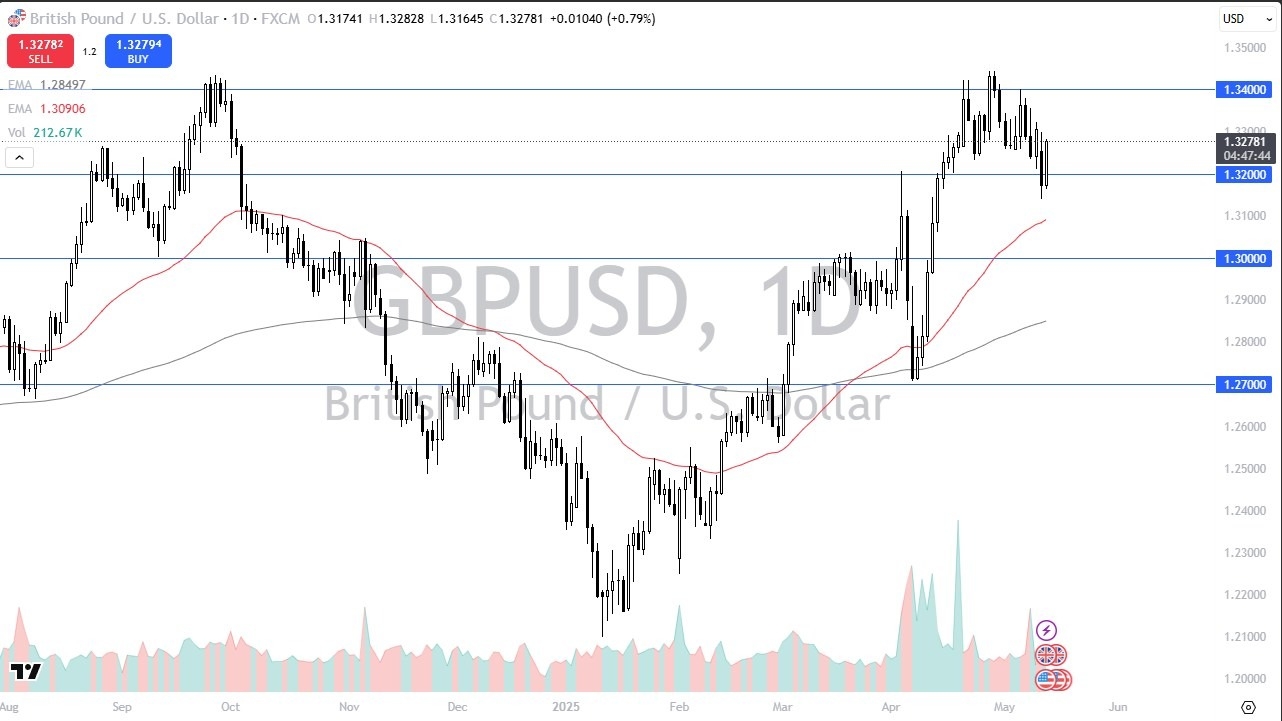

- During the trading session on Tuesday, we have seen the British Pound rallies significantly against the US dollar, gaining roughly 0.8% by the time New York came on board.

- That being said, it’s also worth looking at the longer-term charts of the GBP/USD pair, as we have just formed 3 shooting stars on the weekly chart in a row.

- As far as technical analysis is concerned, it really doesn’t get a whole lot more bearish than that.

That being said, the market will do what the market will do, and technical analysis is only good for so much. After all, if it all worked 100% of the time, then people would all be wealthy trading in the Forex markets. That being said though, it does suggest that there is a lot of selling pressure above, so I think the upside at this point in time is probably somewhat limited.

Furthermore, there are a lot of reasons to ask whether or not the risk appetite out there would continue to go higher. After all, even though we’ve had some movement between the Americans and the Chinese, the reality is that we are still in a “wait and see” mode.

Overhead Resistance

We have those 3 shooting stars on the weekly chart, but I also see a lot of resistance near the 1.34 level. This is an area that’s been important multiple times in the past, and therefore think you need to pay close attention to after all, longer-term charts can guide the way, as larger positions are certainly placed around these areas, but we also have to keep in mind that you must be flexible enough to take the other trade if you do in fact that signal.

For example, the market were to break above the 1.35 level, then it’s obvious that the sellers have been run over, and that the market should probably go higher. On a break lower from here, the 50 Day EMA sits right around the 1.31 level, and is rising. That could be a little bit of dynamic support, but ultimately, I think we can even drop all the way down to the 1.30 level.

Ready to trade the Forex GBP/USD analysis and predictions? Here are the best forex trading platforms UK to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.