The S&P 500 is set for a pullback, stepping back from the key 6,000 resistance – how will the market respond to the downgrade?

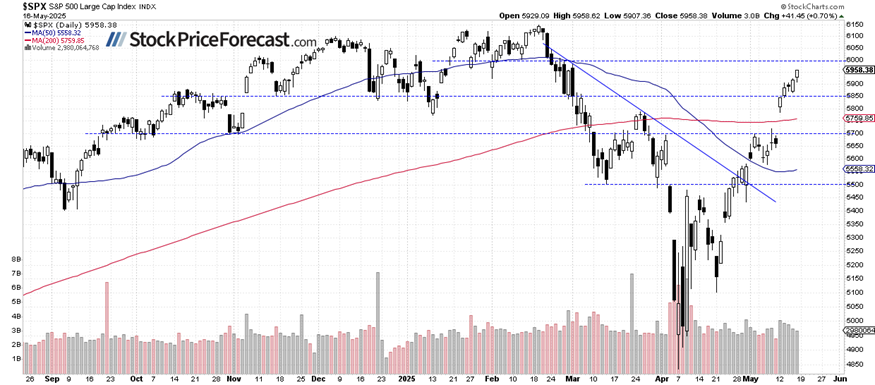

The S&P 500 gained 0.70% on Friday, extending its short-term uptrend and reaching a local high of 5,958.62. However, after the close, Moody’s lowered the credit rating for the US, causing a significant pullback in futures. The index is now expected to open 1.1% lower today, suggesting what currently looks like a correction of the recent uptrend.

The 6,000 level remains a key resistance level that the market failed to breach during last week’s rally. Today’s opening will likely test the market’s resilience as traders react to the credit downgrade news.

Moody’s downgraded the U.S. sovereign credit rating on Friday to ‘Aa1’ from ‘Aaa’, becoming the last of the major agencies to cut the prestigious triple-A rating that had been in place since 1919. The agency cited concerns over the country’s growing $36 trillion debt pile, which could be exacerbated by Trump’s plans to cut taxes.

Investor sentiment has improved, as reflected in the last Wednesday’s AAII Investor Sentiment Survey, which reported that 35.9% of individual investors are bullish, while 44.4% are bearish.

On Friday, the S&P 500 index extended its uptrend, closing at the highest level since late February.

S&P 500: Strong gains last week now face a test

Last week, the S&P 500 index jumped 5.27% as investors cheered the White House’s deal with China to temporarily slash levies.

However, the Moody’s downgrade has changed the short-term sentiment, with futures indicating a significant pullback to start the week.

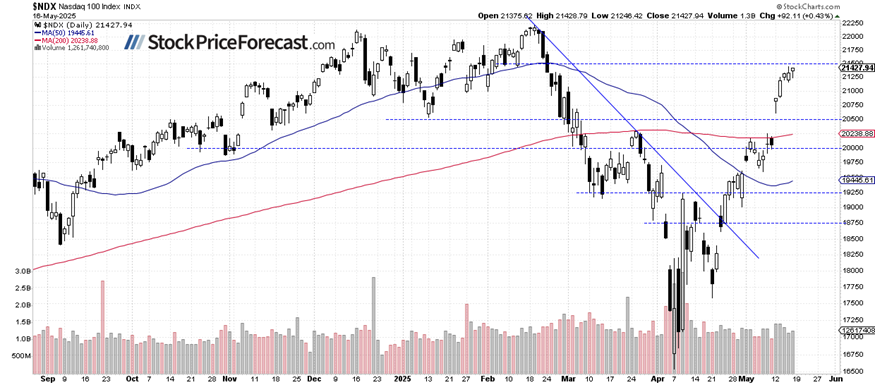

Nasdaq 100: Expecting a pullback

The tech-heavy Nasdaq approached the 21,500 level last week, with Friday’s trading session closing 0.43% higher. Today, it is expected to pull back by 1.5%.

Currently, it looks like a correction of the uptrend as no confirmed negative signals are evident. The market may undergo some profit-taking action.

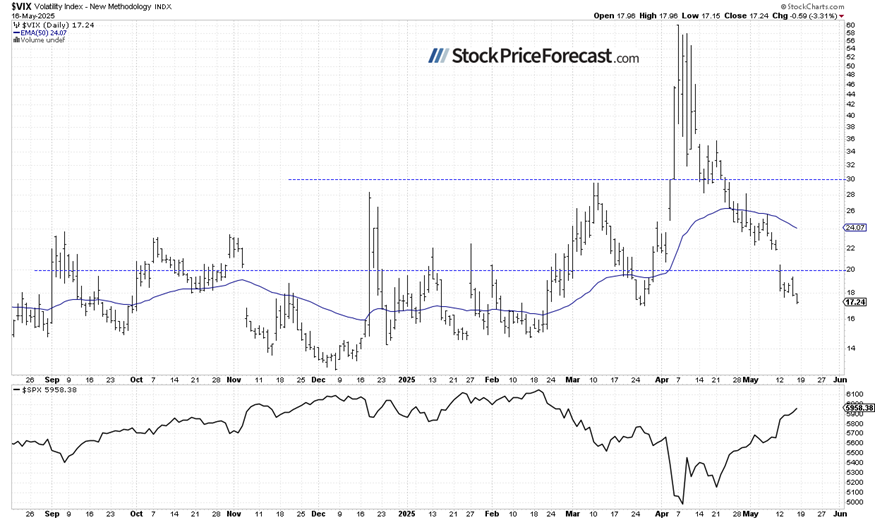

VIX dipped on Friday

On Friday, the volatility index extended its decline, reaching a new local low of 17.15 and indicating less fear in the market. However, investors should remember that the lower the VIX goes, the higher the probability of a potential market reversal.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Stock trading idea – JPM

A long position in JPM stock, opened on May 5 at $251.18, was closed at $267.50. The profit on this trade was $16.32, or +6.50%. This successful trade was closed before the market volatility triggered by the Moody’s downgrade.

S&P 500 futures contract: Pulling back toward 5,900

This morning, the S&P 500 futures contract is retracing some of its recent advances, indicating a negative open with futures down 1.1% in premarket trading.

Support remains near the 5,870 level, marked by the recent local low.

On Friday, I noted “traders should be cautious of potential profit-taking after the rally this week.” This proved correct, as the market is set for a retracement.

Conclusion

The S&P 500 is set to open lower today, pausing its recent rally as traders digest the Moody’s credit downgrade and its implications. The bullish momentum of last week faces a significant test, and we may see increased volatility in the days ahead.

Here’s the breakdown:

-

S&P 500 gained 0.70% on Friday but is expected to open 1.1% lower today after Moody’s downgrade.

-

The S&P 500 reached its highest level since February, nearing the 6,000 level and extending gains for those who bought based on my Volatility Breakout System.

-

The 6,000 level remains a key resistance that the market failed to breach.

-

JPM trade was successfully closed with a profit of +6.50%.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!