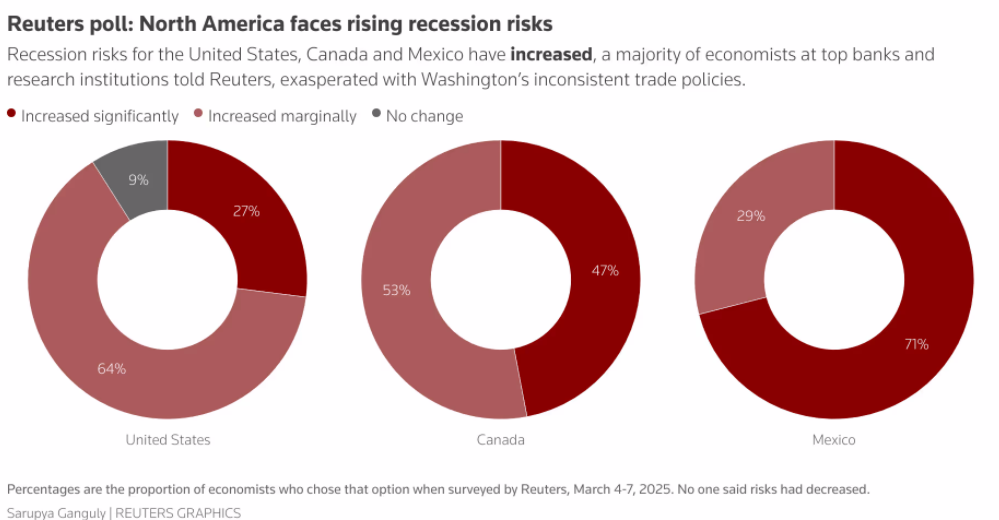

A Reuters poll showed that 70 of 74 economists surveyed suggest that risks for the Mexican, Canadian and American economies are piling up amid United States (US) President Donald Trump’s controversial trade policies.

US inflation risks, which remained skewed to the upside, worsened, preventing the Federal Reserve (Fed) from easing policy.

Tariff announcements and sudden rollbacks have kept traders risk-averse, as the S&P 500 has erased all of its gains since Trump’s November election.

On Thursday, the International Monetary Fund (IMF) said that US tariffs would negatively impact Mexico and Canada.

Source: Reuters

Nearly every economist polled revealed that the economic outlook had soured considerably across the continent.

Regarding the central banks, economists estimate a 25-bps rate cut by the Bank of Canada (BoC) on March 12. Meanwhile, 56 of 102 economists foresee the Fed holding rates until mid-2025, while the rest expect a quarter-percentage-point rate cut.

In the meantime, the Bank of Mexico (Banxico) is expected to cut rates by 50 bps at its March meeting. Ramon de la Rosa, the economics deputy director at Actinver, said: “If tariffs are prolonged and inflation picks up, Banxico will be more cautious about cutting its rate. While we expect a 50-basis-points reduction in March, subsequent cuts would be in doubt.”

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.