Long Trade Idea

Enter your long position between 151.80 (the intra-day low of its last bearish candle) and 155.43 (its latest intra-day high).

Market Index Analysis

- Qualcomm (QCOM) is a member of the NASDAQ 100, S&P 100, and the S&P 500.

- All three indices remain near record highs with rising bearish trading volumes.

- The Bull Bear Power Indicator of the NASDAQ 100 shows a negative divergence.

Market Sentiment Analysis

The trading week started muted. Traders digest more tariff commentary over the weekend and await more earnings. Commerce Secretary Lutnick confirmed the August 1st deadline as a hard deadline when tariffs kick in, but he added that countries will be able to negotiate past the deadline to reach a deal. Traders await earnings from Alphabet and Tesla on Wednesday. 86% of the 59 S&P 500 companies that reported earnings beat expectations, which were modest amid tariff uncertainty. Volatility should continue increasing this week.

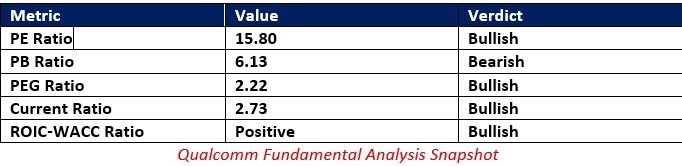

Qualcomm Fundamental Analysis

Qualcomm is a semiconductor and software company catering to wireless technology. It owns patents vital to mobile communications standards 5G, 4G, CDMA2000, TD-SCDMA, and WCDMA. It has also begun expanding into non-mobile sectors to diversify its business.

So, why am I bullish on QCOM despite its recent struggles?

Qualcomm faces issues in its mobile segment, Apple has announced that it will drop Qualcomm chips in 2027, and its China exposure has pressured its share price. I like QCOM for its plans to design custom processors compatible with NVIDIA AI chips, allowing complete integration. I also appreciate its move into the automotive sector, IoT-related business, and PCs. The valuations are ridiculously cheap, making QCOM an under-the-radar and stealth AI play.

The price-to-earnings (PE) ratio of 15.80 makes QCOM a cheap and undervalued stock. By comparison, the PE ratio for the NASDAQ 100 is 41.05.

The average analyst price target for QCOM is 171.47. It suggests excellent upside potential and could experience upside revisions.

Qualcomm Technical Analysis

Today’s QCOM Signal

QCOM Price Chart

- The QCOM D1 chart shows price action ascending inside a bullish price channel.

- It also shows support from the ascending 38.2% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bearish, but bullish pressures are rising.

- The trading volume on the bounce at support was higher than average selling volume.

- QCOM corrected as the S&P 500 rallied to fresh highs, a significant bearish development, adding to short-term volatility issues.

My Call

I am taking a long position in QCOM between 151.80 and 155.43. The low valuations and its exciting future business plans make QCOM an overlooked AI-play. I will also buy the dips in a potential future sell-off. The dividend yield is a small bonus as well.

- QCOM Entry Level: Between 151.80 and 155.43

- QCOM Take Profit: Between 182.10 and 193.84

- QCOM Stop Loss: Between 141.77 and 135.21

- Risk/Reward Ratio: 3.02

Ready to trade our free signals? Here is our list of the best brokers for trading worth checking out.