Expensive mortgage loans continue to hamper the housing market in the United States (US), recent data shows, signaling the increasing woes for a key sector in the world’s largest economy. With mortgage rates unlikely to decline significantly anytime soon and increasing economic uncertainty, the housing market could be in trouble as more and more buyers find it too costly to step into it.

US Pending Home Sales fell by 6.3% in April, according to the National Association of Realtors (NAR) in their latest statistical release published on Thursday. The decline outpaced the 1% fall forecast by analysts, underscoring the issues currently seen in the US housing market.

The NAR’s Pending Home Sales Index – a leading indicator that typically foreshadows existing home sales by one to two months – dropped to 71.3, its lowest level in nearly a year. According to the NAR, an index of 100 would be equal to the level of contract activity in 2001.

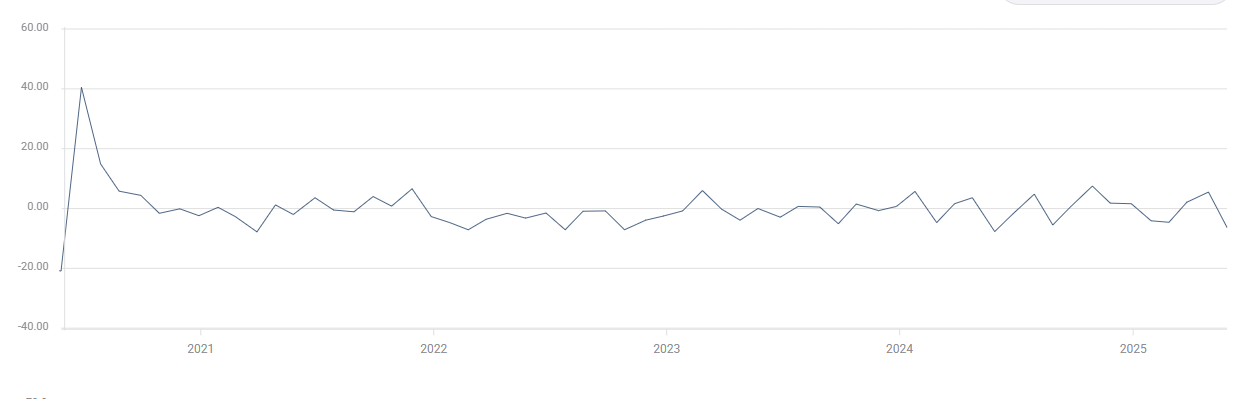

US Pending Home Sales change in % (MoM). Source: FXStreet.

The drop was broad-based, with all four major US regions posting monthly declines. On a year-over-year basis, contract signings slipped in the Northeast, South, and West, with only the Midwest registering a modest gain.

“At this critical stage of the housing market, it is all about mortgage rates,” said NAR Chief Economist Lawrence Yun. “Despite an increase in housing inventory, we are not seeing higher home sales.”

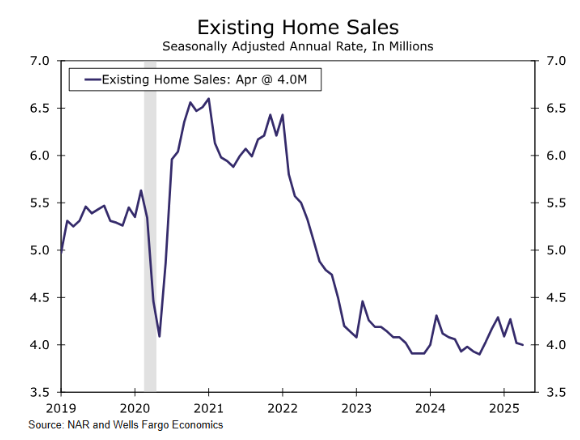

Existing home sales – the market’s main volume indicator – also slipped 0.5% in April and remain near multi-year lows on a seasonally adjusted basis. The disconnect between rising inventory and stagnant sales underscores the degree to which high rates have frozen both buyers and sellers in place.

US mortgage rates hit 2025 highs, housing affordability declines

Indeed, it is not coincidental that the hit in housing contracts agreed comes along as mortgage rates are surging. According to Freddie Mac’s Primary Mortgage Market Survey, published on Thursday, 30-year fixed mortgage rates are at 6.89%, and the 15-year rate is at 6.03%, both marking new peaks since February.

