- The Mexican Peso loses momentum despite April’s upbeat Retail Sales report.

- House of Representatives’ tax bill vote remains in focus, can it deter USD bulls?

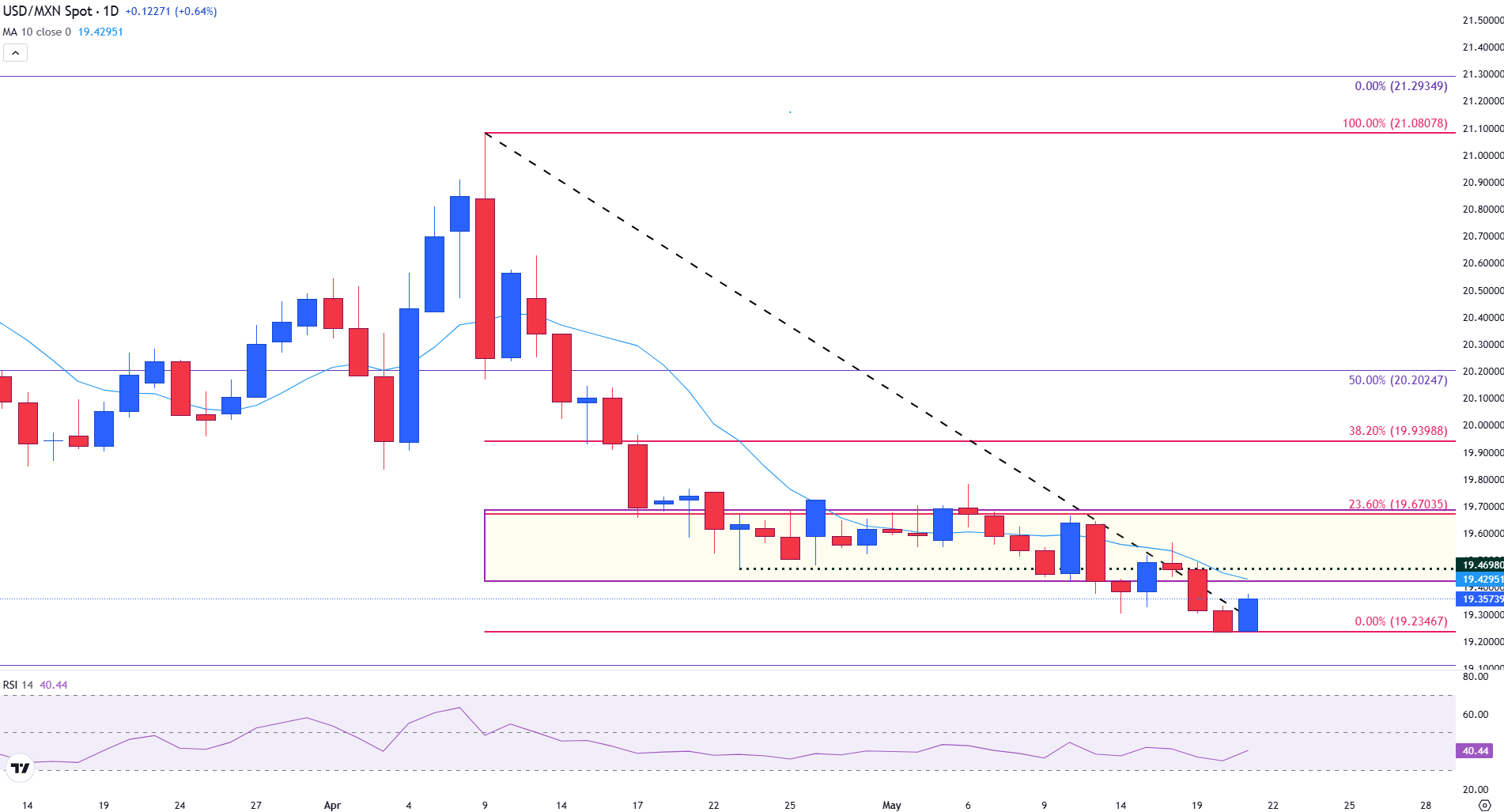

- USD/MXN rises above prior trendline resistance, heading toward 19.400.

The Mexican Peso (MXN) and the US Dollar (USD) have been gearing up for a crucial day of economic and fundamental headwinds, which have offered insight into the current and projected growth outlooks for both economies.

With Mexico Retail Sales 12:30 GMT data release beating forecasts on a monthly and annual basis, developments out of the United States overshadowed the recent report, highlighting the significance of the Greenback in the current economic environment.

As the Mexican Peso continues to trade below a key psychological level of 19.400, a break above prior support-turned-resistance level at 19.30 has provided an additional layer of resistance, assisting in guiding price action for the emerging market (EM) currency, potentially triggering volatility if the data deviates from expectations.

Meanwhile, the projected trajectory of the Greenback remains in focus as investors await further commentary from US Federal Reserve (Fed) officials and the highly anticipated House of Representatives vote on President Donald Trump’s “One Big Beautiful Bill Act.”

Market participants are closely assessing the short- and long-term implications of the proposed tax legislation, which could significantly influence the fiscal policy outlook and investor sentiment toward the US Dollar.

Mexican Peso daily digest: USD/MXN rises on hopes for a stronger Greenback

- Mexican Retail Sales increased by 0.5% in March compared to the 0.2% rise in February, with the YoY figures smashing forecasts, coming in at 4.3%, far above the 2.2% forecasts.

- As the US Dollar drives broader market direction, shifts in USD sentiment, driven by US fiscal policy, economic data, or Fed signals, tend to dictate the short-term trajectory of USD/MXN, with the Peso reacting accordingly.

- President Trump’s “One Big Beautiful Bill” aims to extend the 2017 Tax Cuts and Jobs Act and introduce new tax relief measures.

- Suggested amendments would include State and Local Tax (SALT) deductions, which are expected to triple from $10K to $30K for married couples in the US, reducing the amount of income the government receives per tax year and placing additional pressure on the fiscal budget.

- To offset the cost of expanded tax cuts, President Trump has proposed reducing expenditure on programs associated with Medicaid, food stamps, and green energy subsidies, while reallocating funds toward defense and immigration enforcement.

- On the US side, S&P Global will release the preliminary Purchasing Managers Index (PMIs) for May and Existing Home Sales data for April on Thursday for fresh economic signals.

Mexican Peso technical analysis: USD/MXN trades cautiously with trendline resistance intact

The USD/MXN dropped to its lowest level since October on Tuesday, breaking through the previous psychological support level, which has now turned into resistance at 19.30.

Currently, prices have risen above the prior descending trendline established from the April decline, providing an imminent barrier of support at 19.28.

The Relative Strength Index (RSI) indicator, slightly recovering to 36.97, is reflecting a slight decline in bearish momentum. Since the 30 mark is considered a potential oversold territory, the bearish trend remains intact, with the next key support level at the round number of 19.20.

USD/MXN daily chart

The Relative Strength Index (RSI) indicator, slightly recovering to 36.97, is reflecting a slight decline in bearish momentum. Since the 30 mark is considered a potential oversold territory, the bearish trend remains intact, with the next key support level at the round number of 19.20.

On the other hand, if USD strength resurges and prices rise above the descending trendline, USD/XN could see a retest of the April low near 19.47, bringing the 20-day Simple Moving Average (SMA) into play at 19.53.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.