As the Federal Reserve (Fed) prepares to hold interest rates steady at its July 30 meeting, American savers need more than ever to understand how the central bank’s moves affect their retirement plans, particularly Individual Retirement Accounts (IRAs).

The Fed’s interest rates and retirement planning

The Fed plays a central role in the financial lives of Americans. By adjusting its key interest rates, it influences the cost of credit, returns on savings and the evolution of financial markets.

While these mechanisms may seem abstract, their impact on your retirement planning, and in particular your IRA, is real.

When the Fed raises interest rates, borrowing becomes more expensive, which may slow the economy but improve returns on variable-rate savings accounts or new Bonds.

Conversely, lower interest rates stimulate economic growth by making money cheaper, but reduce interest income for savers.

IRAs: Why Fed interest rates matter

Individual Retirement Accounts are powerful tools for building a solid retirement. Whether Traditional or Roth, they allow savings to grow tax-free (or tax-deferred).

But their performance depends largely on the economic environment, and therefore on the Fed’s decisions.

When interest rates rise, Bond funds held in an IRA may lose value in the short term. However, over the longer term, these funds will gradually integrate higher-rate Bonds, which can improve the income generated by the portfolio.

When interest rates fall, equities tend to perform better, as companies can borrow more cheaply to finance their growth. This can boost the valuation of equity-oriented IRA portfolios.

The current situation: A cautious Fed on the verge of action

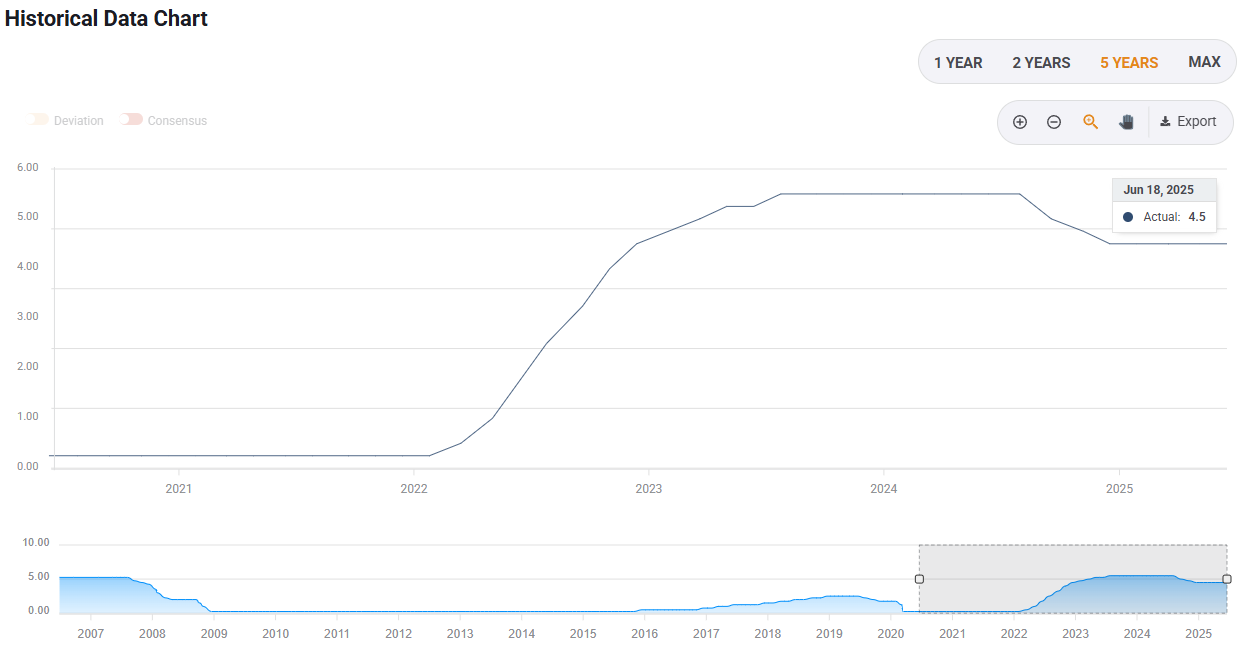

Currently, the Fed is maintaining rates between 4.25% and 4.5% since December, a historically high level.

Fed interest rates. Source: FXStreet

Although inflation is stabilizing, the uncertainties associated with the tariffs imposed by the US President Donald Trump administration are prompting Fed policymakers to remain cautious.

