- During the trading session on Wednesday, we saw the Nikkei 225 go back and forth during the session, showing signs of indecision.

- This is not a huge surprise though, because there are a lot of questions asked about whether or not the Japanese yen is going to continue to weaken.

- This is like rocket fuel for the Nikkei 225, as so many of the companies on the index are major exporters, and therefore the cheaper their goods are for foreigners, the better off they tend to do over the longer term via more sales.

Technical Analysis

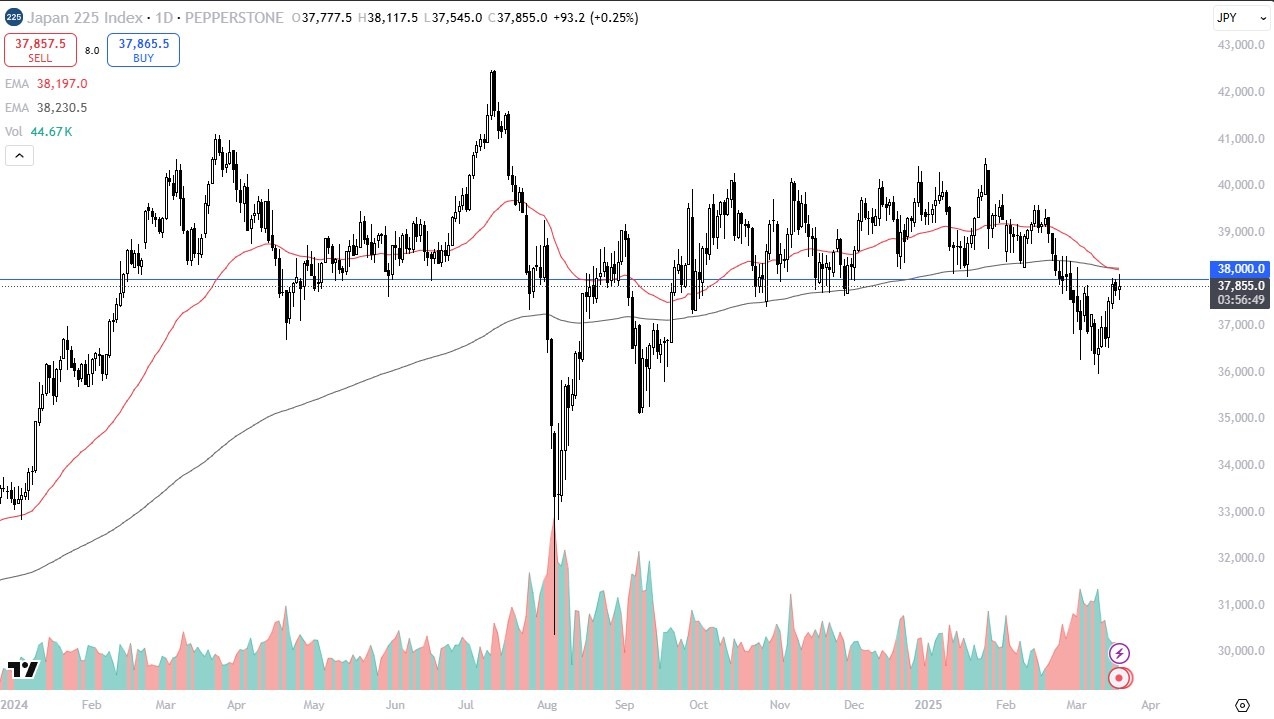

The technical analysis for this market is very interesting, because the ¥30,000 level of course is an area that’s been important multiple times as support, and now so-called “market memory” could come into the picture to offer a bit of resistance. The fact that we stalled a bit during the trading session on both Tuesday and Wednesday done suggests that perhaps we will continue to respect this level.

Furthermore, we have the 50 Day EMA and the 200 Day EMA above offering resistance and trying to cross to kick off the so-called “death cross.” While I don’t necessarily read too much into that, it is something that comes into the picture and a lot of people will be watching. In fact, I think if we can get above both of those moving averages, we could watch this market go to the ¥39,500 level, where we saw the market selloff just a few weeks ago.

If we turn around and break down below the ¥37,500 level, then it’s possible that the market could drop down to the ¥36,000 level, an area that served as pretty significant support about a week and a half ago. Anything below there then it probably sends the Nikkei 225 into a massive plunge that could end up being quite ugly before it is all said and done. As a general rule, if the Japanese yen falls in value, the Nikkei 225 rallies. The exact opposite is also true as well.

Ready to trade the daily stock market forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.