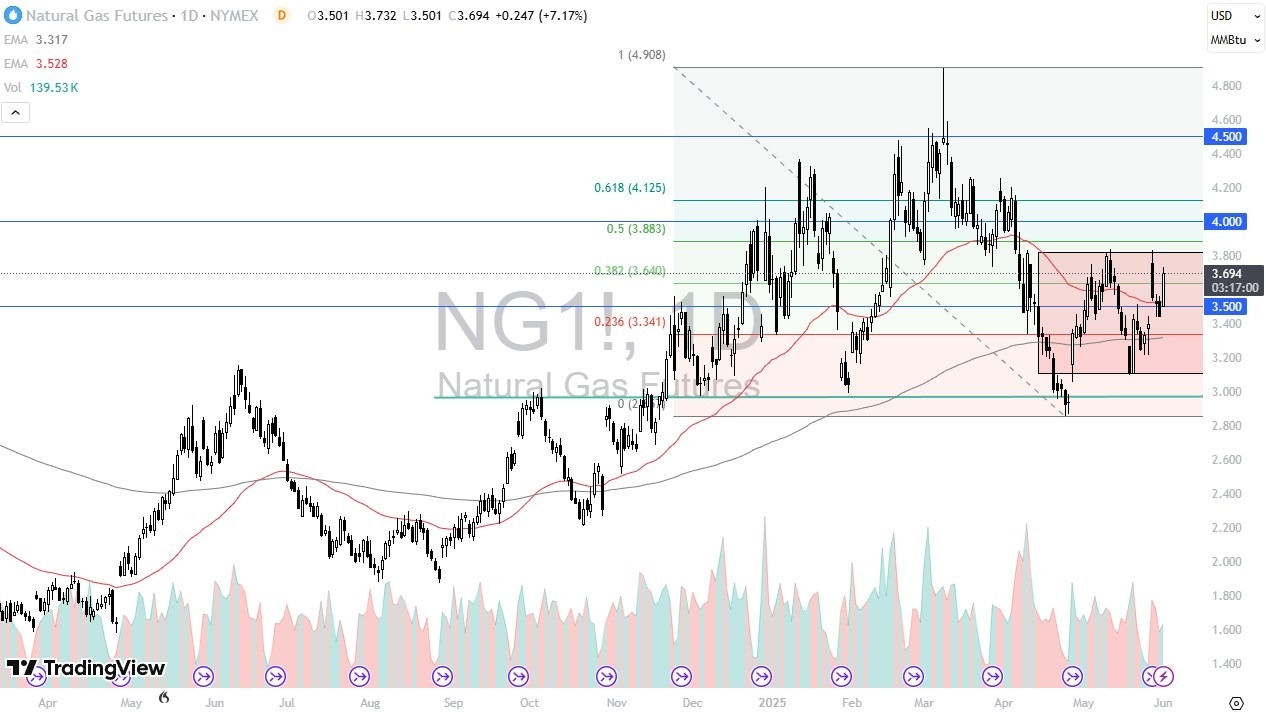

- The natural gas markets have rallied rather significantly during the trading session on Monday, gaining over 7% by the time we settled in the futures market, as there is a bit of a reaction to the Ukrainian drone attack on Russian forces.

- Perhaps people are worried about the disruption of natural gas in the European Union, but quite frankly, as far as United States is concerned natural gas will continue to see a potential lack of demand due to the weather becoming much milder.

I Don’t Trust Rallies

This time of year I just don’t trust rallies and natural gas, and that’s not to say that it cannot go higher, but what it means is that the time of year is typically negative for natural gas so I figure one trying to fight the market at this point, when you can just simply fade signs of exhaustion. It’s not impossible for natural gas to break above $4, but all things being equal it does make a certain amount of sense that we will continue to see downward pressure as natural gas is abundant in the United States, and the US weather doesn’t lend itself for more demand coming into the picture.

It was a nice size candlestick, but I think a lot of this will be proved to be an overreaction to a situation the quite frankly won’t have a major influence on natural gas, as this contract is known as the “Henry Hub Natural Gas Contract.” In other words, it’s based on a Louisiana, and the bulk of natural gas deliveries are within the United States, or the long-standing exports to Asia. Yes, Europe does buy some of it in the form of liquefied natural gas, but at the end of the day, Europe is a small player when it comes to the natural gas markets from this particular contract. Ultimately, I’m looking to play this market at the first signs of exhaustion, aiming to get back down to the $3.30 level.

Ready to trade Forex daily analysis and predictions? Here are the best commodity trading platforms to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.