After gaining over 25% in the past week, SHIB is now consolidating near a key support level.

SHIB Price Pulls Back from Highs

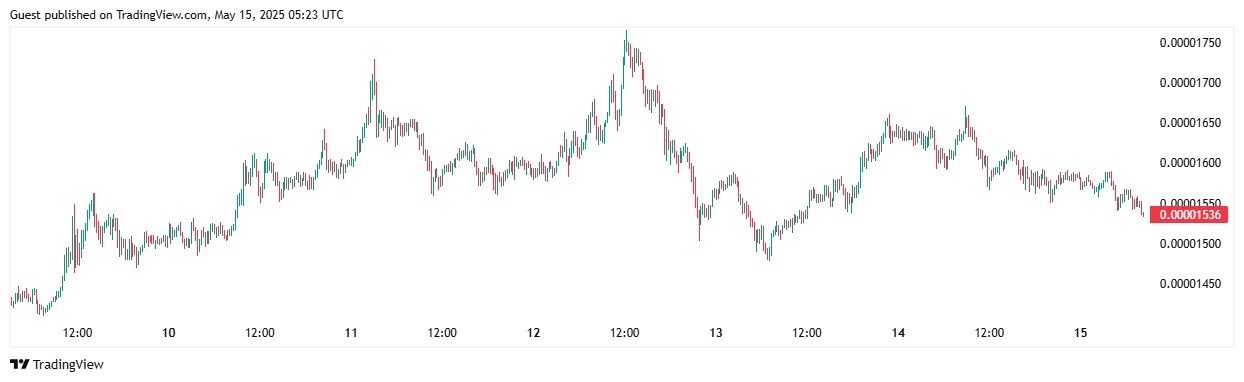

SHIB Price | Source: TradingView

Over the past week, Shiba Inu saw a notable rally, with prices climbing from around $0.0000123 to a local high of $0.0000165. This move came on the back of increased retail interest, improved sentiment in the broader crypto market, and some bullish technical patterns forming across daily charts.

However, SHIB has since retraced, falling roughly 2% in the last 24 hours to trade at approximately $0.00001544. The price dipped below the psychological level of $0.00001550 and is now testing support at the lower boundary of its ascending triangle formation.

This pullback has also brought SHIB back in line with its 20-day EMA, where buyers appear to be re-entering the market.

Technical Indicators Point to Mixed Momentum

The short-term outlook is currently mixed.

According to Investing.com, SHIB is flashing strong sell signals across most major oscillators and moving averages. Their data shows 9 of 12 moving averages currently suggest a sell, with all 7 tracked technical indicators leaning bearish.

The Relative Strength Index (RSI) sits near 39.63, just above the oversold territory, hinting that bears may be running out of steam.

On the flip side, Bitget’s technical dashboard paints a more optimistic picture. Their analysis ranks SHIB as a Buy, citing bullish signals in 10 of 13 moving averages and momentum oscillators like the MACD and ADX showing continued strength. The RSI reading here is more neutral at 62, which suggests room for upward movement if buyers step in.

So, while short-term traders may be cautious, medium-term momentum appears to remain on the bulls’ side.

Bullish Setup Still Intact

Despite today’s correction, SHIB’s broader chart structure remains bullish.

The price recently broke out of a descending channel that had constrained it since early April. That breakout pushed SHIB above the $0.000015 resistance, a critical zone that had previously capped upward moves. Now, that level is acting as short-term support.

Moreover, SHIB appears to be forming a bullish flag on the 4-hour chart, which often signals continuation after a strong upward movement. If this pattern plays out, the next breakout could target the $0.0000175 to $0.000019 range.

The Chaikin Money Flow (CMF), however, has turned slightly negative, indicating some distribution. Still, a rebound from the $0.000015 support level could quickly shift sentiment back in the bulls’ favor.

Key Levels to Watch

On the upside, immediate resistance lies at $0.00001660, the upper range of the current flag pattern. A successful breakout above this level could set the stage for a rally toward the 0.382 Fibonacci level at $0.00001911. Beyond that, eyes will be on $0.00002000, a psychologically important resistance level and potential breakout point.

On the downside, support at $0.00001500 is now key. A daily close below this level could invalidate the bullish flag and expose SHIB to deeper losses. The next key support is seen near $0.00001420, followed by $0.00001280.

A breakdown below $0.00001280 would suggest a return to the mid-April price zone and could invite further selling pressure.

Market Sentiment and Whale Activity

Sentiment-wise, the Crypto Fear & Greed Index stands at 73, which shows “Greed,” often seen before price pullbacks. That aligns with SHIB’s current cooldown after a week of gains. Still, social volume and trading activity around SHIB remain elevated. This shows that the market participants are still paying attention.

Some whale-tracking platforms have also flagged recent SHIB transfers from centralized exchanges to private wallets, a possible sign that large holders are accumulating ahead of a potential next leg up.