- The Australian dollar has been all over the place during the trading session on Wednesday against the Swiss franc, as we have seen a lot of volatility in the markets.

- This is mainly due to the story that the New York Times decided to release suggesting that Donald Trump was going to fire Jerome Powell, which later on was refuted by the president himself.

- Because of this, we did up basically where we started, but this is a pair that I watch a lot for multiple reasons.

The Importance of the AUD/CHF Pair.

One of the things I watch very closely here is whether or not this pair is rising or falling. Typically speaking, the Australian dollar will start to rise against the Swiss franc in times of risk appetite being healthy, as traders look to get involved in other markets such as commodities, and of course are betting on the idea of Asian growth, not only in Australia, but other countries in the region. Conversely, the Swiss franc is considered to be a “safety currency”, meaning that a lot of traders will look to buy the Swiss franc in times of uncertainty, and therefore you will see this pair fall rather rapidly. In this sense, it’s fairly pure signal on what risk appetite is globally and in general as there isn’t a massive amount of trade between the 2 countries.

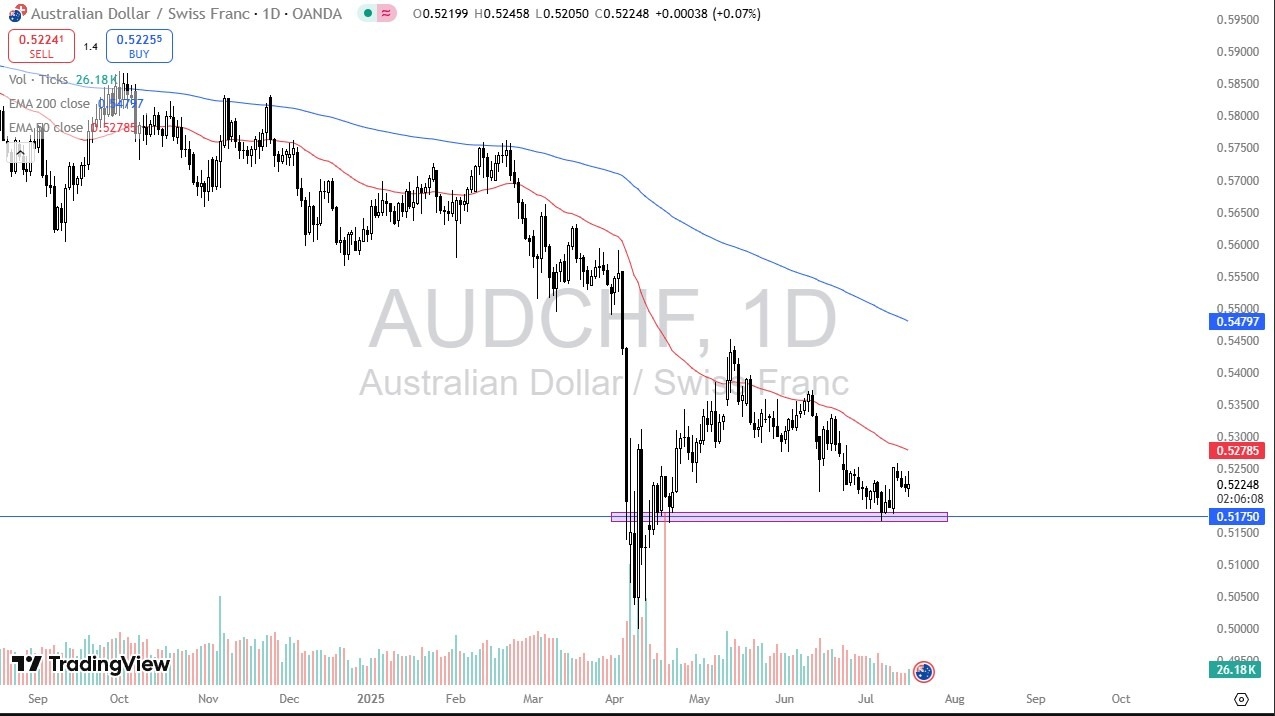

With all of that being said, I’m watching the 0.5175 level very closely, because it’s an area that has been support recently, and if we can stay above there, there’s at least the chance that the market could bounce. The 50 Day EMA currently sits at the 0.5278 level, and is dropping, so that would be your short-term resistance. If we were to break above that level, then I think you would have a massive “risk on rally” around the world, and the Australian dollar could go looking to the 0.54 level rather rapidly.

Keep in mind that the Swiss franc is a bit strong at the moment, so when trying to go against that momentum, you typically want to avoid the heavily traded Swiss related pairs. This might be one of those opportunities. If we break down below the 0.5175 level though, we probably drop to the 0.51 level.

Want to trade our daily forex analysis and predictions? Here’s a list of the best FX brokers in Switzerland to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.