- Nvidia stock rises to $140 afterhours on Wednesday.

- Nvidia earns $0.81 in adjusted EPS, 6 cents better than consensus.

- Revenue of $44.06 billion was $800 million ahead of consensus.

- Chip designer lowers Q2 revenue outlook below consensus.

Nvidia (NVDA) stock gained afterhours following a reported double beat in the first quarter. Nvidia earned $0.81 in adjusted EPS in the first quarter on $44.06 billion in revenue. The $5.5 billion hit from export bans on the H20 chip to China arrived at $4.5 billion rather than the feared $5.5 billion figure as the company was able to repurpose some of the chips.

Wall Street had expected an adjusted EPS of $0.75 and revenue of $43.25 billion. Fiscal Q1 had revenue up about $800 million above consensus saw less positive news.

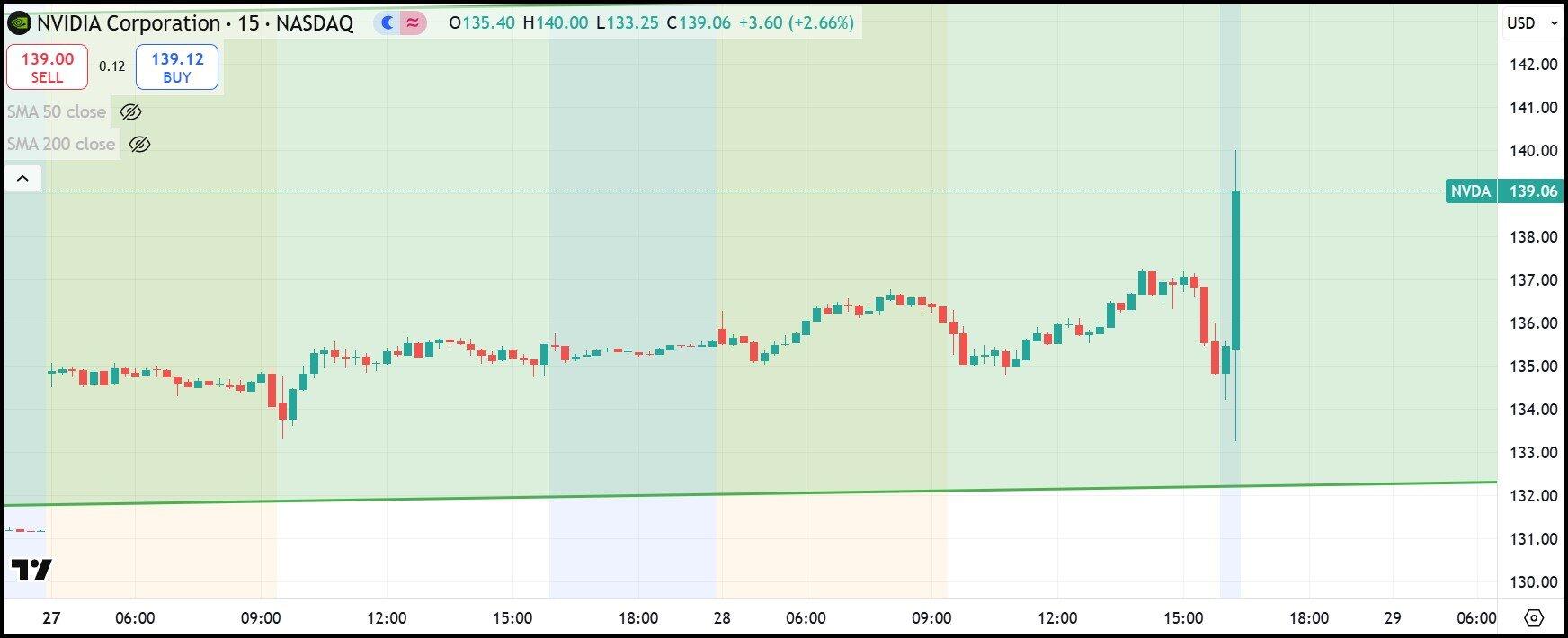

NVDA stock rose to $140 following the news in the post-market.

However, Nvidia’s outlook for fiscal Q2 is less rosy. Nvidia expects revenue of $45 billion, below the consensus of $45.66 billion. The company also said that it would take a $8 billion hit to revenue from China due to the Trump administration’s export limits on selling AI infrastructure to Beijing.

“Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate,” said CEO Jensen Huang in a statement.

Nvidia’s share price sank $2 in the last hour of regular trading on Wednesday, moving from $137 to $135. Ahead of the earnings release, Cathie Wood’s Ark Invest snapped up 34,000 shares of NVDA during Tuesday’s regular session.

All three major US equity indices closed down about 0.5% in regular trading hours. Salesforce (CRM) reported a quarterly beat after the market close on Wednesday, as well as raising full-year revenue guidance. CRM stock gained 5% afterhours on the news.

NVDA 15-minute stock chart