The XRP price action has printed a bull flag in the daily chart timeframe, suggesting a strong upward trajectory. Its daily trading volume has further skyrocketed 71% to $$4.01 billion, indicating heightened market activity.

With the rising activity in the XRP market, how high can the XRP price go?

XRP Price Outlook

The XRP price has pulled back from recent highs but still holds above key support zones. Strong trading volume suggests active interest despite short-term price swings. The daily chart for XRP/USD shows that the price is trading near $2.45, with a 3.78% decrease on the day.

The price is slightly above the upper boundary of a bullish flag, with the nearest resistance at $2.73 and the nearest support at $2.27. The 50-day MA (2.73) is slightly above the 100-day ($2.40) and 200-day MA (1.48), indicating a minor bullish momentum.

If the bulls break above the 50-day moving average at $2.73, there is potential for further upside. In that case, there is a strong possibility that XRP would push toward the $2.84 resistance level, where a breakout could trigger further upside to $3.00 in the short term.

XRP Price Poised For 500% Upswing to $15

From a technical analysis perspective, the XRP price is still validating a bill flag pattern on the daily chart, suggesting that the altcoin could still see a massive move to the upside.

XRP confirmed a bull flag pattern on January 11th, when it closed above the upper boundary of the flag at $2.40. XRP is currently testing the resistance level at $2.73 after establishing support from the flag’s resistance line, which also coincides with the 100-day simple moving average.

Key resistance levels to watch on the upside are the 50-day SMA at $2.73, the $3.0 psychological level at $3.00 and the seven-year high of $3.0.

A high volume move above these resistance levels could accelerate the rally to all-time highs at $3.80 and into price discovery.

The maximum profit target from the pole’s length indicates that XRP could hit a new all-time high of $15. This would represent a 503% uptick from the current level.

XRP/USD daily chart. Source: TradingView

Conversely, the relative strength index (RSI) is below the midline and has dropped from 50 to 42 over the last seven days, indicating an increasing bearish momentum. The RSI’s value of 42 suggests that the market conditions still favor the downside, before XRP gets oversold.

As such, a daily candlestick close below the support level at $2.40 will invalidate the thesis. If this happens, XRP could likely continue its consolidation within the flag’s price range for a few more days.

Meanwhile, popular crypto analyst Ali Martinez believes XRP price is primed for a significant move on the upside.

In a February 23rd post on X, Martinez highlighted a potential 14% move in the XRP Price once it breaks out of a symmetrical triangle.

Ali Martinez XRP Tweet. Source: X

Increasing OI Volume Backs XRP’s Upside

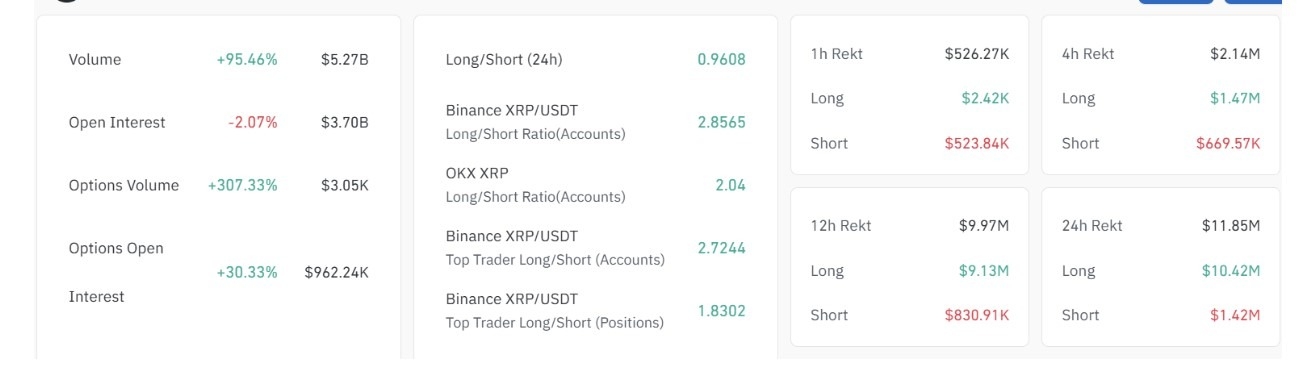

Onchain data further supports a potential upward trajectory in the XRP market. Despite a slight pullback in open interest by 2% to $3.70B, the trading volume spiked by 95% to $5.27 billion. This suggests increased market activity and money entering the market, which may trigger a rally to $15 in the medium term.

XRP Derivatives Data Analysis. Source: CoinGlass

Additional data from market intelligence firm CryptoQuant shows that the XRP balance on exchange has decreased significantly since November 2025.

The chart below shows that the amount of XRP tokens in known exchange wallets has dropped by 17% from 3.27 billion XRP on Nov. 12 to an eight-month low of 2.7 billion XRP at the time of writing.

XRP Tokens in Exchange Wallets

The reducing XRP balance on exchanges suggests that investors are moving their tokens from exchanges to self-custody wallets. This indicates a lack of intention to sell, reducing XRP supply on exchanges and driving its price up.

However, one of the biggest catalysts for XRP that could see its price skyrocket to double-digits would be the approval of the first spot XRP exchange-traded fund in the United States.

The odds of a US spot XRP ETF approval on Polymarket have increased from 78% on February 17th to 80% at the time of writing, adding to the bullish sentiment in the market.

Bloomberg ETF analysts James Seyfartt and Eric Balchunas believe that an XRP ETF has a 65% chance of being approved by the SEC in 2025. If approved, it will validate the altcoin’s legitimacy and could draw billions of dollars in capital inflows, according to JP Morgan.

Ready to trade our Ripple forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.