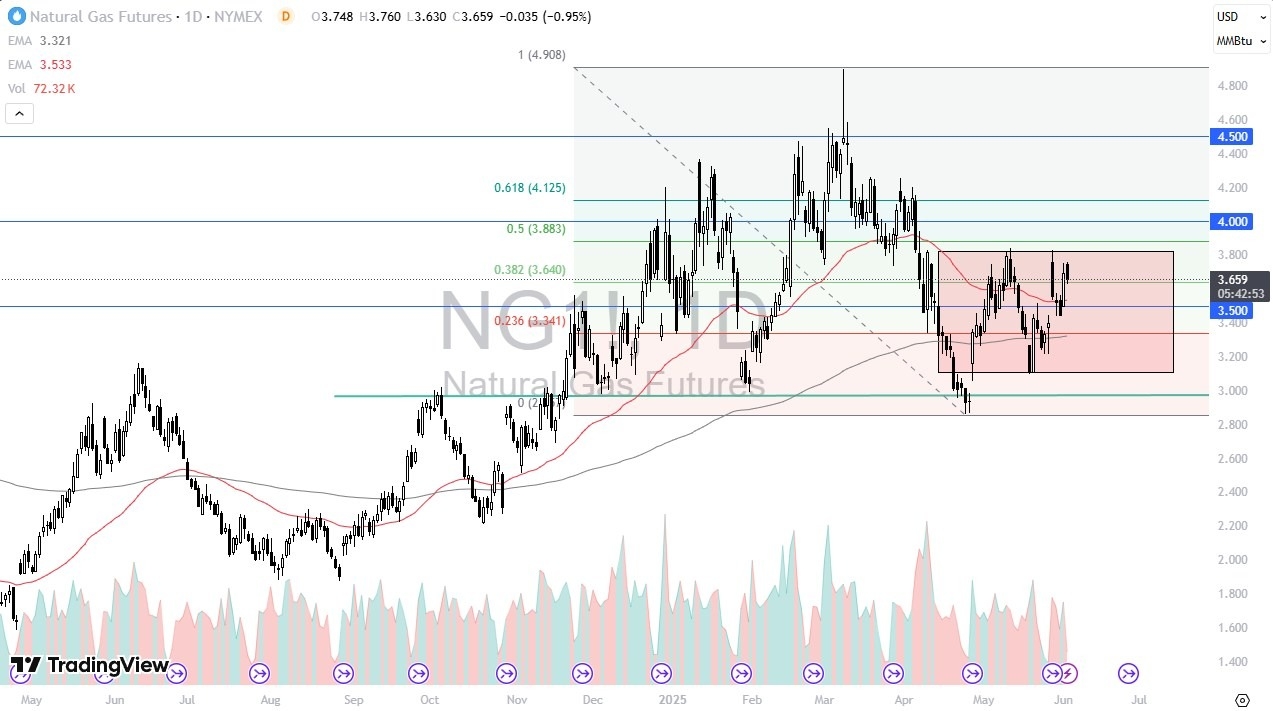

- The natural gas market did fall a bit during the trading session here on Tuesday in the early hours as we continue to see a lot of noise.

- As shown on the chart, there is a bit of a range in my mind from the $3.80 level on the top to the $3.15 region on the bottom.

- Ultimately, I think this is a scenario that makes a lot of sense because we have a lot of noise coming out of Europe at the moment as to whether or not Europe will have to buy more U.S. natural gas.

But at the same time, we also have to keep in mind that this time of year is really poor for natural gas demand in the United States. After all, temperatures are very comfortable, so there’s no need for heating. There’s no huge air conditioning bills. So, with that being said, I think the downside makes more sense from a seasonal standpoint, but I also recognize that there is a wild card in the sense that Europe is out there. This is a US-centric contract, so I pay more attention to the weather in the United States than I do the European situation, but I think it is enough to keep the market somewhat noisy.

At the Top of the Range?

So, with that being said, and the fact that we are near the top of the overall range, it suggests to me that we are in fact going to fall from here, perhaps down to the $3.50 level and then the 200 day EMA. Whether or not this is the collapse that leads natural gas down to $3 remains to be seen, but this is a pretty ugly turn of events after initially gapping higher and then just falling. If we do break out to the upside, I anticipate that the $4 level will cause some headaches as it is a large round psychologically significant figure and an area where you really expect to see a lot of options traders playing around. I am bearish, but not wildly so.

Ready to trade daily Forex analysis? We’ve shortlisted the best commodity brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.