Pound Sterling trades with caution as investors await BoE’s interest rate decision

The Pound Sterling (GBP) trades cautiously against its major peers on Thursday ahead of the Bank of England’s (BoE) monetary policy announcement at 11:00 GMT.

Investors expect the BoE to leave borrowing rates steady at 4.25%, with a 7-2 majority vote. BoE Monetary Policy Committee (MPC) members Swati Dhingra and Alan Taylor are expected to support an interest rate cut, as they endorsed a larger-than-usual 50 basis points (bps) interest rate reduction in the May policy meeting. Read more…

GBP/USD Forecast: Buyers remain on sidelines ahead of BoE

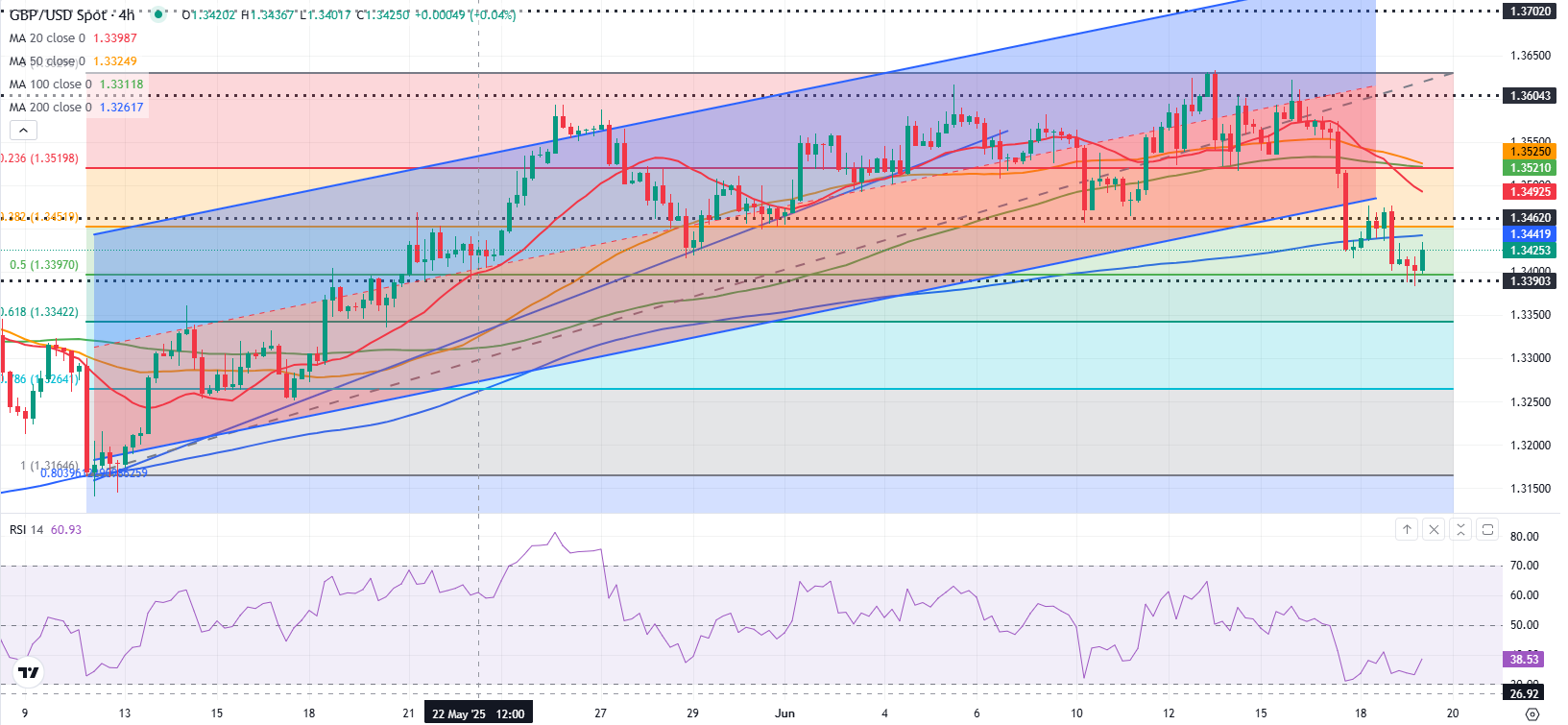

After closing the day virtually unchanged on Wednesday, GBP/USD edged lower and touched its weakest level in about a month near 1.3380 in the Asian session on Thursday. Although the pair managed to recover above 1.3400 by the European morning, it’s struggling to attract buyers ahead of the Bank of England’s (BoE) policy announcements.

The BoE is widely expected to maintain its bank rate at 4.25% following the 25 basis points (bps) cut announced in May. Because there will not be a press conference, the vote split and the language in the policy statement could drive Pound Sterling’s valuation in the near term. Read more…

Pound recovers as UK CPI edges lower

The British pound has stabilized on Wednesday. In the European session, GBP/USD is trading at 1.3551, up 0.28% on the day. The US dollar showed broad strength on Tuesday and GBP/USD declined 1.05% and fell to a three-week low.

UK inflation for May edged lower to 3.4% y/y, down from 3.5% in April and matching the market estimate. The driver behind the deceleration was lower airline prices and petrol prices. Services inflation, which has been persistently high, eased to 4.7% from 5.4%. Monthly, CPI gained 0.2%, much lower than the 1.2% gain in April and matching the market estimate. Read more…