing. After closing on Wednesday near $282, IBM stock has traded as low as $254 on Thursday morning.

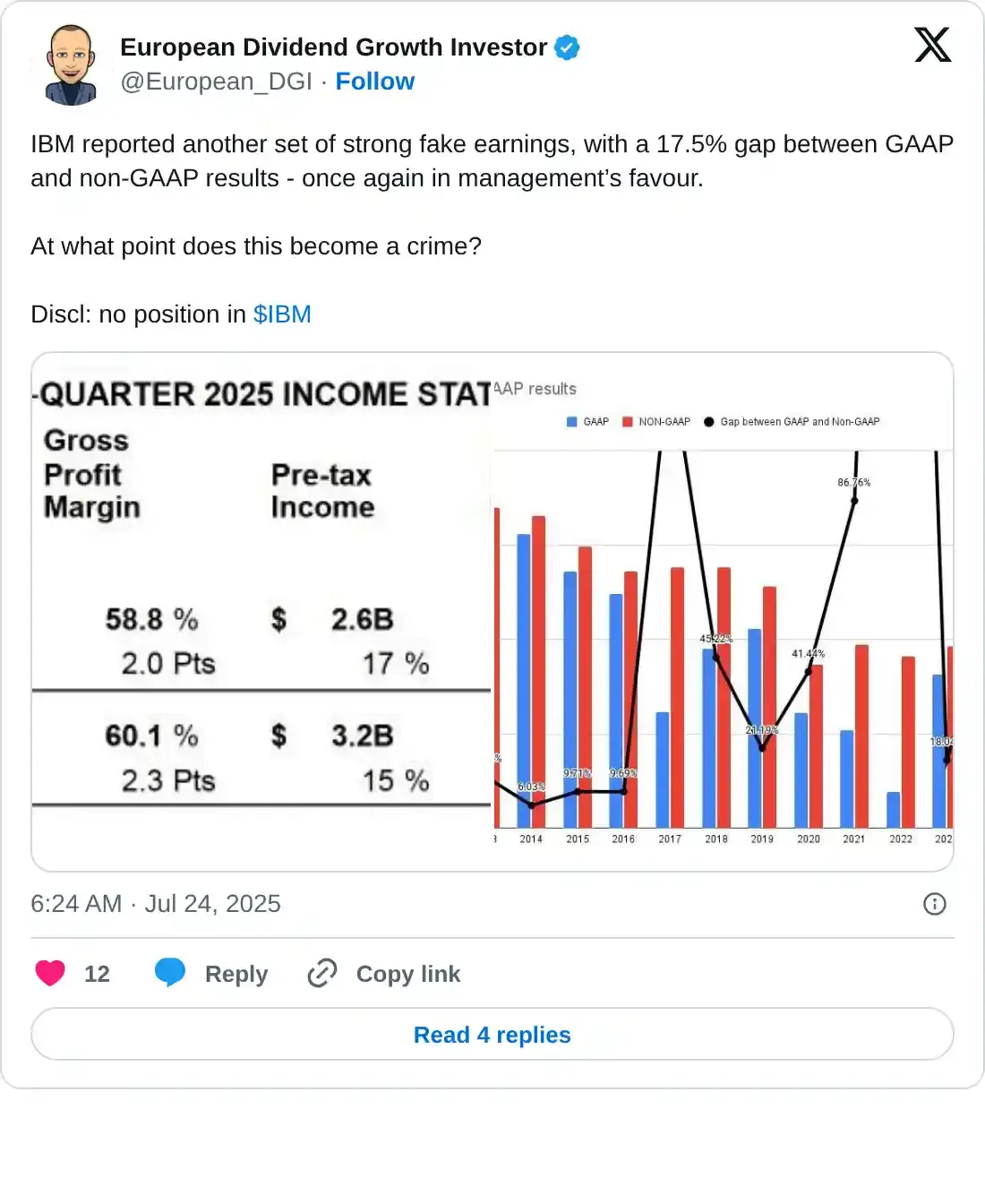

It’s difficult to surmise why the market is so repulsed by the sizable top and bottom line earnings beat, but the tweet below is at least part of the story.

Wall Street analysts have been largely impressed by the quarterly result as well. JPMorgan raised its price target on IBM stock from $244 to $290, while the overly bearish UBS grudgingly raised it from $195 to $200. Bank of America Securities cut its price target from $320 to $310, which still shows serious belief in the company at the current share price.

The only complaint from analyst seems to be that IBM’s gains are largely from cyclical segments of its business that do not buffer the valuation.

IBM’s travails have sent the Dow Jones Industrial Average (DJIA) down by 0.35% at the time of writing, while the S&P 500 and NASDAQ are narrowly higher. Following both of their post-market earnings releases on Wednesday, Tesla (TSLA) shares shot down 9% at the Thursday open, while Alphabet (GOOGL) shares have gained ground.

IBM earnings news

IBM reported adjusted earnings per share (EPS) of $2.80, which was 15 cents better than the Wall Street consensus. Revenue of $17 billion also rose nearly 8% YoY to come in $385 million above the average analyst prediction.

With the US Dollar declining sharply this year, IBM said that exchange rates were expected to add 1.5 percentage points to revenue growth for the full year, and all segments in Q2 performed noticeably better due to exchange rates. Revenue growth for full-year 2025 was guided for just 5% growth in constant currency terms, which might also be part of the negative sentiment story from the market.

IBM’s gross profit margin in GAAP terms rose by 200 basis points to 58.8% in the quarter, while its adjusted operating margin rose 230 basis points to 60.1%. Management now expects $13.5 billion in free cash flow for the year.

CEO Arvind Krishna said the company’s generative AI business has had bookings increase from $6 billion in Q1 to $7.5 billion in Q2. Software sales rose 10% YoY to $7.39 billion but arrived $100 million behind forecasts. Infrastructure revenue rose 14%, while consulting revenue rose 3% and was actually flat on a constant currency basis.

“The innovation we are bringing to market across the portfolio continues to resonate with clients as they scale their AI adoption and investments. As a result, revenue growth, portfolio mix and ongoing productivity initiatives drove significant margin expansion and double-digit profit growth,” said James Kavanaugh, IBM’s senior vice president and CFO. “This combination delivered solid free cash flow, fueling our ability to invest in the business and return value to shareholders through dividends.”

IBM stock chart

IBM stock broke through support provided by the May-June basing period near $258 but has recovered to near that level. Further support can be found at the 200-day Simple Moving Average (SMA) near $245.40, as well as the long-term resistance-turned-support band that surrounds the $240 level (highlighted in light blue).

With the Relative Strength Index (RSI) getting slammed down to 26, some buyers will be interested, but most will wait for a consolidation period near one of the lower supportive structures.

IBM daily stock chart