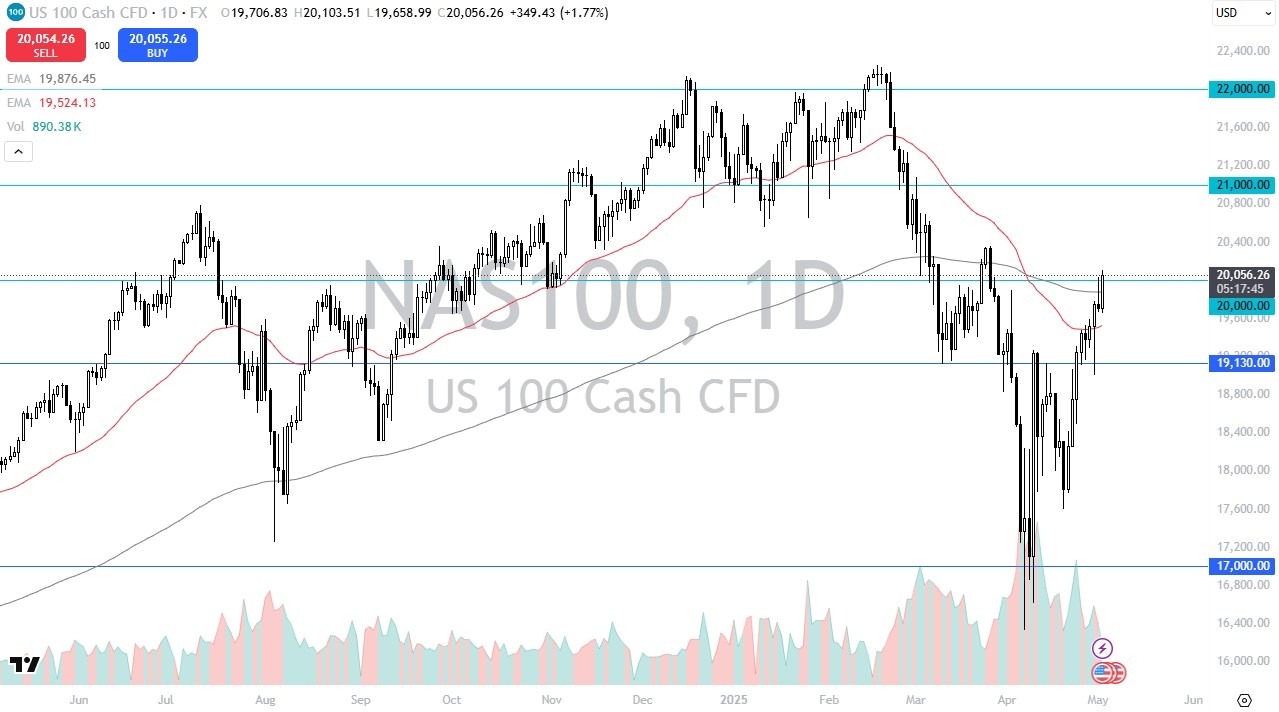

- The NASDAQ 100 was very bullish during the trading session on Friday, as we have seen a lot of momentum coming into this market.

- The fact that we broke above the top of the shooting star from the previous session is obviously very bullish sign, but you should also keep in mind that the jobs number coming out during the Friday morning session would also have a major influence.

- It appears that the stock market likes the numbers, as we basically just continue to go higher after what had been a very bullish overnight session.

Major Point of Inflection

We are at a major point of inflection from what I can see, but the fact that we are closing on the 20,000 level and perhaps may in the day above there is a very bullish turn of events. We are well above the 200 Day EMA now, and it looks at this point in time as if traders are going to continue to favor the upside overall, and unless we get some type of truly negative headlines out there, it’s possible that the NASDAQ 100 will continue to be one of the big winners. You should also keep in mind that the candlestick being as big as it is, does suggest that there are real buyers out there willing to get involved.

Short-term pullbacks at this point in time are probably likely, and if we do drop from here, I’d be watching the 19,500 level, not only due to the fact that it is a large, round, psychologically significant figure, but it is also where the 50 Day EMA sits. Remember, it’s quite common that markets slice back and forth through the 200 day EMA before they truly pick up speed, and that might be what we are seeing here. Regardless, you have to keep in mind that there is a lot of headline noise out there, so you do not want to get overly aggressive with your position sizing.