ICL Group Ltd (ICL – Free Report) recorded profits of $91 million or 7 cents per share in first-quarter 2025, down from $109 million or 8 cents in the year-ago quarter.

Barring one-time items, adjusted earnings per share were 9 cents, which beat the Zacks Consensus Estimate of 8 cents.

Sales rose around 2% yearly to $1,767 million in the quarter. The figure missed the Zacks Consensus Estimate of $1,770.3 million.

The company saw higher sales across its Industrial Products, Phosphate Solutions and Growing Solutions units in the reported quarter, aided by higher volume and improved pricing.

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

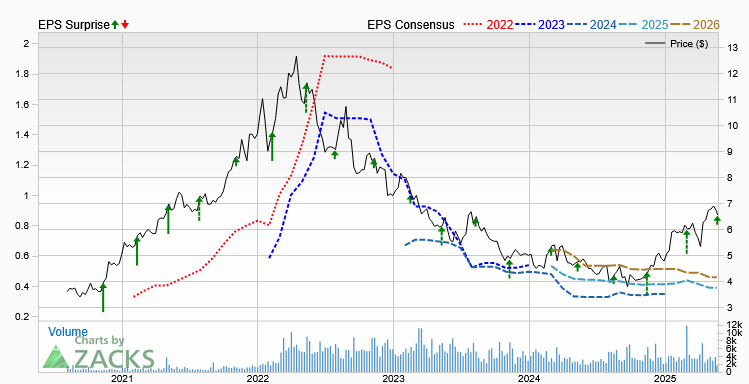

ICL group Ltd. price, consensus and EPS surprise

ICL’s segment highlights

Sales in the Industrial Products segment rose roughly 3% year over year to $344 million in the reported quarter. The upside was driven by improved volumes in flame retardants.

Sales in the Potash segment dropped around 4% year over year to $405 million in the quarter. Sales were hurt by lower potash prices in the quarter.

The Phosphate Solutions segment’s sales rose roughly 3% year over year to $573 million. Sales were driven by strength in commodities, partly offset by the weakness in specialties.

Sales in the Growing Solutions segment went up around 3% year over year to $495 million in the quarter. Sales rose across Brazil, North America and Asia, partly offset by a decrease in Europe.

ICL group’s financials

At the end of the quarter, ICL had cash and cash equivalents of $312 million, down around 14% year over year. Long-term debt was $1,856 million, down nearly 1% year over year.

Net cash provided by operating activities was $165 million in the reported quarter.

ICL’s guidance

ICL continues to expect the specialties-driven segments’ EBITDA to be between $0.95 billion and $1.15 billion for 2025. For potash, it sees 2025 sales volumes to be between 4.5 million metric tons and 4.7 million metric tons.

ICL stock’s price performance

ICL’s shares have gained 37.4% in the past year compared with the Zacks Fertilizers industry’s 5.3% increase.

Image Source: Zacks Investment Research

ICL’s Zacks rank and other basic materials releases

ICL currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ingevity Corporation (NGVT – Free Report) logged adjusted earnings of 99 cents per share in the first quarter, up from 47 cents a year ago. NGVT expects 2025 sales to be between $1.25 billion and $1.40 billion, and adjusted EBITDA between $380 million and $415 million.

The Chemours Company’s (CC – Free Report) adjusted earnings were 13 cents per share for the first quarter. The metric fell short of the Zacks Consensus Estimate of 19 cents per share. CC expects full-year 2025 adjusted EBITDA between $825 million and $950 million.

Element Solutions Inc. (ESI – Free Report) logged first-quarter adjusted earnings per share of 34 cents per share. It beat the Zacks Consensus Estimate of 33 cents. ESI anticipates adjusted EBITDA for 2025 to be between $520 million and $540 million.

Zacks names one semiconductor stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report