- The US dollar rally during the trading session on Friday, as liquidity and volume of course might have been a bit of a problem as the Americans celebrated Independence Day.

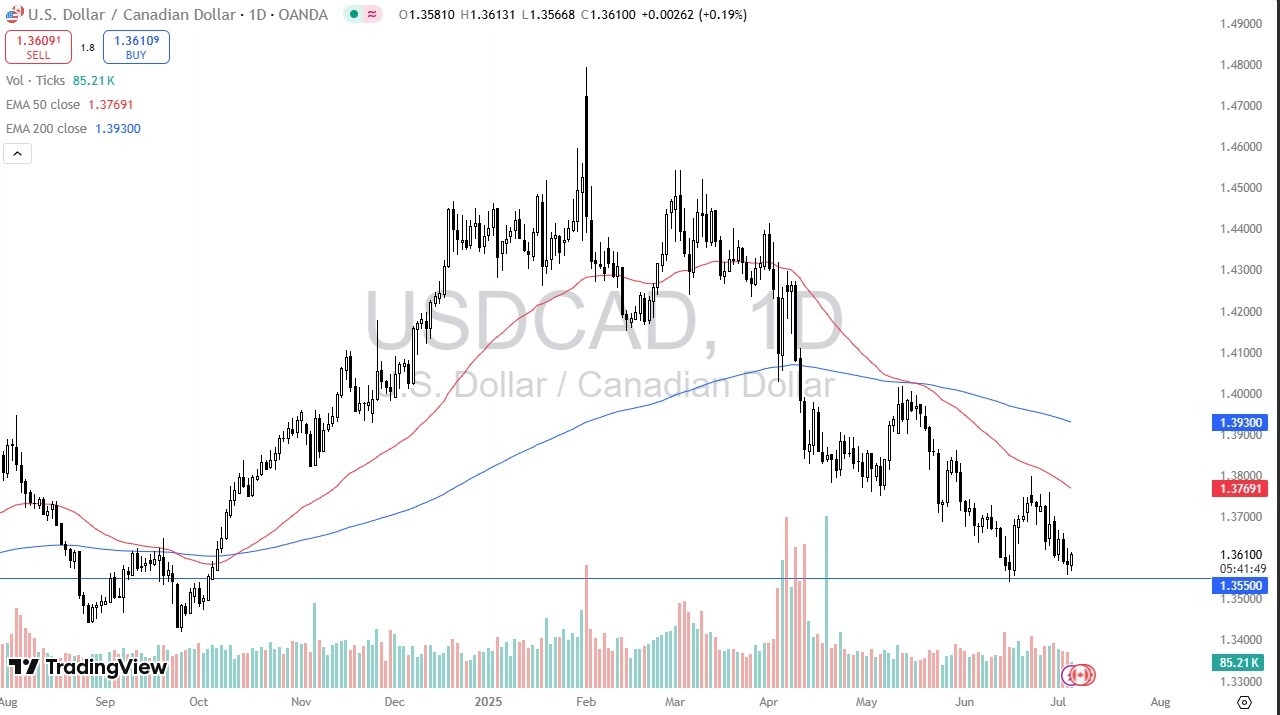

- That being said, it looks as if we are at least attempting to build some type of double bottom at the 1.3550 level, an area that’s been important multiple times in the past.

Keep in mind that the market has been selling off quite drastically, and that the 50 Day EMA is an indicator that a lot of people have watched very closely, and I think will continue to be a bit of a barrier even if we do rally from here. If we can break above 50 Day EMA, then the next target might be the 1.39 level, possibly even the 200 Day EMA. On the other hand, if we were to break down below the 1.3550 level, then it’s likely that the market will go looking to the 1.35 panel underneath, which is a large, round, psychologically significant figure, and an area that a lot of people have been paying attention to for what seems like ages.

Interest Rates

Interest rates between the 2 economies still favor the US, but a lot of people are still expecting the US to start cutting rates, and of course the Fed Funds Futures markets still expect an interest rate cut in September, and there are some even now who expect an interest rate cut in July. While I don’t necessarily believe that we are going to see interest rates cut in July, I think by the end of the year would probably see the Fed do something about loosening monetary policy.

The other thing that’s been moving this pair is the fact that the Canadians have made a few overtures to the Americans in order to settle the trade dispute, and people are looking at the Canadian economy is one that is highly sensitive to how it interacts with the US, which is its major destination for exports. Ultimately, I think this is a market that continues to consolidate in this area with 550 level as support.

Ready to trade our USD/CAD daily analysis and forecasts? Here’s a list of the best Forex Trading platform in Canada to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.