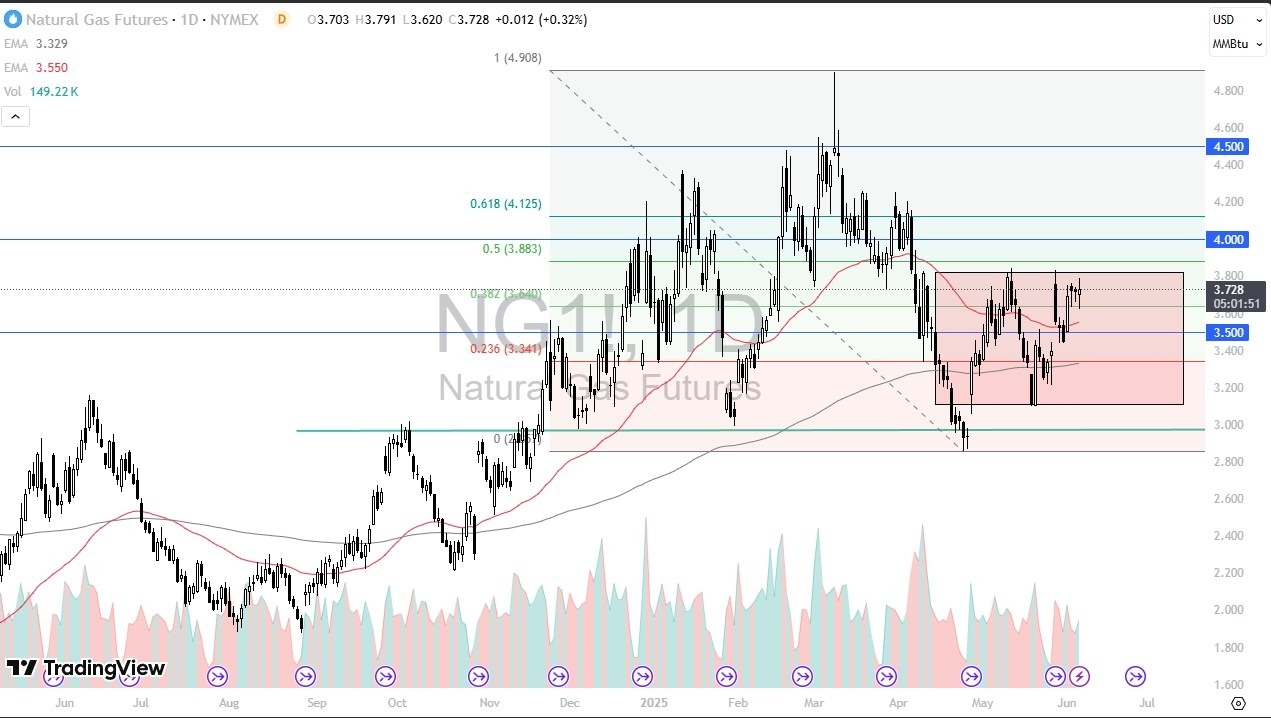

- During the trading session on Thursday, we saw a lot of volatility in the natural gas market, which I don’t find overly surprising as we are near the top of an overall consolidation area.

- After all, this is a market that’s been bouncing around between the $3.15 level below, as well as the $3.85 above.

- As we are closer to the top then the bottom, it does suggest that we can probably see quite a bit of downward pressure.

Technical Analysis

All things being equal, the technical analysis suggests that we are at the top of a major consolidation range, but we are essentially in a sideways market, which makes a certain amount of sense considering that we are in the time of year that is typically very lackluster, if not flat-out negative. The 50 Day EMA sits near the $3.53 level and rising, so that could offer a little bit of support, but after that we would then have the $3.50 level offering support.

If we break out to the upside, then I think you have to look at the $4.00 level has a major “line in the sand” for sellers. This year is a little bit different than most, when you typically see a lot of weakness due to the fact that demand for natural gas drops off of a cliff due to the winter being over in the United States, and to a lesser extent, Europe.

All things being equal, full disclosure here, I am negative of this market. That doesn’t necessarily mean that we have to see the market fall, I wish it were that easy. The reality though is that demand will probably drop a bit, and I think given enough time we will probably have to see whether or not we get any follow-through from negative behavior. That being said, this year is a little different as I alluded to earlier, mainly due to the fact that the Europeans are buying more gas from America, due to a lack of Russian supply.

All things being equal, I’m willing to short this market, but I also recognize that the Non-Farm Payroll announcement comes out Friday morning, and that could give you an idea of how much demand there will be in the United States if employment is in fact going well or falling by the wayside. Because of this, I would be very cautious.

Ready to trade daily Forex analysis? We’ve shortlisted the best commodity brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.