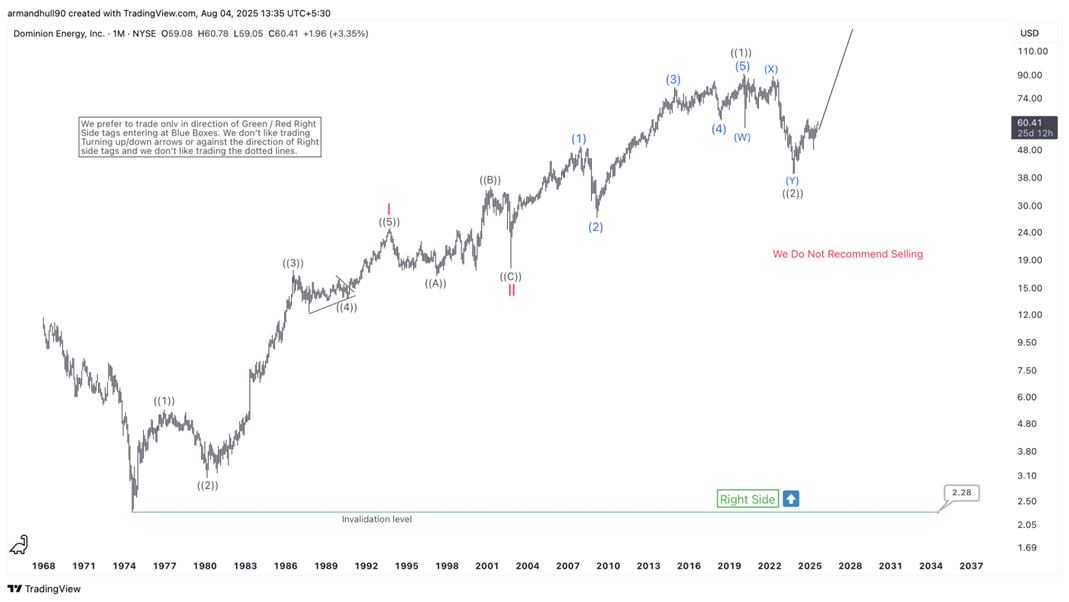

Wave ((2)) Correction Likely Complete – Long-Term Elliott Wave Rally May Be Underway Toward $100+

Dominion Energy (D) has shown a strong bullish structure on the monthly chart, suggesting a significant Elliott Wave progression. According to the latest analysis, the stock may have completed the corrective wave ((2)). If confirmed, this sets the stage for the beginning of a powerful bullish wave ((3)) to the upside.

The wave count shows a clear five-wave impulse from the 1980s into the 2007 peak, followed by a WXY double three correction that likely completed in the recent low near $45. This pullback was deep but remains above the key invalidation level at $2.28. Since then, prices have rebounded, and bullish momentum is building.

The preferred Elliott Wave count favors the right side higher, with a projected long-term path pointing above $100. We do not recommend selling into weakness. Instead, traders should consider positioning on the long side, ideally near blue box areas if pullbacks happen. These zones represent high-probability areas where the next leg up could begin.

This setup fits into a larger degree wave ((3)), which typically shows strong momentum and price acceleration. If the count holds, this rally could last for years, offering significant upside potential for long-term investors.

Summary:

In summary, Dominion Energy appears to have completed its multi-year correction. A new bullish cycle may have already begun. The current structure supports further upside, making this a stock to watch closely in the months ahead.