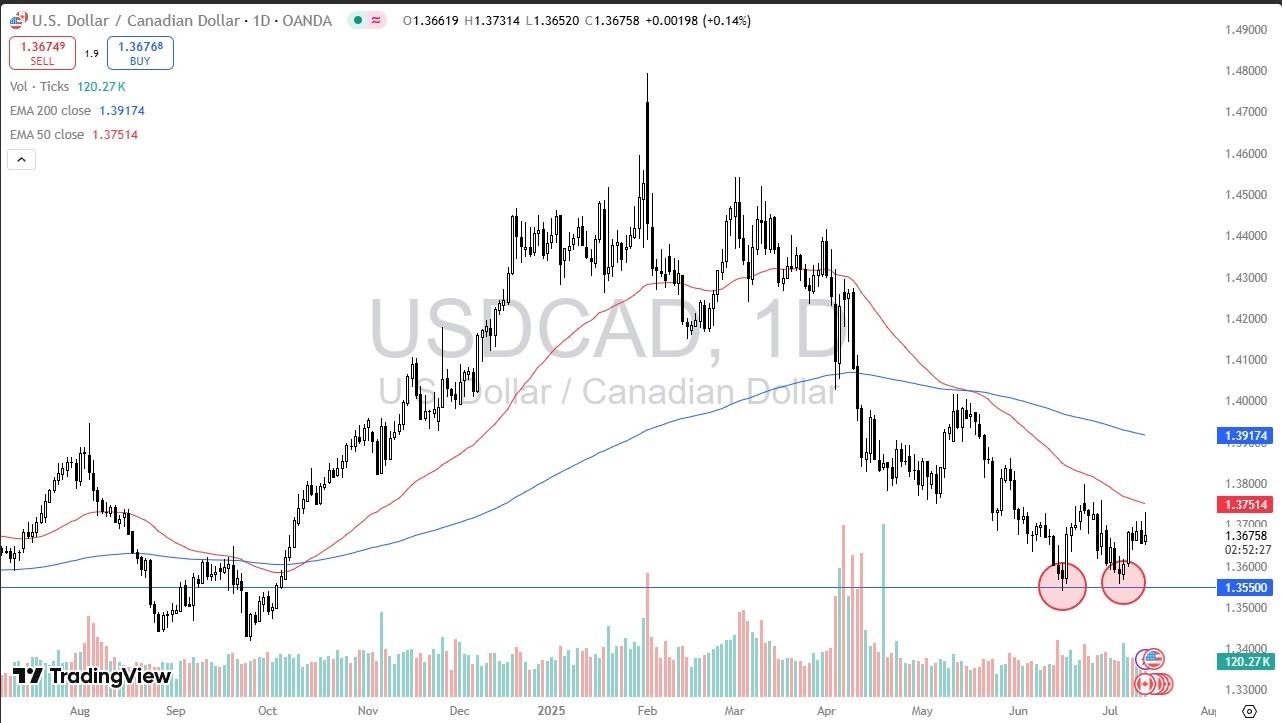

- The US dollar initially rallied against the Canadian dollar during trading on Friday, but you can see that the 50-day EMA has offered a little bit of a barrier.

- Because of this, I think you’ve got a situation where traders will continue to watch this market very closely, especially considering that the Americans are now talking about levying yet another tariff on Canada.

- It seems like this situation is only getting worse. And therefore, I think there are going to be a lot of questions about this pair.

The 1.3550 level is an area that has been supported for a while. And I think that extends down to the 1.35 level. All things being equal, the market is likely to turn around occasionally. But the question now is, can we break above the 1.38 level and by extension, the 50 day EMA. That would open up a bigger move towards the 1.4 level and anything above there, then we will be above a major swing high and the 200 day EMA opening up a move to much higher levels.

If We Break Lower in this Pair

If we were to break down below the 1.3450 level, then I think the dollar’s in serious trouble. You would probably see the US dollar following against most currencies. It wouldn’t just be the Canadian dollar, and quite frankly, I don’t know that the Canadian dollar itself is so strong that I would use this as the first way to short the US dollar, but it is a viable trade. Ultimately, I think this is a situation where we just see a lot of choppiness while we try to sort out whether or not this support holds. Expect a lot of noise, but ultimately, watch these levels mentioned in this video and tell you where we’re going for a longer term move.

Ready to trade our USD/CAD daily analysis and forecasts? Here’s a list of the best Forex Trading platform in Canada to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.