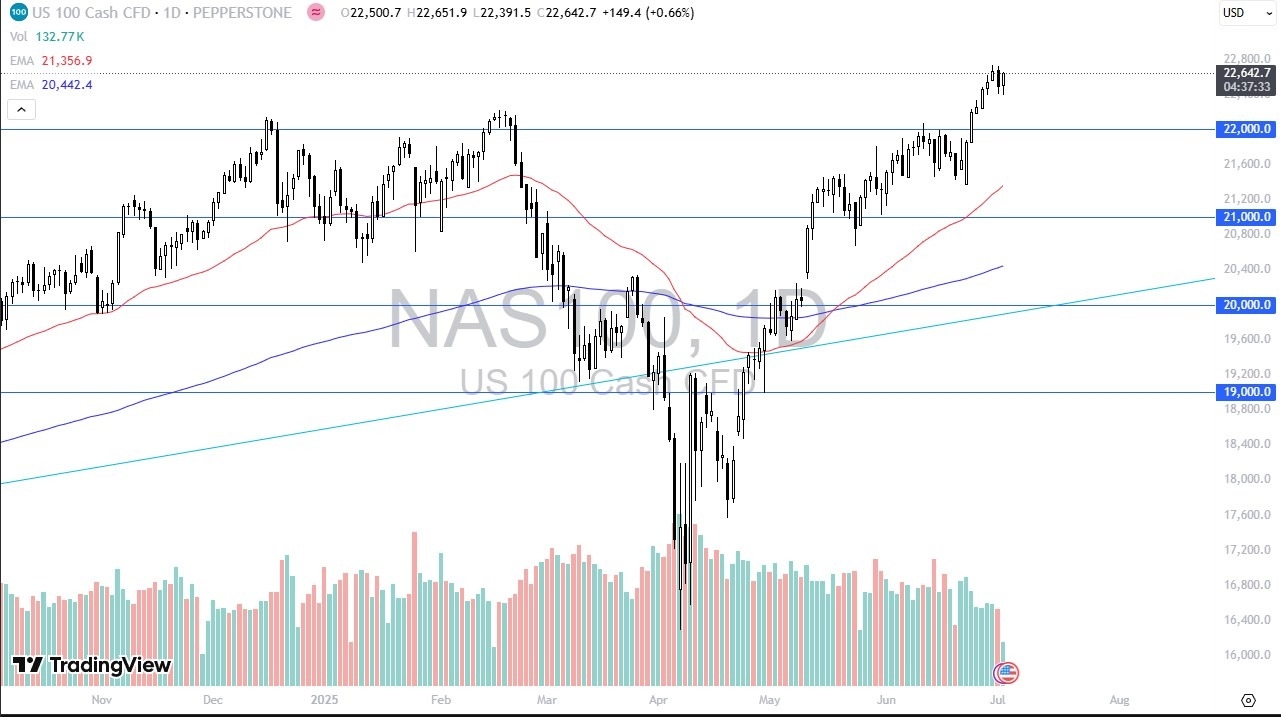

- The NASDAQ 100 Index initially did break down a bit during the trading session, only to turn around and show signs of life.

- This is a market that continues to find plenty of buyers, and I do think you have a situation where it’s only a matter of time before we have to make some type of longer-term decision.

- In essence, I think the market has probably already made that decision due to the breakout above the 22,000 level.

The 22,000 level is a major round number and an area that previously had been very important as resistance. So, I do think you have a situation where we will continue to be looking at that as the potential floor, due to potential “market memory” in this area.

On a Move Higher, the Most Likely Outcome…

To the upside, if we can break above the 22,800 level, then I think you have a real shot at possibly going much higher based on value. I do think that the jobs number of course will make things very crazy, but that’s nothing new. If you’ve actually traded that day before, it shouldn’t surprise you. I look at any pullback as an opportunity to take advantage of what has been an absolute monster rally, which shows absolutely no interest whatsoever in trying to turn things around.

With that being the case, I like the idea of taking advantage of this and therefore possibly looking at a potential move to the 25,000 level, although I do think that takes some time. Regardless, it is about impossible at this point in time to get cute and start shorting. Sellers are all but non-existent at this point, so there is no need to fight momentum in this, or most other indexes.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.