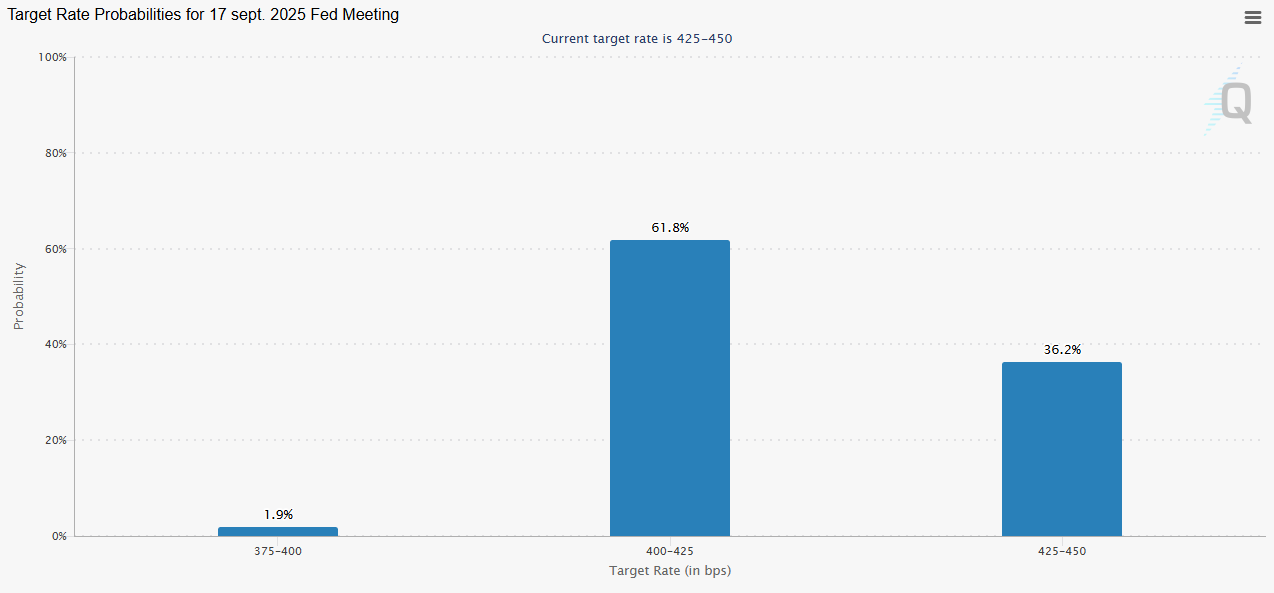

However, markets are anticipating a first rate cut as early as September, if the next employment and inflation reports confirm an economic slowdown.

Target Rate Probabilities for the September meeting. Source: CME Group

For savers, this means that the cycle of interest rate cuts paused this year could soon resume, with concrete consequences for IRAs.

How to adapt your IRA strategy in this context

Reassess the Bond portion of your portfolio

If you hold Bonds via funds in your IRA, monitor their sensitivity to interest rates (duration).

In a context of falling interest rates, these assets may see their value rise. You could also consider extending duration or incorporating high-yield Bonds, with discretion.

Explore rate-sensitive stocks and sectors

Sectors such as Real Estate, Technology and Utilities can benefit from a low-rate environment.

Dividends from certain stocks can also offer an interesting alternative to Bond income in your IRA.

Stay diversified and aligned with your retirement horizon

It’s tempting to adjust your portfolio with every Fed move, but your retirement planning strategy must remain consistent with your long-term goals.

Diversifying your IRA account between Equities, Bonds, cash and, where appropriate, Commodities remains key.

Consider the tax impact of distributions

If you’re close to the age of Required Minimum Distributions (RMDs), a drop in interest rates could affect your future income.

Plan ahead to avoid forced withdrawals during unfavorable market conditions.

Follow the Fed, but don’t panic

The Federal Reserve’s movements have a profound influence on the economy and the markets, and therefore on your Individual Retirement Accounts.

But rather than reacting impulsively to every interest rate decision, the most prudent approach remains to follow a diversified strategy, rebalance your portfolio regularly and stay aligned with your retirement planning goals.

If interest rates fall soon, this could be an opportunity to boost your retirement savings. Provided you’re prepared.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.