- As you can see, the natural gas market has been a little bit positive, but all things being equal.

- This is a market that I think continues to see a lot of volatility.

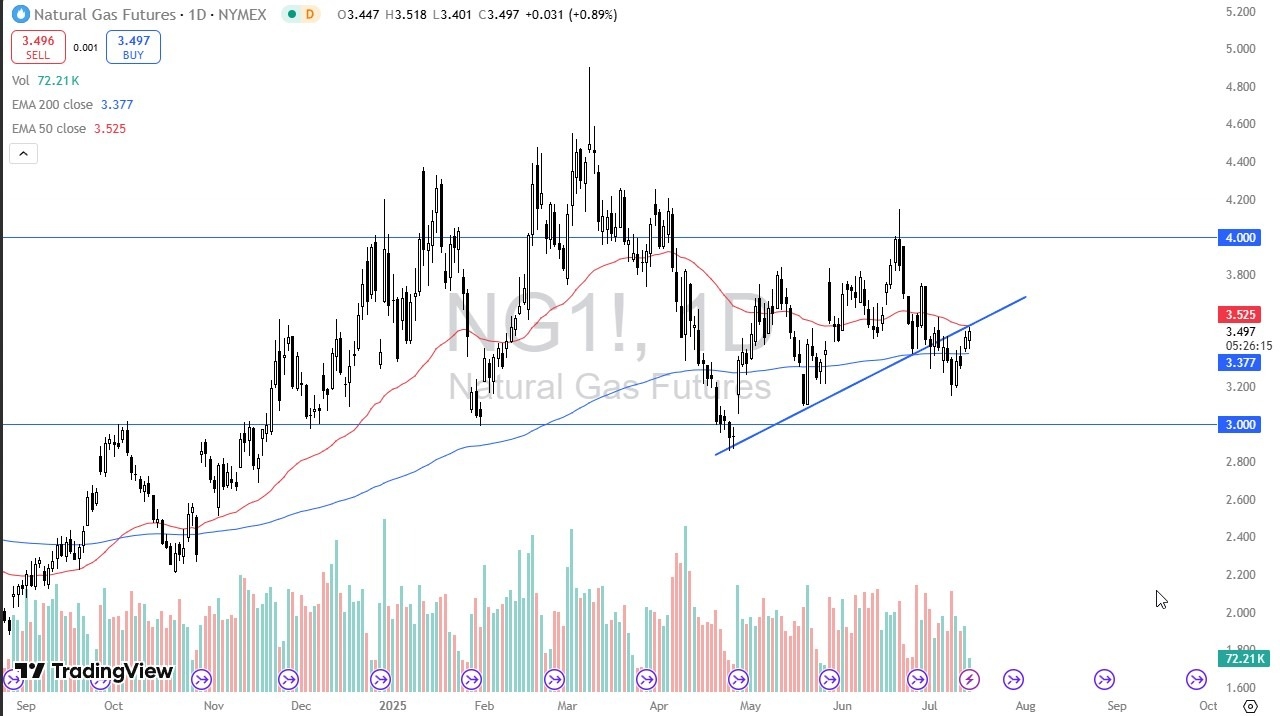

- The market is now testing the previous uptrend line and there should be a little bit of resistance there, but I also recognize that we are right around the 50 day EMA and that does offer a certain amount of resistance.

If we can break above the 50 day EMA, then that’s obviously a very bullish sign. But I also recognize that market participants are swimming upstream here due to the fact this time of year is typically very poor for natural gas. It is a little bit different this year in the sense that the European Union continues to import natural gas due to the lack of Russian gas that is available.

Is Natural Gas a Bit Lost?

With that being the case, I think you look at this through the prism of a market that just continues to bounce around really somewhat lost. I do think that the lack of demand coming out of the United States due to a lack of need for heating, and the fact that we are not in a heat wave will eventually put a little bit of weight upon this market. And I still like the idea of fading short-term rallies. I don’t necessarily look at this as a market that you want to short and just hang on to that position. I think it’s just more of a fade the rally type of environment. If we do break above the 50 day EMA, we could go looking at the $3.77 region.

On other hand, we break down below the 200-day EMA, which sits just below the candlestick for the last couple of days, we could see natural gas drop down to the $3.20 level, followed by the $3 level.

Ready to trade daily Forex forecast? Here’s a list of some of the best commodities brokers to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.