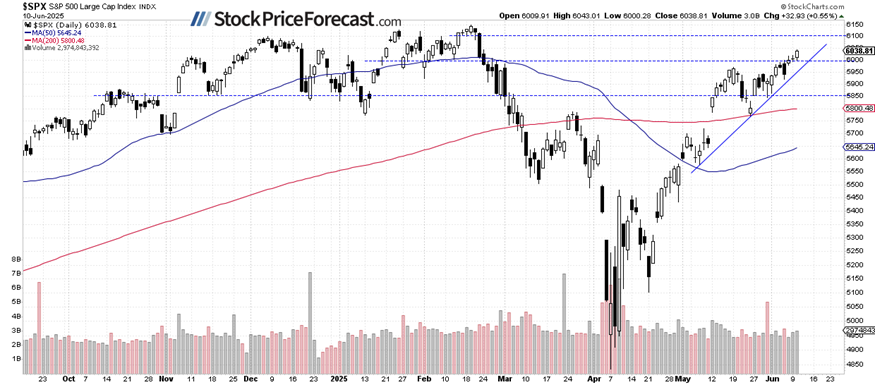

Will the CPI data push stock prices towards their February record highs?

Stock prices advanced on Tuesday, with the S&P 500 index closing 0.55% higher as investors were hopeful about the U.S.-China trade deal and anticipated today’s Consumer Price Index release. The CPI came in slightly lower than expected at 0.1% month-over-month, and the S&P 500 is expected to open 0.5% higher as indicated by futures contracts.

Investor sentiment remained mixed, as reflected in the last Wednesday’s AAII Investor Sentiment Survey, which reported that 32.7% of individual investors are bullish, while 41.4% are bearish.

The S&P 500 broke above the 6,000 level and is currently testing its January-February trading range.

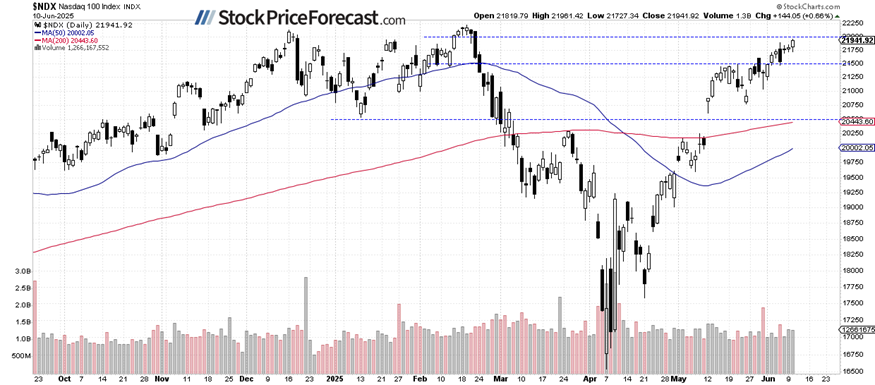

Nasdaq 100 nears 22,000

The Nasdaq 100 closed 0.66% higher yesterday, as it broke above its recent trading range, nearing the 22,000 level. Today, it’s likely to open 0.5% higher, and it may see an attempt at reaching its February 19 all-time high of 22,222.61.

Support is now around 21,700, while resistance remains at 22,000-22,200.

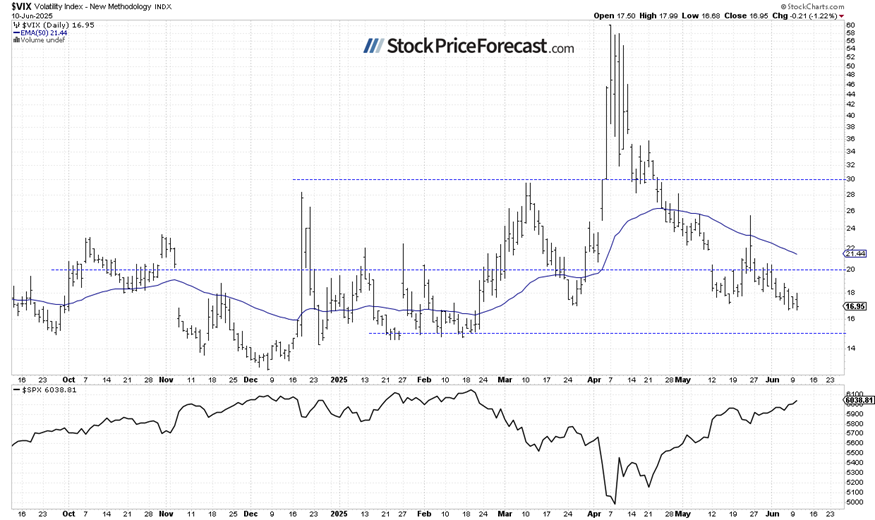

VIX remains relatively low

The Volatility Index (VIX) fell to a local low of 16.65 last Friday, indicating reduced investor fear. It has been essentially moving sideways since.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 futures: Extending advances above 6,000

This morning, the S&P 500 futures contract is extending its short-term uptrend, breaking above the 6,050 level after the CPI data. No negative signals are evident right now; however, the market may be nearing a downward correction.

Conclusion

The S&P 500 is expected to open 0.5% higher this morning, extending its short-term uptrend on lower-than-expected consumer inflation data. The market is also reacting to the U.S.-China trade deal news. We are approaching a key resistance zone, marked by record highs from February. Therefore, I think that a downward correction is likely at some point.

Here’s the breakdown:

-

The S&P 500 reached yet another local high, nearing its record high from February and extending gains for those who bought based on my Volatility Breakout System.

-

There are no clear bearish signals, but a downward correction is not out of the question at some point.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!