- WTI crude climbs above $62 as OPEC+ signals no immediate change to current production policy.

- Oil prices rise on expectations that supply increases will remain limited in the near term.

- OPEC+ core eight meet Saturday to decide on a proposed 411,000/bpd production hike for July.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) convened at its Vienna headquarters on Wednesday to assess the current state of the oil market.

While no immediate changes to production policy were announced, the meeting laid the groundwork for continued discussions on 2027 production baselines and the potential for future output adjustments in the months ahead.

At the time of writing, WTI Crude oil is trading above $62, gaining more than 1.50% on the day as markets respond to the group’s cautious stance.

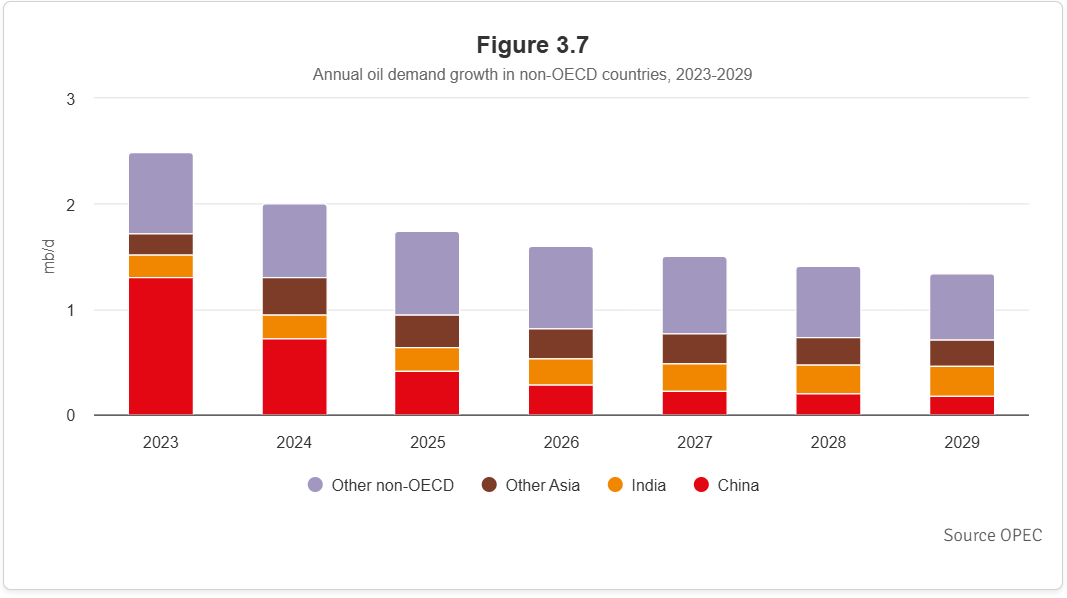

A key backdrop to Wednesday’s meeting was the evolving trajectory of global oil demand, particularly within non-OECD economies. According to OPEC’s latest outlook, annual demand growth is expected to slow through 2029, with China’s contribution declining sharply after 2023. In contrast, “Other non-OECD” economies are projected to drive the majority of demand growth beyond 2025, even as total volumes begin to moderate.

*Non-OECD refers to countries that are not members of the Organisation for Economic Co-operation and Development (OECD). These are typically emerging and developing economies, in contrast to the OECD’s mostly advanced, high-income nations.*

Source: OPEC

This demand landscape directly informed OPEC+’s cautious approach to future output planning.

It also underscored the urgency behind ongoing talks to revise 2027 production baselines as countries like the UAE and Iraq seek higher quotas aligned with their growing capacity to serve emerging markets.

With demand patterns shifting and long-term growth slowing, the alliance is under increasing pressure to balance supply discipline with internal quota reform, making the outcome of these baseline negotiations pivotal to OPEC+’s long-term strategy.

On Saturday, a separate meeting will be held via videoconference between the OPEC+ core eight key producers. Members include Saudi Arabia, Russia, the United Arab Emirates (UAE), Kuwait, Iraq, Algeria, Oman, and Kazakhstan.

The primary objective of this gathering is to decide on a proposed 411,000 barrels-per-day (bpd) increase in oil production for July, following similar adjustments in May and June.

This decision will be closely watched by markets since it underscores OPEC+’s ongoing efforts to align supply with evolving global demand conditions and maintain price stability.

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.