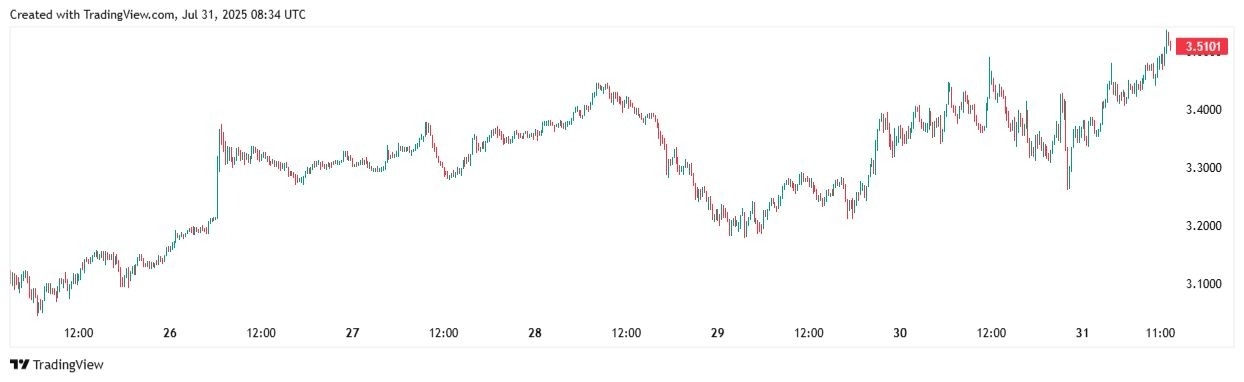

Currently, TON is trading at $3.50, representing a 9.6% increase over the past week.

TON Price | Source: TradingView

A daily close above $3.50 would flip near-term structure bullish and up the path toward $3.80, where prior wicks topped out in late June.

If buyers can push through that, the next upside target is $4.10, which aligns with the upper trendline of a descending wedge from the June highs. That level also intersects with the 50-day EMA, which makes it a key inflection point.

On the downside, initial support rests near $3.29, a zone that caught repeated dips since July 17. A failure to hold this level could send price back toward $2.90, where heavier support and prior accumulation took place.

Technical Indicators Show Strength

Momentum indicators suggest bulls are gaining traction, but conviction is not yet locked in.

The RSI is hovering around 60, signaling positive momentum with room to run before hitting overbought territory. The MACD is in bullish crossover, with a widening histogram indicating rising buying pressure.

Price is also bouncing along the top of its Bollinger Band, which can suggest overextension or mark the early stages of a breakout. A volume-backed candle above $3.50 would confirm the latter.

The 20-day moving average is sloping up and currently sits around $3.32, providing short-term dynamic support. The 200-day MA remains flat near $3.75 and could be tested if bulls follow through.

Derivatives & On-Chain Trends Back the Move

Open interest in TON futures has ticked up alongside price, suggesting real capital backing the latest push. Perpetual funding rates remain neutral to slightly positive, a sign that the rally isn’t overly leveraged.

Whale accumulation is gradually returning after a June cooldown, and daily active addresses on the TON network have increased 4.2% week-over-week.

The uptick coincides with rising usage of Telegram-integrated TON features, including the wallet and mini-apps.

However, DEX volumes and DeFi activity on the TON chain remain light relative to L1 peers like Solana and Avalanche. Until those fundamentals improve, rallies may struggle to break into new high territory without broader market tailwinds.

My Take

For traders, $3.50 is the key short-term trigger. A clean daily close above it, especially on rising volume, sets up a swing toward $3.80, with a stretch target at $4.10 if momentum holds.

Failing to break this level or a dip below $3.29 would suggest another leg of consolidation. Below that, a flush toward $2.90 becomes likely.

Toncoin’s trend is improving, but confirmation requires more than a single candle. Without volume and follow-through, price risks getting trapped in the current range.