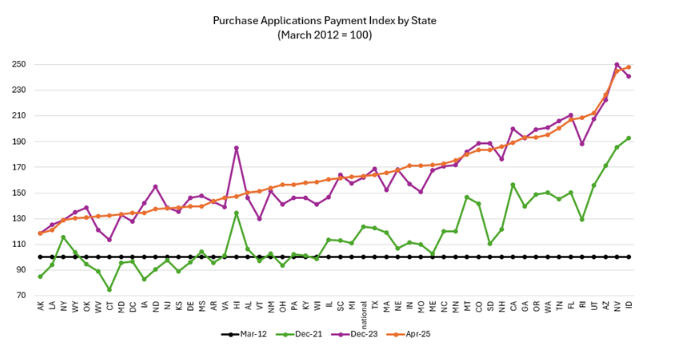

The Mortgage Bankers Association (MBA) is due to publish its weekly mortgage interest rate data on Friday, but it reported similar behaviour last week, with 30-year rates hovering near 6.9% for fixed loans in late May. Their monthly mortgage application data published on Thursday showed that homebuyer affordability declined in April, “with the median payment applied by purchase applicants increasing to $2,186 from $2,173.”

Purchase applications payment index (source: Mortgage Bankers Association)

Fed stays hawkish, keeps delaying rate cuts in 2025

One of the main “culprits” of expensive mortgage loans is the Fed because borrowing costs are highly dependent on the rates set by the US central bank. Commercial banks borrow and lend their excess reserves to each other at that level, so any change in Fed Funds rate expectations decisively affects commercial interest rates for mortgage loans.

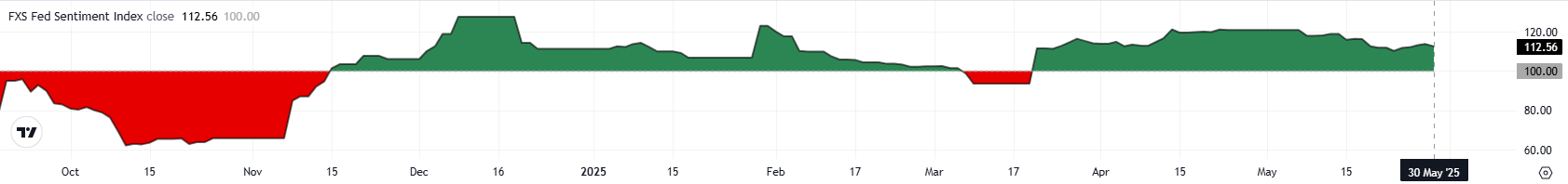

The Federal Reserve’s (Fed) stance remains blowing headwinds for the housing market. Minutes from the May meeting and a chorus of recent Fed speeches have reinforced a “higher-for-longer” interest rate outlook. The FXStreet Fed Sentiment Index is currently sitting above 110, comfortably remaining in hawkish territory, after this week’s Fedspeak activity.

FXStreet’s Fed Sentiment Index

Even traditionally neutral voices like New York Fed President John Williams (an average 5.8 speaker, a neutral score according to FXStreet’s FedTracker) have turned more hawkish recently, emphasizing “the need to prevent inflation from becoming highly persistent,” as Williams said in a speech (7.2 – Hawkish, according to the FedTracker) on Tuesday.

Dallas Fed President Lorie Logan echoed the theme, saying policy is “in a good place” and hinting that any shift could take “quite some time” – language that indicates no urgency whatsoever to cut interest rates and offers little comfort to would-be homebuyers or mortgage lenders.

Following these remarks, markets keep pricing in delayed interest rate cuts, per CME’s FedWatch tool, which now only projects an average of two cuts this year, in September and December.

What is the correlation between the bond and the housing market?

The realization that interest rates could be staying at higher levels for a longer period is also hitting the US Treasury market, which is still showing signs of weak demand.

Longer-term yields have retraced slightly from the 18-month highs made last week after Moody’s cut the rating of the US sovereign debt, but remain at very high levels. US 20-year and 30-year Treasury yields are right below the psychological 5% mark, currently at 4.94% and 4.93%, respectively.

With the Fed signaling patience and mortgage rates stuck near cycle highs, the US housing market is likely to stay subdued. Until borrowing costs retreat meaningfully, affordability will remain out of reach for many, and new mortgage signings will stay weak.

As NAR’s Yun put it: “Lower mortgage rates are essential to bring home buyers back into the housing market.” For now, they may have to keep waiting.