- The Mexican Peso edges lower ahead of the FOMC Meeting Minutes.

- Monetary policy divergence between the Fed and Banxico comes into focus ahead of Friday’s US PCE data.

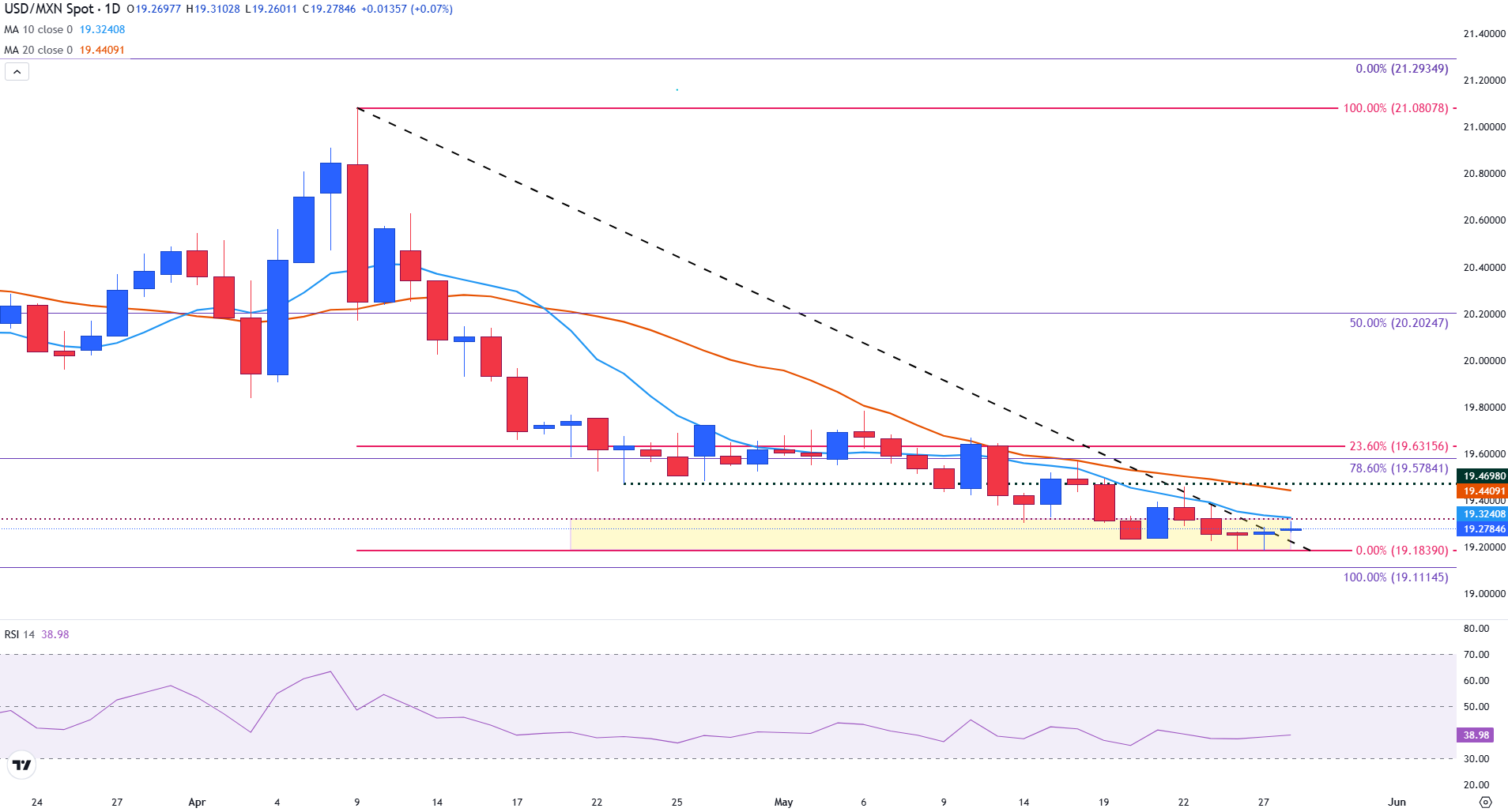

- USD/MXN tests trendline resistance with the 10-day SMA capping gains.

The Mexican Peso (MXN) is holding broadly steady against the US Dollar (USD) on Wednesday, remaining close to year-to-date highs, as investors await the release of the Federal Reserve’s (Fed) May Federal Reserve Open Markets Committee (FOMC) meeting minutes.

The report is expected to shed light on the Fed’s rationale for holding rates steady and its assessment of evolving economic risks, particularly those tied to President Trump’s escalating tariff measures.

Fed officials have maintained a cautious stance, opting to observe the full impact of these trade policies before adjusting the policy rate.

According to the CME FedWatch Tool, market participants are currently pricing in a 49.1% chance of a rate cut in September. For June and July meetings, the expectation is that the Fed will keep its benchmark rate at the current 4.25%-4.50%.

Federal Reserve Bank of New York President John Williams, a FOMC voter, said on Wednesday that the Fed should respond “relatively stronger” when inflation begins to deviate from the target. “[I] want to avoid inflation becoming highly persistent because that could become permanent,” he said.

The FXStreet speech tracker, which gauges the tone of Fed officials’ speeches on a dovish-to-hawkish scale from 0 to 10 using a custom AI model, rated William’s words as hawkish with a score of 7.2. This is a significant deviation from the 5.8 average, signaling a shift toward a more hawkish tone.

If this narrative is reflected in the minutes, any changes to interest rate expectations could directly impact the US Dollar and, therefore, the USD/MXN exchange rate.

Mexican Peso daily digest: USD/MXN hinges on the Greenback

- Mexico’s central Bank, Banxico, is set to release the minutes from its latest policy meeting on Thursday, following its seventh consecutive rate cut on May 15.

- Markets will closely examine the commentary for signs of a potential pause in the easing cycle, particularly as policymakers weigh external risks such as US tariff threats.

- Thursday also brings a wave of high-impact data from the United States, including the second reading of the Q1 Preliminary Gross Domestic Product (GDP) and weekly Initial Jobless Claims, which directly form part of the Fed’s string of indicators it considers when deciding on rates.

- The core PCE figures for April – the Fed’s preferred inflation measure –and the final University of Michigan Consumer Sentiment figures are both scheduled for release on Friday.

- With the Fed reiterating its ‘data-dependent’ stance, these data points are crucial for understanding inflation and consumer sentiment, as they gauge the feelings of US citizens about the current economic situation.

- On Tuesday, the US Dollar received some support after the publication of Consumer Confidence data from The Conference Board, which showed that households’ moods improved significantly after declining for five consecutive months. The rebound was partly attributed to the US-China trade deal.

Mexican Peso technical analysis: USD/MXN tests trendline resistance ahead of Fed Minutes

USD/MXN continues to trade within a downward trend, with prices capped beneath the 20-day SMA at 19.44.

After hitting a new year-to-date (YTD) low of 19.18 on Monday, a modest rebound in the US Dollar has pushed the pair to trendline resistance from the April decline at 19.29.

Momentum indicators remain weak, with the Relative Strength Index (RSI) flattening at around 39, indicating that while bearish momentum is present, the market is not yet in oversold territory.

With the downtrend currently intact, a break below 19.20 could draw attention to the October 2024 low at 19.11, which serves as the next significant support level.

A sustained break below this level could open the door to deeper declines toward 19.00, while any rebound would first need to reclaim 19.44 20-day SMA to shift short-term sentiment.

USD/MXN daily chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.