Long Trade Idea

Enter your long position between 44.12 (yesterday’s intra-day low) and 46.37 (the upper band of its horizontal support zone).

Market Index Analysis

- Chipotle Mexican Grill (CMG) is a member of the S&P 500.

- This index remains near record highs, but the underlying technical picture flashes warning signs.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Equity markets appear to brush off the latest developments in the US-China trade talks. Today’s overhyped FOMC announcement is unlikely to offer new insights. Markets expect the US Fed to keep interest rates unchanged with a similar statement to before. Tariff uncertainty persists, and businesses and consumers continue to feel its impact. It will take time for the effects to ripple through the supply chain, and the US central bank will monitor developments despite political pressure. Earnings should drive today’s price action.

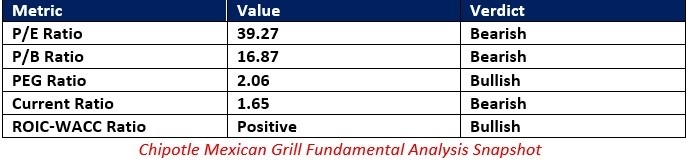

Chipotle Mexican Grill Fundamental Analysis

Chipotle Mexican Grill is a fast-casual restaurant chain known for preparing orders in front of customers. It has been the best-performing restaurant stock since its IPO. Chipotle Mexican Grill has over 3,800 locations.

So, why am I bullish on CMG after its share price plunged?

Chipotle Mexican Grill delivered a disappointing earnings report and lowered its guidance, but I like its expansion plans to reach 7,000 locations. It has an excellent return on equity, and its catering service remains well-positioned for tremendous growth. While foot traffic slowed due to a drop in consumer confidence, it is already showing signs of recovery.

The price-to-earning (P/E) ratio of 39.27 makes CMG an expensive stock at current levels. By comparison, the P/E ratio for the S&P 500 is 29.49.

The average analyst price target for CMG is 58.60. It suggests massive upside potential from current levels.

Chipotle Mexican Grill Technical Analysis

Today’s CMG Signal

- The CMG D1 chart shows price action inside a horizontal support zone.

- It also shows price action finding support at the descending 0.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bearish, but the trendline is bullish.

- Trading volumes have spiked during the sell-off, hinting at a potential wash-out of sell orders.

- CMG corrected as the S&P 500 rallied to fresh highs, and investors should brace for volatility.

My Call

I am taking a long position in CMG between 44.12 and 46.37. CMG has high valuations, but customer loyalty is high, and foot traffic is rebounding. Even during an economic downturn, Chipotle Mexican Grill is one chain consumers view as an affordable luxury. It makes CMG a buy-the-dip candidate.

- CMG Entry Level: Between 44.12 and 46.37

- CMG Take Profit: Between 51.53 and 53.86

- CMG Stop Loss: Between 42.40 and 43.04

- Risk/Reward Ratio: 4.31

Ready to trade our free stock signals? Here is our list of the best brokers for trading worth reviewing.