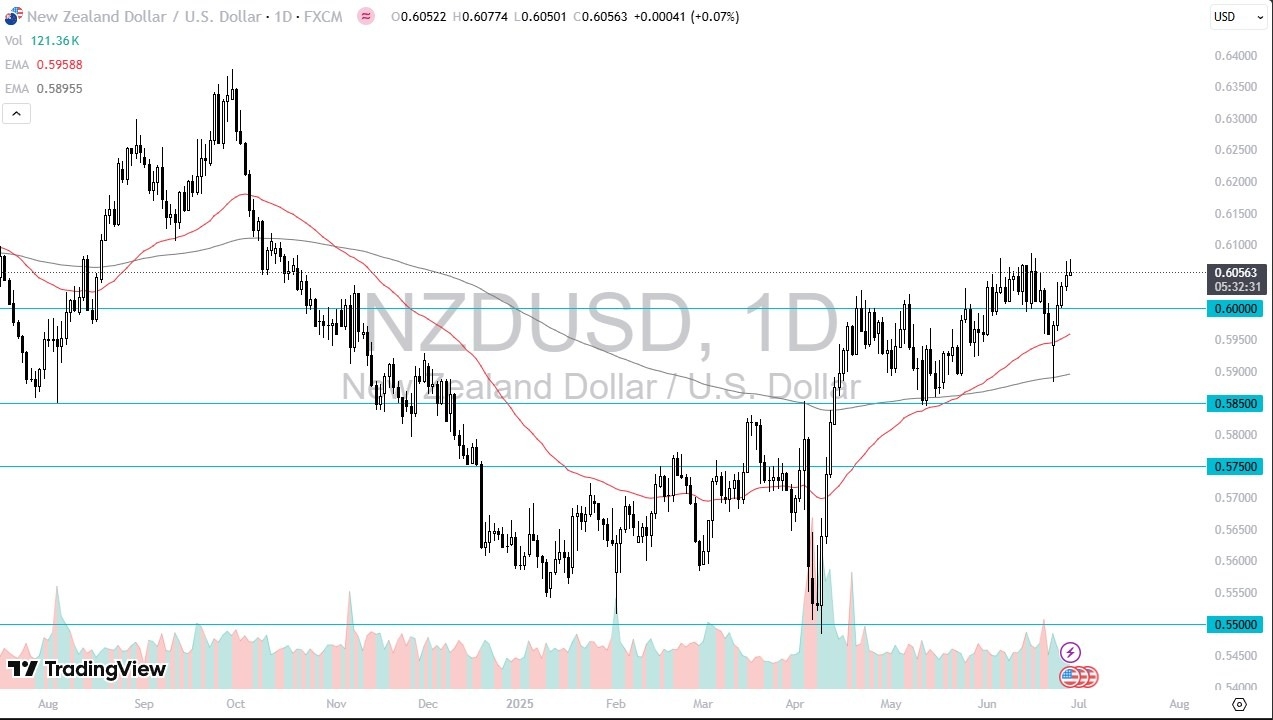

- The New Zealand dollar initially did try to rally during the trading session on Friday but has given the gains back, to show signs of hesitation just below the 0.61 level.

- This is an area that has been important for some time, so it’s not a huge surprise to see that we have failed in this region.

- That being said, I don’t necessarily think that we are going to mount down, but we may get the opportunity for a short-term selling opportunity, perhaps down to the 0.60 level. That would not surprise me, because this time of year is typically very quiet.

Technical Analysis

The technical analysis for this market is somewhat flat, although it’s got a little bit of a “positive tilt” to it, so I think at this point in time is easier to buy dips, but short-term range bound traders may take advantage of the apparent weakness in this pair. If we were to break down below the 0.60 level, then we go looking at the 50 Day EMA, an indicator that a lot of people will be paying close attention to the 0.5955 region. With that being the case, then the market will probably dump quite a bit as we could even drop down to the 0.59 level, where the 200 Day EMA resides.

On the other hand, if the market were to rally and break above the 0.61 level, that could send the New Zealand dollar much higher, probably to the 0.62 region. This would also have a knock on effect over in the Australian dollar, as the 2 tend to move lockstep against the greenback. While I do think this could happen, it’s obvious that we don’t have the momentum quite yet, and therefore I think you have to be very cautious about getting overly long in this market until we get some type of pullback. Regardless, we are in the dead of summer and a lot of time that will influence a very severe lack of volatility as well.

Ready to trade our daily Forex analysis? Here’s a list of the brokers for forex trading in New Zealand to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.